By Ben Hirschler

LONDON (Reuters) - GlaxoSmithKline (L:GSK) will look at acquisition options to bulk up its consumer health business as rivals like Pfizer (N:PFE) and Merck KGaA (DE:MRCG) quit the field, its chief executive said on Wednesday.

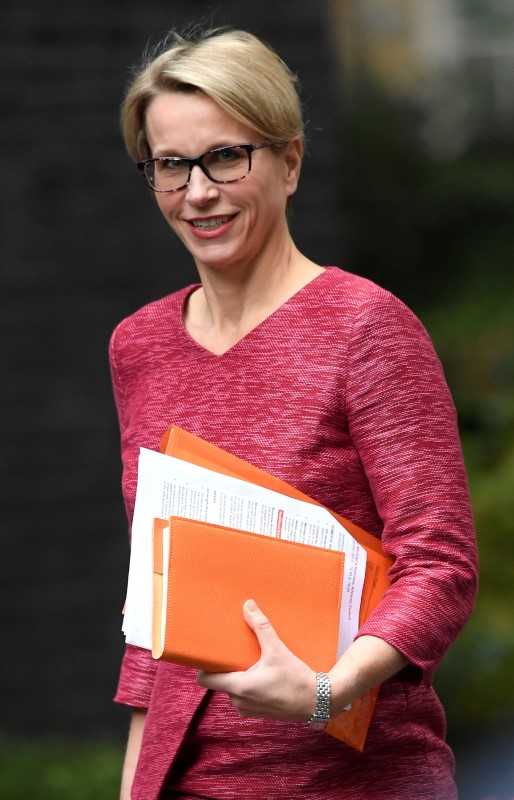

Emma Walmsley said her top priority was still to bolster GSK's prescription drugs division, but the prospect of a consumer deal worth some $15 billion (£11.3 billion) sparked investor fears of a dividend cut, sending the shares down more than 5 percent.

GSK sees itself as a "consolidator" in a fragmented consumer health sector, where scale and geographic reach are crucial and more businesses are likely to merge, Walmsley told reporters.

"We would look at these assets and really look at them carefully in terms of their complementarity ... but it is a question of looking at them and making sure we stay focused on returns," she said.

"Our first priority is focused on improving our largest business, the core pharma business, and R&D within that."

Pfizer's decision to consider selling its consumer health business poses a dilemma for GSK, since top-selling brands like painkiller Advil and Centrum multivitamins would fit well with the British group's operations.

But the Pfizer business is expected to carry a price tag of around $15 billion, or possibly more, and buying it would deplete GSK's financial firepower at a time when Walmsley is seeking to bolster the pivotal pharmaceutical division.

She has made boosting the drug line-up and focusing on fewer, bigger new medicines her signature goal since becoming CEO in April. GSK has lagged rivals in producing multibillion-dollar blockbusters in recent years and the new approach may well involve acquisitions.

GSK also needs cash available to buy the minority stake in its consumer health joint venture with Novartis (S:NOVN), if its Swiss partner opts to sell up next year. Analysts estimate that could cost around $10 billion.

German Merck's consumer health business is smaller and would not move the dial so much, but it is also of potential interest, Walmsley said.

Such large deals could strain GSK's ability to pay a dividend that is an important lure for many shareholders. "Investors remain focused on the safety of the dividend," said Leerink analyst Seamus Fernandez.

Other possible bidders for the Pfizer and Merck businesses could include Reckitt Benckiser (L:RB), Procter & Gamble (N:PG) and Nestle (S:NESN).

COST CUTTING

Walmsley's remarks came as GSK announced a 4 percent increase in third-quarter sales, with cost cuts keeping it on track to deliver on full-year financial targets.

Adjusted earnings per share rose 3 percent to 32.5 pence on sales of 7.84 billion pounds. Analysts, on average, had forecast 31.8p and 7.88 billion pounds, according to Thomson Reuters data.

"These are very much a 'business as usual' set of numbers," said Steve Clayton, manager of the HL Select UK Income Shares fund, who holds GSK stock.

At constant exchange rates, GSK's preferred measure, the group reiterated that 2017 earnings were expected to grow by between 3 and 5 percent.

The failure of generic companies to win U.S. approval so far for copies of ageing lung inhaler Advair helped in the quarter, although Walmsley said U.S. generics were "probable" in 2018.

GSK has benefited since June 2016 from a weaker pound, which has inflated overseas income. However, the currency boost dissipated in the third quarter with the passing of the first anniversary of the Brexit referendum.

The company now expects to see a 7 percent benefit to earnings from currency factors in the full year, down from 8 percent previously.

GSK's near-term focus is the launch of a trio of new products. The first two of these, a shingles vaccine and a three-in-one lung drug, have already won regulatory approval and the third, a dual-drug regimen for HIV, could get a U.S. green light by Dec. 1.

The committee responsible for U.S. vaccination schedules voted 8-7 on Wednesday to give GSK's shingles shot Shingrix a preferential recommendation over Merck & Co's (N:MRK) Zostavax, while also endorsing its use in people over 50 years.