Proactive Investors - Ofgem’s energy price cap has been slated for bumping up bills, fuelling inflation and preventing market competition in a report by think tank the Centre for Policy Studies.

Arguing that the 2019-introduced price cap has overstayed its welcome, researchers pointed out that the system is effectively a way for regulator Ofgem to determine energy bills.

“The energy price cap has now become the de facto market price,” the group said.

“A policy that was originally brought in to ‘protect’ disengaged or vulnerable customers now rules almost the entire market.”

Ofgem’s cap puts a maximum price on what suppliers can charge customers per unit of energy. This has sat at 8p/KWh for gas and 30p/KWh for electricity since 1 July.

Based on this, the average British household using the typical amount of energy would pay £2,074 a year – with the cap also including standing charges of 20p and 53p for each type of energy respectively.

However, since wholesale prices began climbing in 2021 – worsened significantly by the Ukraine war – suppliers have essentially used the cap’s pricing as standard.

“This has obviously removed any incentive to change supplier,” the Centre for Policy Studies added, given companies broadly charge the same, maximum, prices for energy.

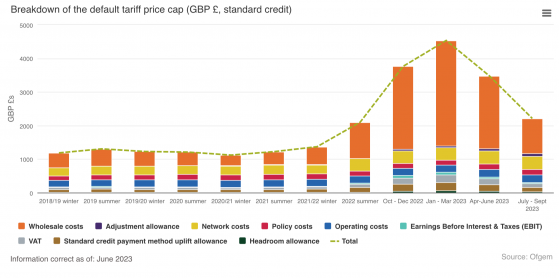

Given the cap is only partially based on wholesale costs, with operating and policy expenses, alongside the price of supporting customers of collapsed suppliers, also included, the group argued Ofgem’s intervention has led to increasingly “bizarre” situations.

“Witness the predictable outrage that followed Centrica PLC (LON:CNA)’s half-yearly results,” researchers said, which saw the firm’s retail wing British Gas pen a near 900% jump in pre-tax profit.

“The report urges the government to move from a wartime to a peacetime regulatory regime,” the Centre for Policy Studies added.

“Put simply, the price cap was conceived of in an era of relatively benign wholesale prices and is patently no longer fit for purpose in today’s market.”