By Devika Krishna Kumar

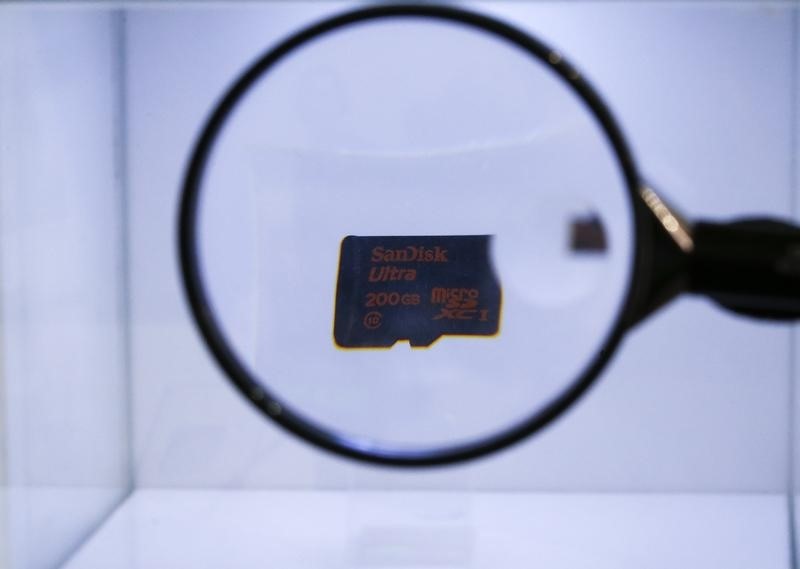

(Reuters) - Data storage products maker SanDisk Corp (NASDAQ:SNDK), whose stock has lost 40 percent since touching a record high in July, has become a potential target for companies looking to boost their presence in the enterprise market, analysts said.

The stock has slipped nearly 32 percent this year alone as SanDisk reported a string of issues, including unplanned maintenance at its chip foundry, weak sales of enterprise products and lean inventory levels of NAND memory chips.

The stock's sell off has left SanDisk with a market value of about $13 billion (9 billion pounds) as of Thursday's close, making the company "an excellent takeover target" and attractive to memory chipmakers including Micron Technology Inc (NASDAQ:MU) and SK Hynix Inc, Bernstein analysts said in a research note.

These analysts say SanDisk is best positioned in the "enterprise NAND" market for applications such as cloud computing, datacenters and networking systems.

Shares of SanDisk, whose flash memory storage chips are also used in smartphones and other mobile devices, rose as much as 5 percent to $67.78 on Monday.

SanDisk was not immediately available for comment.

Susquehanna Financial Group analyst Mehdi Hosseini said Western Digital Corp (NASDAQ:WDC) could be a buyer, adding that if the maker of solid-state drives were to pay about $86 per share, or about $19 billion, for SanDisk, the deal would add to its profit by the second year.

However, Needham & Co's Richard Kugele said Western Digital would find it "extremely expensive" to buy SanDisk, which would appeal more to NAND producers looking to consolidate market share.

That could bring Samsung (LONDON:0593xq) Electronics Co Ltd or Toshiba Corp, with whom SanDisk has a joint venture to make NAND products, into the picture, RBC Capital Markets analyst Douglas Freedman said.

Samsung, which has been boosting its chipmaking business to help offset declining sales of smartphones, had made an unsuccessful hostile bid, worth $5.85 billion, for SanDisk in 2008.

The joint venture with Toshiba could make it difficult for SanDisk to sell itself to a competitor of the Japanese conglomerate, Wedbush Securities analyst Betsy Van Hees said.