Benzinga - by The Arora Report, Benzinga Contributor.

To gain an edge, this is what you need to know today.

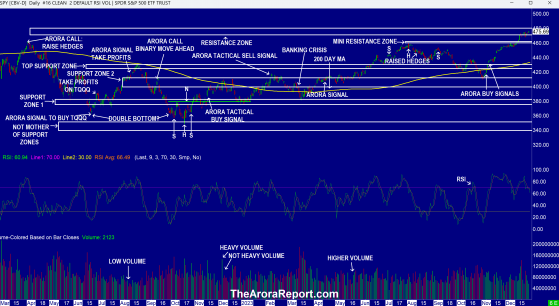

Nice Profits On Tactical Positions Please click here for a chart of S&P 500 ETF (ARCA:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows the market is in the resistance zone.

- RSI on the chart shows that the market is neither overbought nor oversold.

- The chart shows the Santa Claus rally is in full swing.

- Sentiment is extremely positive. Prudent investors should take note, this is a contrary indicator. We previously wrote:

As we have been sharing with you, at extremely positive, sentiment is a contrary indicator. In plain English, sentiment at extremely positive is a sell signal. Here are the key points:

- No one should act based only on sentiment.

- Sentiment is an important indicator but only one of the many indicators that go into a comprehensive 360 degree analysis.

- Sentiment is not a precise timing indicator.

- If the stock market pulls back, sentiment may also pull back, and thus negate any negative implications.

- Market mechanics continue to be on the positive side.

- When the calendar changes to the new year, the stock market can abruptly change. We previously shared with you:

In The Arora Report analysis, the start of the new year will likely be the same as every other new year after a strong year for the stock market — if the stock market starts going down, everyone will jump on the selling bandwagon; if the stock market starts going up, everyone will buy.

- There are nice profits on tactical positions. It is prudent before the year end to take partial profits on tactical positions or raise hedges or a combination of the two.

- Consider continuing to hold strategic positions.

- Be ready to take more profits and raise hedges depending upon how the stock market behaves in the new year.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

In the early trade, money flows are neutral in Microsoft Corp (NASDAQ: MSFT), Alphabet Inc Class C (NASDAQ: GOOG), and Apple Inc (NASDAQ: AAPL).

In the early trade, money flows are negative in Amazon.com, Inc. (NASDAQ: AMZN).

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is