Proactive Investors -

- FTSE 100 nurses heavy losses, down 1.9%

- Banks and insurers slump on fears over US lender

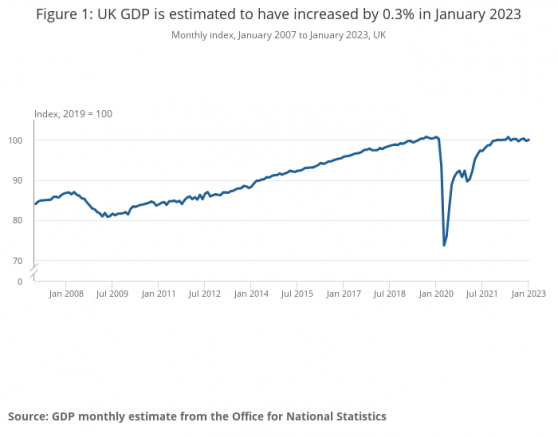

- UK economy grows in January

SVB crisis not a Lehman moment - Shore Capital

Gary Greenwood at Shore Capital has taken a look at events in the US with a read across to UK banks. He noted US bank shares fell sharply yesterday for two reasons - Silicon Valley Bank (SVB) got into difficulty due to mark downs on its security investments raising contagion fears and market fears increased that net interest margins are going to be squeezed by higher deposit betas (i.e. having to pass more of the recent rate rises to savers) along with a potential turn in the rate cycle.

He said the sharp rise in interest rates and bond yields that we have seen over the past year was always going to expose some issues in financial services.

He stressed for the most part, banks are well regulated and managed these days, but "clearly not all of them."

SVB clearly was in the latter camp he said and, while there may be more examples like this to come, Greenwood said he doesn't "see this as a ‘Lehman’s moment’ for the industry" and doesn't expect any of the big UK banks getting themselves into this kind of trouble.

"Where I am much more fearful is for the shadow banking industry which has taken on a lot of the risk that banks have eschewed since the Financial Crisis and are also a lot less well regulated," he explained.

Greenwood also noted concerns have been increasing around the degree to which interest rates increases are being passed through to depositors.

"To date, banks have benefited by withholding interest rate increases thus allowing deposit spreads to widen," he noted.

But now depositors are starting to wise up and are beginning to shop around more for better rates with this happening more in the US than the UK, he suggested.

However, Greenwood said ultimately he does deposit beta to increase in the UK and this is reflected in guidance and forecasts, but it should also be remembered that the domestic UK banks retain a big tailwind from their structural hedges, which will reprice upwards over a number of years.

"Consequently, while NIM may have peaked on a sequential quarterly basis in the UK, I see this now stabilising rather than collapsing," he added.

FirstGroup forecasts raised after strong update

Away from the turmoil in the banking sector and a rare riser was FirstGroup PLC, up 1.8% after it said it anticipated profits for the financial year ending 25 March 2023 would be ahead of previous expectations following strong trading in its bus and rail operations.

In a statement, the FTSE 250-listed firm said the improved performance at First Bus was driven by higher passenger volumes in the second half of the financial year and driver resource pressures easing in certain locations.

Bus passenger volumes have increased to 83% of 2020 equivalent levels, with commercial and concessionary volumes at 87% and 75% respectively. The increase in demand has partially resulted from the £2 bus fare cap scheme introduced in England in January 2023, the company said.

Analysts at Liberum raised EPS forecasts for the financial year 2023 by 23% accordingly and reiterated a buy rating with an unchanged sum of the parts valuation of 165p.

London rocking from the earthquake in Silicon Valley

"An earthquake in Silicon Valley led to aftershock on Wall Street and the tremors could still be felt in London on Friday morning.”

That was the view of AJ Bell investment director Russ Mould as the rout in UK banking stocks showed no signs of letting on Friday.

“Lending to tech start-ups is at the racier end of finance and in that context Silicon Valley Bank’s announcement of a US$2.25bn rescue share issue, after a period when appetite from lenders and investors towards this part of the market has dried up, should not have come as a major surprise."

“However, in a heavily interconnected banking industry it’s not so easy to compartmentalise these sorts of events which often hint at vulnerabilities in the wider system. The fact SVB’s share placing has been accompanied by a fire sale of its bond portfolio raises concerns," he felt.

“Lots of banks hold large portfolios of bonds and rising interest rates make these less valuable – the SVB situation is a reminder that many institutions are sitting on large unrealised losses on their fixed-income holdings."

Banks and insurers continue to lead the FTSE 100 lower although it has pulled off worst levels for the session, now down 1.8%.

Bank stocks extend falls but not a Lehman moment

UK equity markets in London remain firmly in the red led by a rout in UK banking and insurance stocks following sharp falls in US banks on Thursday.

At 9.00am the FTSE 100 was down 2% at 7,723.19, down 156.79 points while the FTSE 250 also fell 2% to 19,290.40, down 402.50 points.

Victoria Scholar, head of Investment, interactive investor noted the “negative momentum from last night’s sell-off on Wall Street has permeated across global markets with European indices opening lower.”

“Banks like Barclays, NatWest and Standard Chartered are trading at the bottom of the FTSE 100 while Frankfurt listings of the major Wall Street lenders continue to face selling pressure today. On the continent, Deutsche Bank, Commerzbank, Santander, and Credit Suisse are all down by more than 5% each.”

The falls were sparked after SVB Financial sank by more than 60%. This was after the bank, a prominent lender to tech startups, announced a US$2.25bn capital raise in response to a US$1.8bn loss on the sale of a portfolio marked at US$21bn. The portfolio included US Treasuries and mortgage-backed securities. The news knocked US banking stocks with big falls in a number of leading names such as Bank of America and Wells Fargo.

In London, banks also fell heavily with Barclays down by 5.5%, HSBC (LON:HSBA) down 5.1%, Standard Chartered down 4.6%, Lloyds (LON:LLOY) down 4.1% and NatWest down 4%. Insurers were also hit. Prudential tumbled 4.6% while Legal & General dipped 4%.

The mood was no brighter on the continent with the Dax in Frankfurt and the CAC 40 down 1.8% and 1.9% respectively. Across Europe bank stocks fell. Aaide from the falls in German banks outlined above Banco Santander fell 6.2%, BNP Paribas slipped 4.6% and UBS by 4.4%.

Neil Wilson at markets.com asked whether this was Lehman moment. He felt not.

“SVB does not represent the wider US banking sector, albeit the plummet in SVB stock clearly hit sentiment. It seems as though SVB was just gripping the wrong end of the stick with regards to rising interest rates, parking way too much of its assets in long-dated bonds which it thought safe but are now worth a lot less,” he commented.

Read more on Proactive Investors UK