Proactive Investors -

- FTSE 100 pushes higher after slow start

- Former BoE Governor Mark Carney says higher rates are here to stay

- WE Soda blames "unrealistically low" valuations for pulled float

Issa brothers close to Asda store deal

The billionaire Issa brothers are on the verge of selling off a chunk of Asda’s property empire to a US investor in a deal worth £650mln, according to The Times.

Mohsin and Zuber Issa, who bought the supermarket giant in 2020 with the private equity firm TDR Capital, are targeting sale and leaseback transactions for the grocer’s estate to try to bring down the firm’s hefty debt pile amid soaring interest rates.

The Times said Realty Income Corp, a New York-based investor, is said to be close to buying about 25 Asda stores on leases of up to 20 years, citing React News, an industry newsletter. The price tag equates to a net initial yield of about 6.5%.

Realty Income Corporation bought £429 million worth of Sainsbury’s portfolio as its debut UK deal in 2019. Since then, it has bought retail parks, supermarkets and logistics units in the UK.

Melrose falls as CEO offloads shares

Shares in Melrose Industries (LON:MRON) have fallen after chief executive officer Simon Peckham sold 2mln shares in the firm - half his stake - at 524.5p "as a result of a change in personal circumstances".

Peckham still holds just over 2mln shares and "has no current intention to sell any further shares", Melrose said.

Shares are trading 2.7% lower at 510.20p each in London.

L&G slips as unveils new CEO

A cautious reaction to the appointment of a new CEO at Legal & General Group PLC (LON:LGEN).

Russ Mould at AJ Bell thinks "the new boss at Legal & General has a hard act to follow. Since Nigel Wilson was appointed to the top job in June 2012, Legal & General shares have outperformed its life insurance peers, Aviva (LON:AV) and Prudential (LON:PRU), to chalk up a total return of more than 200%."

“Wilson didn’t necessarily make a big splash but was busy in the background, turning Legal & General into a more focused and efficient business," Mould explained.

“This could provide his successor, Antonio Simoes, with the opportunity to take Wilson’s approach of focusing on long-term assets and so-called ‘inclusive capitalism’ to another level, but that comes with uncertainty too after more than a decade of leadership continuity", he pointed out.

“The initial market reaction betrays at least some investor nervousness, even though Wilson will stay on board until January to help smooth the succession.”

Shares in L&G are 2.6% lower at 231.80p per share.

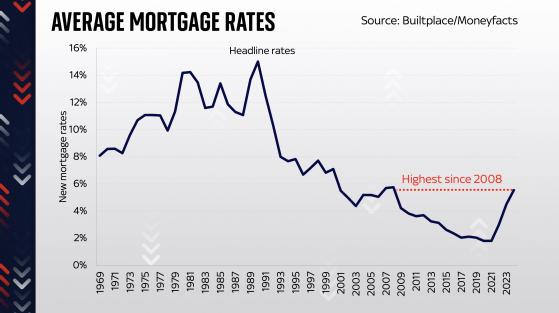

Borrowers face biggest mortgage squeeze since 1990s

Although UK interest rates have risen from .1% to 4.5% in the last 18 months, they are still well below the levels seen in the 1990s housing crash.

But, as Ed Conway of Sky News explains, borrowers are already facing a big mortgage squeeze (once you adjust for the size of mortgages, and people’s disposable income as a propoortion of those payments).

In a detailed analysis, Conway pointed out money markets are now pricing in interest rates of 5.75% by early next year, a “massive change from only a month ago, when they thought rates might peak under 5%.”

????BlimeyUK money markets now pricing in @bankofengland interest rates of 5.75% by early next year.

That’s a massive change from only a month ago, when they thought rates might peak under 5%.

Things looking increasingly grisly for mortgage payers/the housing market pic.twitter.com/7S9OCon9uu

— Ed Conway (@EdConwaySky) June 14, 2023

Conway then explains why is it such a big deal.

Right now, the average two year fixed rate deal is 5.9% according to Moneyfacts. The average 5 year deal is 5.54% which taking the lower rate is the highest since 2008.

But adjusting for the fact that these days people have bigger mortgages and lower incomes versus their monthly payments the mortgage burden is much higher.

He said right now, based on rates currently available, those refixing or taking out new loans are entering the biggest mortgage squeeze since 1991.