Proactive Investors -

- FTSE 100 firmer, up 13 points

- Slowing US growth knocks Diageo (LON:DGE)

- M&S chairman fires broadside over Brexit

10.46am: M&S chairman takes aim at Government over Brexit

The chairman of Marks & Spencer Group PLC has become the latest prominent business leader to criticise the government’s economic policy, as he called plans for post-Brexit trade “baffling” and “overbearing”.

The former Conservative MP, Archie Norman, said the plans for solving the Northern Irish Protocol stand-off would push prices higher and give EU companies a competitive advantage over their UK counterparts.

His comments on planned labelling changes for retailers came in a letter to the foreign secretary, excerpts of which have been seen by the Daily Telegraph.

““The overbearing costs of a labelling regime would raise prices and reduce choice for consumers, further disadvantage UK farmers and suppliers and impact UK retailers’ competitiveness in other international markets,” the report in the Telegraph said.

“The simple fact is retailers already operate in real-time digital information – day or night, at the click of a button, we can locate our products, be that in a depot, in transit or in a store.

“In a digital era – when one tap of a mobile can check-in a customer at a store and locate their order in under 60 seconds, it’s baffling that the Government and EU have rewound four decades to discuss an expensive ‘solution’ involving stickers & labelling.”

Using different product labelling could ease the need for customs checks at the border but Norman argued that it would lead to increased costs for producers and in turn higher prices for customers.

“A costly labelling solution will mean customers will be hit by reduced ranges, higher prices – at a time of huge inflation and when the economy in Northern Ireland is already disadvantaged – and a worsening of availability.”

“This proposal adds cost, labour and complexity at a time when the supply base really does not need it and is struggling to stay on its feet to the specific advantage of EU producers.”

Last week, billionaire businessman Sir James Dyson accused the government of a “short-sighted” and “stupid” economic approach while the director general of the confederation of British Industry questioned the lack of a “strategy”.

10.08am: Slowing US growth knocks Diageo

Shares in Diageo PLC are top of the FTSE 100 fallers despite better-than-expected interim sales and profits as slowing growth in the US took the fizz out of the share price.

AJ Bell investment director Russ Mould said ““Booze is supposed to be pretty recession resistant but Diageo sparked some concern from investors, despite an otherwise solid set of first-half results, by reporting slowing growth in its key North American market.”

North American organic sales increased by 3% but this was below consensus expectations for 6.4% growth.

Overall sales and EBIT growth of 9.4% and 9.7% were ahead of City forecasts of 7.9% and 7.6% advances respectively.

Analysts at Jefferies pointed out that the growth in the US is normalising as the pandemic effects recede.

The broker suggested using “near term bumpiness as this growth normalisation takes place to buy into a top tier staples stock.”

It reiterated a ‘buy’ rating.

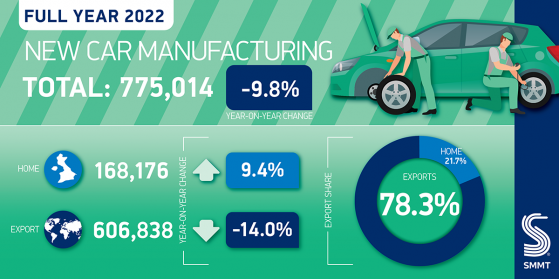

9.44an: Car production fell 9.8% in 2022

Annual UK car production fell -9.8% to 775,014 units in 2022 as global chip shortages and structural changes depress output, according to figures from the Society of Motor Manufacturers and Traders (SMMT).

The latest industry update also showed record levels of electrified vehicle production with almost a third of all cars made fully electric or hybrid – worth £10bn in exports alone.

UK volumes rose 9.4% but failed to offset declining exports, down -14.0%, with some eight in 10 cars shipped overseas.

9.26am: Lloyd's insurers on cusp of "golden era" - JP Morgan

JP Morgan has issued a bullish update on the three Lloyd’s insurers and share prices have reacted well.

The bank said it expects Hiscox Ltd (LON:HSX), up 1.9%, Beazley PLC, up 2.4% and Lancashire Holdings Limited, up 1.7%, to “produce the strongest ROEs since the mid 2000s with our average ROE for 2023/24E at 24%/21%.”

“At this stage in the cycle, with all three names set to deliver, we believe the Lloyd’s insurers are on the cusp of a new golden era similar to the one that we saw in 2012-15.”

The bank said its estimates reflect this being well ahead of consensus.

JP Morgan has upgraded Hiscox to neutral from underweight “as we believe the Retail issues that have dogged results in recent years are likely to be behind the company and an improving reinsurance market should allow the company to retain more business in this segment.”

But its favoured plays remain Beazley (overweight) which has been placed on the bank’s positive Catalyst Watch heading into its results in March and Lancashire (overweight).

9.08am: FTSE 100 firmer but Diageo slips

FTSE 100 has held its early gains although Diageo PLC has slipped back on further consideration of its interim numbers.

The lead index is now up 15 points and Andy Haldane, the Bank of England’s former chief economist, has called on the Bank of England to slow down its pace of interest rate rises this year.

Haldane, who is now chief executive at the Royal Society of Arts, told BBC Radio 4's Today programme that he hoped that now headline inflation had peaked “there’s a decent chance that central banks will go a bit slower during the course of this year”.

He said he hoped they “won’t become too much of a break on the recovery.”

Hopes that central banks may be close to a “pivot” on interest rates have helped push risk on sentiment so far in 2023 with the Bank of Canada signalling yesterday that it was pausing further rate hikes.

Back to equities and on Diageo, Victoria Scholar, head of investment, interactive investor noted it “reported first half net sales up 9.4%, surpassing expectations for a gain of 7.9%.”

“However it flagged weakness in the US outlook, putting the stock on track for its worst one-day drop since May 2022” she said.

Shares are now down 4.4%.

Elsewhere private equity group 3i (LON:III) Group topped the FTSE 100 leader board, up 4.8%, after its quarter three update.

But shares in Fevertree Drinks (LON:FEVR) have slumped 5.9% after it warned about inflation cost pressures this year.

According to a pre-close trading statement, revenue in the 12 months to 31 December was £344.3mln compared to £311.1mln a year earlier, with UK sales contributing £116.2mln towards the total.

Meanwhile, National Grid PLC (LON:NG) has begun warming up its back-up coal-fired power stations for the third time this week as it battles with an energy squeeze brought on by the cold weather.

The three Drax plants in North Yorkshire will be kept ready as a contingency plan should the power network operator need to bolster energy supplies at peak times later today.

8.37am: Strikes have cost Royal Mail (LON:IDSI) £200mln so far but guidance held

Royal Mail owner, International Distributions Services PLC, saw its shares rally 2% today as it detailed the cost of industrial action on the business so far.

In a trading statement, the company said the net cost of strike action in the nine months covered by the update were around £200mln with an adjusted operating loss of £295mln.

IDS said it continues to expect an adjusted operating loss around the mid-point of the existing £350mln to £450mln range, due to tight control of costs and strike contingency measures.

But this assumed no more days lost to strike action.

Revenues were down 12.8% year on year in the nine-month period with the performance continuing to be driven by a return to structural decline in letters, weaker retail trends, the impact of industrial disruption (18 strike days year to date), and lower test kit volumes.

Total letter revenue declined 6.1% year on year and total parcel revenue reduced by 17.8% year on year, with volumes down 20%.

The company said it expects the number of voluntary redundancies needed to achieve the required 10,000 job cuts by August 2023 to be “significantly lower” than the 5,000-6,000 communicated in October.

At its GLS business, IDS said volumes declined 2% year on year in the nine months while revenues grew 9.7% in sterling terms.

Adjusted operating margin for the nine months of 7.5% was 100 bps below the prior year.

For GLS, the company maintained guidance for revenue growth year on year of high single digit % and it tightened its guidance on adjusted operating profit to a range of €380 to €400mln (previously €370 to €410mln).

8.18am: FTSE pushes higher

FTSE 100 bounced back strongly in early exchanges on Thursday lifted by a late rally in the US and as investors digested a number of trading updates and broker recommendations.

At 8.15am the lead index was up 24 points at 7,768 while the FTSE 250 was 93 points to the good at 19,897.

But the research team at JP Morgan gave some reasons for caution on the New Year equity rally.

“While major equity market indices have posted a positive return YTD, our teams are more cautious from both a top-down and bottom up perspective, with our Chief Global Markets Strategist highlighting risks to both earnings expectations and equity flows, and our European Equity Research teams holding their highest ratio of UW recommendations in over 5 years” analysts pointed out.

Chief global markets strategist Marko Kolanovic highlighted a widening disconnect between forward earnings and macro, with weak 2023 guidance a potential catalyst for a reset of investor expectations, against the backdrop of equity flows that may be running out of steam.

But for now the mood is positive with shares in Johnnie Walker owner, Diageo, up 2% after it cheered investors with a healthy increase in sales and profits. Price increases, favourable currency movements and a shift to more premium brands underpinned the half-year figures while the group also pledged to return more cash to shareholders.

John Moore, senior investment manager at RBC Brewin Dolphin, said: “ Diageo has delivered good sales and profit growth, despite inflation taking its toll on margins.”

“Diageo has been smart about managing, developing, and evolving its brands, with their ‘premiumisation’ a major selling point and a way of insulating them from massively competitive markets, such as gin” he added.

He suggested while these results “highlight brand portfolio management it seems reasonable to expect to a more meaningful investment and addition to its current stable in the short to medium term.”

But Wizz Air Holdings PLC slumped nearly 10% despite a strong increase in revenues and reduced losses.

The stock was a strong performer yesterday in the wake of easyJet’s trading update and higher than expected costs may have prompted some profit-taking.

Rolls-Royce Holdings PLC rose slightly as Deutsche Bank upgraded to buy from hold with a price target of 136p, up from 90p.

Ocado PLC bucked the firm market trend and slipped 0.7% as RBC downgraded its recommendation to underperform while the same broker also cut the rating on Boohoo.com to underperform, shares fell 0.7%.

But shares in Lloyds insurer, (Hiscox PLC, jumped 1.8% as JP Morgan upgraded to neutral with the investment bank also favouring Beazley (overweight) where shares were also over 1% to the good.

7.55am: Bottoms up, sales and profits jump at Diageo

Diageo PLC, the world's largest spirits maker, reported strong growth in sales and profits at the interim stage benefiting from favourable currency movements, higher prices and as consumers drank more premium brands.

The Johnnie Walker owner reported net sales of £9.4bn in the six months to 30 December, up 18.4% with growth driven by “our diversified footprint, advantaged portfolio, strong brands and underpinned by favourable industry trends of premiumisation.”

Operating profits grew 15.2% to £3.2bn although the operating margin declined by 92bps with organic margin expansion more than offset by exceptional operating items and foreign exchange, the company said.

The FTSE 100 listed group said price increases and supply productivity savings more than offset the impact of absolute cost inflation on gross margin.

Growth was delivered across most categories, primarily scotch, tequila and beer with premium-plus brands contributing 57% of reported net sales and driving 65% of organic net sales growth.

EPS rose to 100.9p from 84.3p last year and a dividend of 30.83p, up 5%, was declared.

Diageo pledged to return up to an additional £0.5bn of capital to shareholders in fiscal year 2023.

Ivan Menezes, Chief Executive, said: “As we look to the second half of fiscal 23, whilst the operating environment remains challenging, I remain confident in the resilience of our business and our ability to navigate volatility.”

“We believe we are well-positioned to deliver our medium-term guidance of consistent organic net sales growth in the range of 5% to 7% and sustainable organic operating profit growth in the range of 6% to 9% for fiscal 23 to fiscal 25.”

7.35am: Wizz Air revenues more than double, confident of profit in 2024

Wizz Air Holdings PLC has reported more than doubled revenues in the third quarter and reduced losses as passenger numbers soared by 59.1%.

In a trading update the budget airline operator posted third quarter revenues of €911.7mln, up 123.2% with an EBITDA loss of €2.8mln, down from €87.5mln last year.

Operating losses for the quarter were €155.5mln compared to €213.6mln last time while the load factor improved by 10.2 percentage points to 87.3.

Revenue per available seat kilometre (RASK) jumped 50% to €0.03.73c and is now 4% higher than pre-pandemic levels.

The company still expects to post an overall net loss in fiscal year 2023 but remains “remain confident” that fiscal year 2024 will be profitable.

On costs, operational adjustments contributed to a significantly lower flight disruption cost compared to prior quarters while the strengthening Euro helped to reduce overall fuel and certain maintenance costs, the company said.

But the biggest impact was on revaluation of US dollar leasing liabilities, reversing most of the prior two quarters' losses and helping to deliver a net profit of €33.5mln for the quarter.

Looking ahead and bookings in January are ahead of 2022, in line with expectations.

“We remain optimistic and maintain our RASK guidance for H2 F23 at mid-single digits above the same period in 2019” commented József Váradi, Wizz Air group chief executive officer.

Wizz Air said it remains on track to operate at 35% plus higher capacity versus the second half of 2020 and for the first half of fiscal year 2024 the planned average seat kilometre growth is over 30% against 2023.

The company added “As with the third quarter, we expect to see slightly more ASK contribution from longer routes, connecting locations in Middle and Near East, as this region continues to attract a higher volume of passengers in the months to come. This should also bode well for better pricing opportunities.”

7.00am: FTSE seen higher

FTSE 100 is expected to open higher on Thursday after a rebound US markets following losses and ahead of a hefty batch of corporate updates in the UK.

Spread betting companies are calling the lead index up by around 25 points.

At the close, US stocks had recovered from the tech-led drop in early trading. The Dow Jones eked out a winning session, up 10 points to finish flat at 33,744. Meanwhile, the S&P 500 was also on even footing at 4,016 and the Nasdaq had mostly recovered but still finished 21 points (0.2%) lower at 11,313.

Michael Hewson chief market analyst at CMC Markets UK sid: “As a result of yesterday’s rebound in US markets, European markets look set to open higher this morning.”

US Q4 GDP figures will also be focus later in the day while results from Tesla Inc. after the bell yesterday will aflso see further scrutiny.

The EV maker beat Street expectations on earnings and revenues.

Back in London and Diageo PLC, Rank PLC and Wizz Air Holdings PLC are among the companies updating on trading today.

Read more on Proactive Investors UK