MELBOURNE (Reuters) - Woodside Petroleum Ltd, Australia's biggest independent oil and gas producer, has approached smaller rival Oil Search Ltd (AX:OSH) with an $8 billion (5.23 billion pounds) all-share takeover plan, which Oil Search said on Tuesday it was considering.

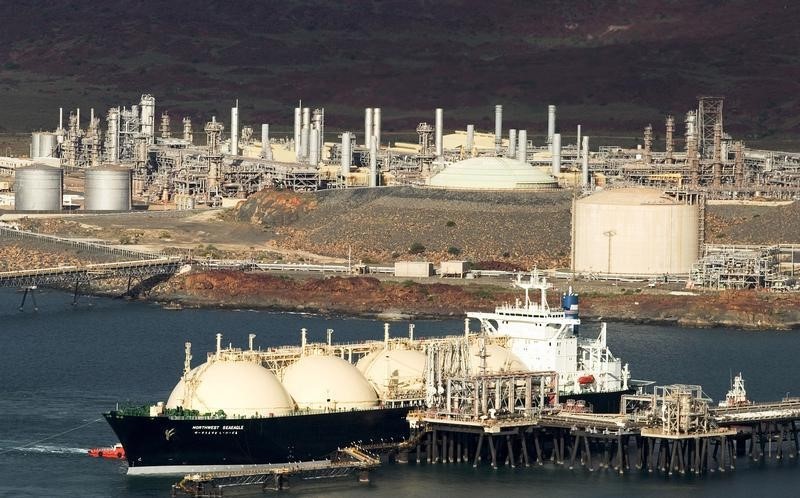

A takeover of Oil Search would help fill a gap in Woodside's growth prospects, giving it a 29 percent stake in Oil Search's Papua New Guinea Liquefied Natural Gas project, which started producing last year and is considered one of the lowest cost, expandable LNG projects in the world.

"It makes sense for Woodside - a company that's ex-growth that's looking for the next leg," said Ric Ronge, a portfolio manager at Pengana Capital, which owns stakes in Woodside and Oil Search.

Woodside would also gain a 23 percent holding in PNG's biggest undeveloped gas prospect, the Elk and Antelope fields.

"Clearly, Oil Search shareholders are entitled to an offer which adequately reflects this value potential," Oil Search said in a statement to the Australian market.

Woodside has offered one of its shares for every four Oil Search shares, worth A$11.6 billion on Monday's close, subject to gaining a period of exclusivity to look at the company's books and securing support from key stakeholders.

Based on Monday's close that was only a 14 percent premium. However based on Oil Search's and Woodside's average share prices over the three months before August 27, when rumours of a bid first emerged, the premium is 23 percent, a Woodside adviser said.

Oil Search shares jumped 13 percent to A$7.60 after the offer was announced, trading above the implied value of the offer as Woodside's shares fell 4 percent, suggesting investors expect Woodside will have to raise its bid.

"It's a first shot. The premium being offered looks very modest," said Rohan Walsh, a portfolio manager at Karara Capital.

Oil Search's biggest shareholder is the PNG government, with a 12.9 percent stake. Woodside has already talked to the PNG government, the spokesman said.

A PNG official was not immediately available to comment on the government's view of the offer.

Oil Search is being advised by Morgan Stanley (N:MS). Woodside is being advised by Bank of America (NYSE:BAC) Merrill Lynch and Gresham.

"The company wishes to emphasise that there is no guarantee that a binding proposal can be agreed between the parties," Oil Search said.

The move on Oil Search boosted other battered energy company shares, notably Santos Ltd (AX:STO), which jumped 10 percent, as it also has a stake in the PNG LNG project and is looking to sell assets.