By Francesco Canepa

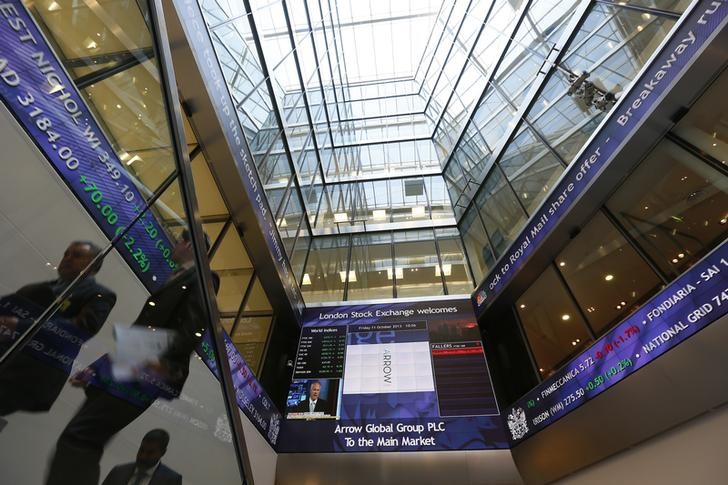

LONDON (Reuters) - British shares resumed their fall after a one-day break on Tuesday, pressured by a batch of gloomy trading updates from companies including luxury brands Burberry (L:BRBY) and Mulberry (L:MUL).

Shares in small-cap Mulberry tumbled 20 percent as the handbag maker said it expected full-year pre-tax profit to be significantly below expectations after a slump in first-half trading added to the disruption of a product overhaul.

Blue-chip Burberry shed 5 percent after saying the external environment was becoming more difficult.

The weak updates cast a shadow over the third-quarter reporting season, which will gain momentum in the coming weeks.

Britain's blue-chip FTSE 100 (FTSE) was down 0.4 percent at 6,344.12 points while the broader FTSE 350 (FTLC) index was down 0.3 percent. The FTSE 100 had edged up on Monday after hitting a 15-month low in early trading following four days of declines.

"With some of the early results coming in lower than expected, this is clearly not a good sign for the earnings season," said Manoj Ladwa, head of trading at TJM Partners.

"We are still net long (the FTSE 100) but we have some shorts to reduce our exposure," he added, citing retailer Next (L:NXT) as an example.

Short sellers borrow a security and sell it, betting they will be able to buy it back at a lower price before returning it to the lender and pocketing the difference.

Emerging market-focused fund manager Ashmore Group (L:ASHM) and investment platform operator Hargreaves Lansdown (L:HRGV) added to the bleak market sentiment.

The former reported a fall in assets under management while the latter saw a slowdown in net new business inflows. Their shares fell 2.8 percent and 4.1 percent, respectively.

Liberum Capital reiterated its "sell" stance on Hargreaves after the update.

"I think these (results) will disappoint and would expect further downside pressure," the broker wrote in a note.

Mid-cap staff recruitment firm Michael Page (L:MPI) fell 9.8 percent after it said that it expected full-year operating profit to be lower than expected after it saw growth rates for its net fees slow in Europe and Asia.

(Editing by Catherine Evans)