ZURICH (Reuters) - Switzerland's luxury watch sector can profit from a smartwatch boom as more consumers seek high-end versions of the technology, an industry veteran was quoted as saying.

Swiss watchmakers, who once dismissed smartwatches as a fashion accessory, are racing to grab a share of a fast-growing market via technology partnerships and stepping up investments.

"If it is true that Apple (O:AAPL) has sold around 20 million Apple Watches and has a market share of around 50 percent, then the potential is enormous," said Jean-Claude Biver, head of LVMH (PA:LVMH) watch brands including TAG Heuer, Hublot and Zenith.

"A luxury market arises as soon as people want to differentiate themselves from the masses. That is the case here as well. With our know-how, Swiss quality and prestige we have the best preconditions to master this segment too," he told Swiss paper SonntagsBlick.

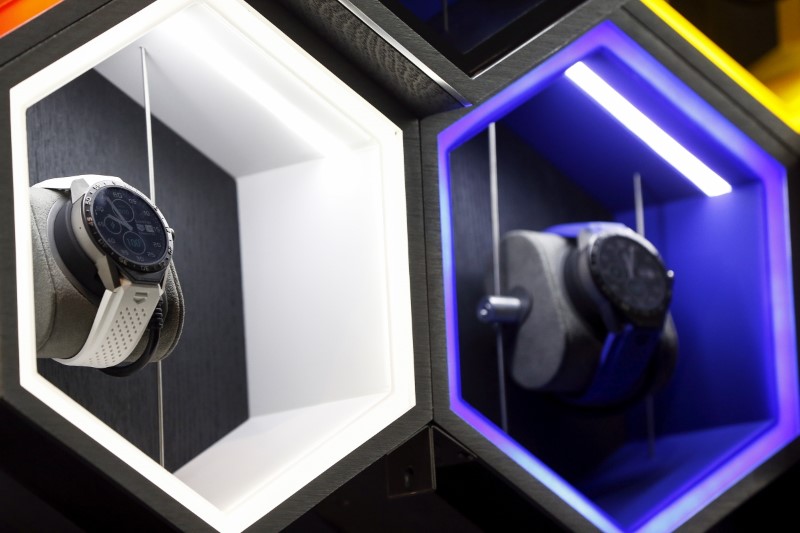

TAG Heuer, for instance, partnered with U.S. technology firms Google (O:GOOGL) and Intel (O:INTC) for its TAG Heuer Connected watch, whose first units offered at just under 1,400 Swiss francs ($1,375) apiece sold out quickly last year.

The Swiss watch industry, which includes Swatch (S:UHR) and Richemont (S:CFR), may overall be selling fewer timepieces as exports decline 15 months in a row but it is not facing an existential crisis as in the 1970s, Biver said.

He said the industry was instead consolidating as top brands boost market share.