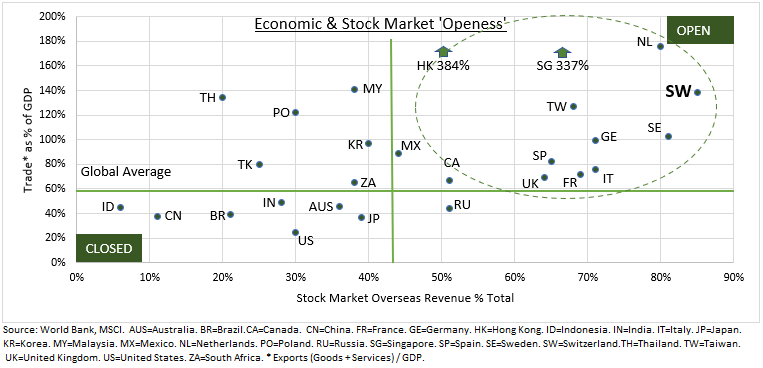

CATCH UP: The Swiss stock market is supersized, increasingly attractive, and due a catch up. It’s 14% off its all-time highs, lagging the recent records in US, Japan, and Europe’s Stoxx 600. It’s the global market with the greatest proportion of overseas sales (see chart). Making it very sensitive to the catalyst of the weaker Swiss franc (CHF), as its central bank changes focus. This competitiveness boost should add to the market’s attractive 10% earnings growth outlook. The local SMI index is dominated by defensive consumer staples and healthcare stocks, with an above average dividend yield. Its 17x forward P/E valuation is in line with its long-term average.

CHF: The Swiss Franc (CHF or ‘Swissy’) is -5% this year vs the dollar. This is uncharacteristic. Given its historic safer-haven status, huge 10% current account surplus, FX reserves equal to 100% of GDP, and its traditionally interventionist central bank (SNB). But after a big currency rally last year, inflation down to only 1.3%, and the economy near recession, the SNB is taking a more dovish stance. By halting interest rate hikes early in mid-2023 and its long-standing CHF purchases. It is now cracking open the door to mid-year rate cuts, if not sooner. Any weaker CHF would have a disproportionate impact given the country’ trade and stock market openness.

SMI: The 20-stock Swiss stock index (XSMI.DE, EWL) is the world’ seventh largest. Supersized vs its $870 billion economy, the world’s 20th biggest. And giving it a 170% market cap/GDP. It is dominated by food giant Nestle (NESN.ZU), healthcare duo Novartis (LON:0QLR) (NVS) and Roche (LON:0QQ6) (ROG.ZU), globally systemic bank (UBSG.ZU), and luxury leader Richemont (LON:0QMU) (CFR.ZU). As well as industrials ABB (ST:ABB) (ABBN.ZU), Sika (SIX:SIKA.ZU), and Holcim (SIX:HOLN.ZU). Defensives healthcare and consumer staples are over half the index and give it an above average dividend yield. With cyclical financials and industrials most of the rest. Popular tech stocks are under 2% the index.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Super-sized Switzerland due a catchup

Published 23/02/2024, 08:12

Updated 09/02/2024, 07:53

Super-sized Switzerland due a catchup

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.