Proactive Investors -

- FTSE 100 posts strong gains, up 64 points

- EU inflation falls to 10% in November, below forecast

- US GDP revised upwards, PCE tops expectations, jobs growth slows - ADP (NASDAQ:ADP)

1.45pm: US Q3 GDP growth revised upwards, PCE above forecast

A raft of US data has just been released with the headline numbers below.

US quarter three GDP has been revised upwards to 2.9% from the 2.6% initially forecast and ahead of market expectations of 2.7%.

US personal consumption rose 1.7% in quarter three from 1.4% before and market forecasts of 1.6% while the closely watched core PCE inflation rate increased 4.6%, slightly ahead of forecasts for a rise of 4.5%.

US GDP Annualised (Q/Q) Q3 S: 2.9% (est 2.8%; prev 2.6%)- US Personal Consumption Q3 S: 1.7% (est 1.6%; prev 1.4%)

- US GDP Price Index Q3 S: 4.3% (est 4.1%; prev 4.1%)

- US Core PCE (Q/Q) Q3 S: 4.6% (est 4.5%; prev 4.5%)

— LiveSquawk (@LiveSquawk) November 30, 2022

1.35pm: ADP jobs survey much weaker than forecast

The latest ADP jobs showed a 127,000 increase in private payrolls, well below the consensus of 200,000.

This was the lowest since January 2021 and the drop in goods-producing jobs is a strong hint that the slowdowns seen in the manufacturing surveys is finally hitting the real economy.

US ADP November employment +127K vs +200K expectedhttps://t.co/3t0sQKAowT— ForexLive (@ForexLive) November 30, 2022

"Turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains,” said Nela Richardson, chief economist, ADP.

“In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting and the post-pandemic recovery is stabilizing.”

But Ian Shepherdson, chief economist at Pantheon Macroeconomics, pointed out “This is only the fourth release of ADP’s private payroll estimate compiled using their new methodology, so we have very little history to judge its reliability. “

“ In August and September it substantially undershot the official measure, but it was very close in October.”

He is sticking with his forecast for a 250,000 rise in non-farm payrolls.

1.25pm: Eurostar staff to strike

Security staff on Eurostar are to strike for four days next month in a dispute over pay.

Members of the Rail, Maritime and Transport (RMT) union employed by a private contractor will walk out on December 16, 18, 22 and 23 after voting in favour of industrial action, by around four to one.

The RMT said the strike will “severely affect” Eurostar services and travel plans for people over the pre-Christmas period.

12.40pm: BoE's Huw Pill expects inflation to tail off rapidly in second half of 2023

Bank of England chief economist Huw Pill has been speaking to businesses this morning, and said he expects UK inflation to start falling next year, assuming natural gas prices stabilise and then start to drop.

Pill told a conference organised by accountancy body ICAEW that the Bank has "more to do" on raising interest rates to control inflation, but that borrowing costs probably will not rise as much as financial markets have priced in.

Pill said the Bank is concerned about tightness in the labour market, which risks fanning inflationary pressures.

“We are expecting to see headline inflation tail off in the second half of next year, in fact, quite rapidly on account of those base effects” he said.

“There's a lot of uncertainty around the outlook for gas price developments.”

11.50am: US seen slightly higher at the open

US stocks are expected to open slightly higher on Wednesday as investors eye Federal Reserve chairman Jerome Powell’s key speech on the outlook for the US economy and labor market.

Futures for the Dow Jones Industrial Average were flat in pre-market trading, while those for the S&P 500 were 0.2% higher, and contracts for the Nasdaq-100 gained 0.3%.

“What will Jerome Powell say? Well, he will say that the pace of the US rate hikes will slow. But he will also say that the Fed is not done fighting inflation and that the terminal Fed rate will likely be higher,” noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

The Federal Reserve has delivered four 75 basis point interest rate hikes in as many meetings this year as it tries to curb runaway inflation levels. With headline inflation now starting to ease from 40 year highs, investors are holding out hope that the pace of interest rate increases will also start to slow and will be acknowledged by Powell in today's speech.

Powell is due to speak at a Brookings Institution event at 1.30pm ET.

“The US yield curve remains inverted, and the spread between the US 3-month and 10-year yield continues widening, hinting that an upcoming recession in the US could further help ease inflationary pressures,” added Ozkardeskaya.

Today also brings a whole raft of economic data which could have an impact on market activity.

“Investors will be watching the update on US GDP, expected to be revised slightly higher, the US job openings, expected to remain above 10 million and hinting at a still solid job environment, and the November ADP report, expected to reveal around 200’000 new private jobs added during last month,” said Ozkardeskaya.

Further ahead, Thursday will bring the Fed’s favorite inflation gauge, the PCE data, which will show how much inflation eased in October, and on Friday the pivotal US non-farm payrolls are due.

The recent focus on developments in China, where ordinary citizens are protesting the government’s stringent zero-covid policy, continues but the appetite for Asian equities has improved slightly on the back hints that China could ease its Covid curbs in response to the protests. Notably, Nasdaq’s Golden Dragon China index rallied 5% yesterday.

11.40am: HSBC to close 114 branches

More high street banks are to close as HSBC Holdings PLC (LSE:LON:HSBA) announced it will close 114 branches across Britain from April next year.

The Asian-foucsed lender blamed changing customer behaviour for the move, saying customers are increasingly banking online.

HSBC to close 114 bank branches - is your local on the list?https://t.co/X2WlKt6WQu— The Sun (@TheSun) November 30, 2022

It follows similar announcements by peers such as Lloyds Banking Group PLC (LSE:LON:LLOY) in recent months as banks slash their networks to try and cut costs.

HSBC said it will invest tens of millions of pounds in updating and improving its remaining 327 branches.

11.25am: Abrdn falls as it looks set to miss out on FTSE 100 promotion

Shares in Abrdn PLC (LSE:ABDN) fell 3.7% as the asset manager looked set to miss out on an immediate return to the FTSE 100 in the latest quarterly reshuffle which was based on last night’s close.

Weir Group PLC (LSE:LON:WEIR) was set for promotion to London’s blue-chip index but Harbour Energy was set to return to the FTSE 250.

Russ Mould, investment director at AJ Bell commented: “After what felt like a symbolic relegation from the FTSE 100, Abrdn shares have seen a strong recovery in recent weeks on hopes the company allergic to vowels has been able to turn the tide on outflows, but it has just fallen short in a bid for index promotion.”

“Of the names expected to make the move up mining services firm Weir is being rewarded for a more coherent and focused strategy which is beginning to pay dividends for the company.”

“Oil prices have been volatile in 2022 and Harbour Energy is turning into a yo-yo stock having already been promoted and demoted this year and is set to go back to the FTSE 250 ranks once again.”

“This shows the risks associated with shares in companies reliant on the price of a commodity over which they have no control.”

10.55am: Fall in EU inflation points to 50bps rate rise at next ECB meeting

The fall in the EU inflation figure to 10% “supports ECB doves’ calls for a slower pace of rate hikes going forward” according to Melanie Debono, senior europe economist, at Pantheon Macroeconomics.

She forecast the ECB would raise rates by 50bps next month after two 75bp rate increases at its last two meetings.

ING Economics agreed “While we’re far from out of the woods yet, it does look like the current economic environment could push the European Central Bank to a smaller 50bp hike next month.”

Debono said “The headline inflation rate was pulled lower mainly by a fall in energy inflation, to 34.9% after 41.5%, which more than reversed the increase in October. This was enough to offset another rise in inflation of food, alcohol and tobacco, by 0.5pp to 13.6%.”

“We continue to think that core inflation has now peaked” she said although it may remain elevated for some time.

ING was of a similar view. “Don’t expect a miracle just yet, core inflation tends to adjust slowly to energy shocks and a lot of the higher costs have not yet been priced through to the consumer.”

10.05am: EU inflation falls to 10% in November

Over in Europe and better news on pricing pressures. Euro area annual inflation fell to 10.0% in November, down from 10.6% in October according to a flash estimate from Eurostat, the statistical office of the European Union.

The 10% number was below market forecasts of 10.4%.

Euro area #inflation at 10.0% in November 2022, down from 10.6% in October. Components: energy +34.9%, food, alcohol & tobacco +13.6%, other goods +6.1%, services +4.2% - flash estimate https://t.co/3Iezb5Glwi pic.twitter.com/9fH6JMPrM9— EU_Eurostat (@EU_Eurostat) November 30, 2022

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in November (34.9%, compared with 41.5% in October), followed by food, alcohol & tobacco (13.6%, compared with 13.1% in October), non-energy industrial goods (6.1%, stable compared with October) and services (4.2%, compared with 4.3% in October).

9.40am: M&S buys Thread in bid to boost personalisation sales

Marks & Spencer Group PLC has swooped to buy the intellectual property of fashion personalisation website Thread, which has collapsed into administration.

The pre-pack deal includes Thread’s source codes and algorithms that will be integrated into the M&S website.

The retailer will also hire 30 of Thread’s staff, including founders Kieran O’Neill and Ben Phillips.

M&S already uses personalisation techniques to drive additional sales with the "frequently bought together" recommendations on its website estimated to have added £20mln in sales over the past year.

M&S co-chief executive Katie Bickerstaffe expects personalisation to help boost sales by £100ln a year.

She said: “In the next 12 to 18 months we are targeting 50% of digital customer interactions to be personalised [versus 20-25% this year]. The integration of Thread technology will enable us to take personalisation to the next level.”

9.25am: Business confidence on the slide

UK businesses confidence has weakened, as bosses fear a looming recession as inflation continues to grip the economy.

The Confederation of British Industry reported that optimism fell across the services sector for the third consecutive quarter, with business and professional services firms particularly gloomy.

Charlotte Dendy, head of economic surveys at the CBI , said firms want to see more pro-growth policies from the government: “Strong cost and price pressures are continuing to hurt services firms, damaging optimism and investment intentions and hitting profitability.”

A separate survey from Lloyds Bank found that business confidence is now the lowest since February 2021.

9.18am: Phase Eight owner to rescue Joules - Sky

The administrator to Joules, the collapsed fashion retailer, is on the brink of a rescue deal with the South African owner of Phase Eight, according to Sky News.

Sky said it has learnt that the Foschini Group (TFG) is close to securing an agreement to buy the majority of Joules' stores and assets.

One source said a deal could be struck as soon as Wednesday afternoon.

If completed, it is likely to see roughly a quarter of Joules' 132 shops closed, with the loss of "several hundred" jobs.

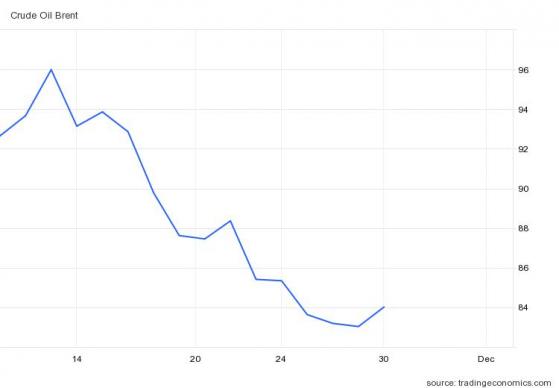

9.15am: Oil prices rise for third day

Oil prices moved higher for a third consecutive day supported by a bigger-than-expected drop in US crude inventories, while investors are also looking ahead to the upcoming OPEC+ meeting.

API data on Tuesday showed that crude oil stockpiles dropped by about 7.9mln barrels in the week ended November 25, the most since the week ended July 2, 2021, and well above market expectations.

Meanwhile, OPEC and its allies, including Russia, are expected to keep their output quotes unchanged at their next meeting on December 4.

Neil Wilson at marketscom said it "seems increasingly likely that the cartel and allies leave things unchanged, with this week’s meeting set to be a virtual one."

Brent crude prices are up 1.22% to $84.07 while West Texas Intermediate prices rose 1.02% to $79.06.

9.00am: Betting companies enjoy boost from JP Morgan

Betting companies, Entain PLC (LON:ENT) and Flutter Entertainment PLC, were near the top of the FTSE 100 risers as JP Morgan raised price targets for both.

“We continue to favour growth, scale and diversification within the industry” it said.

The broker gave three reasons to remain positive on the two companies: 1) comparisons are easing from quarter four onwards, further enhanced by the World Cup, 2) US profitability is imminent and 3) appealing valuations.

JPM upped its price target for Entain to 2270p from 2,050p and for Flutter to 16,000p from 14,800p whilst keeping an overweight rating on both.

8.35am: Ofgem proposes new price controls for local electricity networks

Ofgem has confirmed a five-year investment package for the electricity distribution network companies to help deliver "cheaper, cleaner, more reliable local grids."

As a result the operators of Britain’s local energy networks will be forced to spend more of their profits on investing to future-proof the country’s electricity grid as the industry regulator said it would not allow any rises in customer bills.

In a new set of price controls which will run from 2023 to 2028, Ofgem said that it would keep costs to consumers at around £100 per year.

The companies impacted include Scottish and Southern Electricity Networks, Northern Powergrid, SP Energy Networks, Electricity North West, National Grid (LON:NG) and UK Power Networks.

Shares in SSE PLC (LON:SSE) and National Grid were both around 1% higher after news.

SSE said the final determination allows SSEN Distribution £3.59bn of baseline total expenditure for the five-year period against an initial business plan ask of £4bn.

It said: “SSEN will now carefully examine the full details of Ofgem's Final Determination to gauge the extent to which it correctly represents a fair and balanced outcome for customers and investors.”

8.15am: FTSE 100 pushes higher

The FTSE 100 opened higher on Wednesday, despite further bad news from China, record food price inflation in the UK and two surveys pointing to falling business confidence.

At 8.15am the lead index was up 38 points at 7,512 and the more domestically focused FTSE 250 rose 79 points to 19,265.

China's factory activity shrank for a second straight month in November, official data showed, with the purchasing managers' index hitting 48.0 points, down from October's 49.2 according to data from the National Bureau of Statistics.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown (LON:HRGV) said: “It’s clear that a change to the zero-Covid policy can’t come soon enough to propel a recovery, and investors are clinging onto hopes that renewed attention of a vaccination programme for older citizens will hasten a relaxation of the rules.”

Back in London and food price inflation hit a fresh record high whilst surveys of British business by the CBI and Lloyds Banking Group pointed to deteriorating business confidence.

Otherwise, investors will be eyeing EU CPI numbers and a speech by Federal Reserve, Jerome Powell, later today for further evidence as to where interest rates are likely to be heading on either side of the pond.

Stocks on the move included luxury handbag maker Mulberry Group (AIM:MUL) PLC which plunged 22% as it swung to a half-year loss and revealed sales tumbled by 10% across the UK as the economic uncertainty and cost-of-living crisis knocked shopper confidence.

The group reported a pre-tax loss of £3.8mln for the six months to October 1 against profits of £10.2mln a year ago.

Rolls-Royce (LON:RR) PLC was higher as Barclays (LON:BARC) published a bullish update with an outperform rating and 110p price target.

7.50am: Food price inflation hits new record

Food inflation hit a new record in November with prices soaring 12.4% over the last 12 months according to the latest data from the British Retail Consortium (BRC).

No let up was in sight either with the BRC warning that Christmas will be pricier this year as well:

Helen Dickinson OBE, CEO of the BRC “Winter looks increasingly bleak as pressures on prices continue unabated.”

“Food prices have continued to soar, especially for meat, eggs and dairy, which have been hit by rocketing energy costs, and rising costs of animal feed and transport.”

“Coffee prices also shot up on last month as high input costs filtered through to price tags. Christmas gifting is also set to become more expensive than in previous years, with sports and recreation equipment seeing particularly high increases.”

The BRC-Nielsen IQ Shop Price Index showed that overall shop prices are now 7.4% higher than last November, up from 6.6% in October, setting another record high.

The data noted fresh food inflation rose even higher to 14.3%, up from 13.3% last month, driven particularly by the cost of meat, eggs and dairy.

7.00am: FTSE 100 set to make a bright start

FTSE 100 expected to make a bright start on Wednesday as investors look ahead to CPI figures from the EU and a speech by Federal Reserve chair, Jerome Powell later today.

Spread betting companies are calling the lead index up by around 30 points.

Michael Hewson chief market analyst at CMC Markets UK said the main focus today “is set to be on today’s flash CPI from the EU, which could set the scene as to whether we get 50bps or 75bps when the ECB meets in just over two weeks’ time.“

US markets closed in mixed fashion with investors preferring to remain sidelined ahead of Powell’s speech. He is due to speak at a Brookings Institution event on Wednesday about the outlook for the US economy and the labour market

At the close the Dow Jones Industrial Average was 3 points higher at 33,850, the S&P 500 slipped 6 points, or 0.16%, to 3,958 and the Nasdaq Composite fell 66 points, or 0.59%, to 10,984.

In Asia, stocks were mixed. Tokyo's Nikkei 225 index was down 0.2%. In China, the Shanghai Composite was down 0.4%, while the Hang Seng index in Hong Kong was up 0.3%. The S&P/ASX 200 in Sydney was up 0.4%.

Back in London and there are half-year results from water utility Pennon, luxury fashion company Mulberry and consumer gift packaging and stationery firm IG Design Group in the corporate diary.