By Greg Roumeliotis NEW YORK (Reuters) - Belgian pharmaceutical company UCB (BR:UCB) is exploring a sale of its Kremers Urban Pharmaceuticals Inc division, a U.S. speciality generics business that could fetch as much as $2 billion (£1.18 billion), according to people familiar with the matter.

UCB is just the latest drug company looking to shed non-core businesses. Other companies that are exploring similar sales include GlaxoSmithKline Plc (L:GSK), Sanofi SA (PA:SASY) and Merck & Co Inc (N:MRK).

UCB is working with investment bank Lazard Ltd (N:LAZ) on the sale of the business, which is expected to be valued between $1.5 billion and $2 billion and attract both other companies and private equity firms, the people said on Tuesday.

Kremers Urban is projected to have earnings before interest, tax, depreciation and amortisation of around $170 million in 2014, the people added.

UCB and Lazard representatives did not respond to a request for comment.

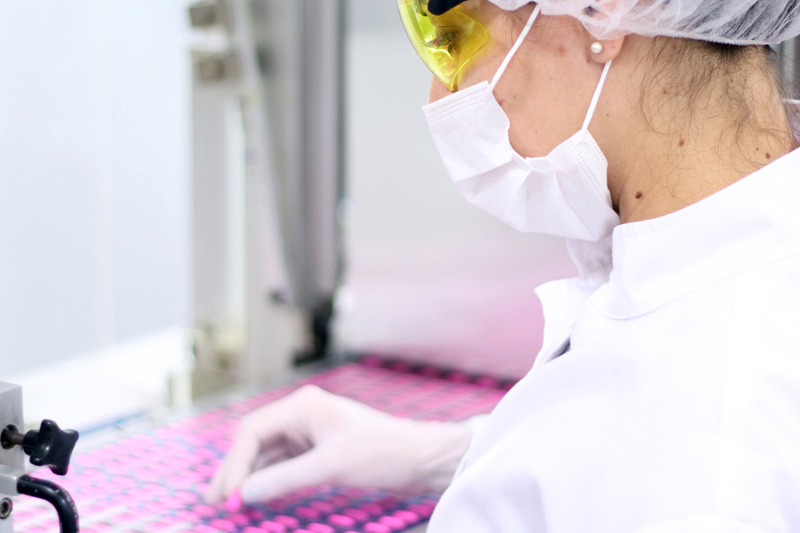

Based in Princeton, New Jersey, Kremers Urban is a maker of generic drugs with high barriers to market entry. Its product for the treatment of attention deficit disorder was approved by the U.S. Food and Drug Administration last year.

Kremers was acquired by Schwarz Pharma Manufacturing in the mid 1990s, before Schwarz was acquired by UCB in 2006.

Based in Brussels, UCB focuses on drugs for the treatment of conditions in the immune system and the central nervous system. It generated revenue of 3.4 billion euros (£2.66 billion) in 2013.

(Reporting by Greg Roumeliotis in New York; Editing by Lisa Shumaker)