By Michele Kambas

NICOSIA (Reuters) - Cyprus freed capital flows on Monday, ending two years of controls that set an unwanted precedent for the euro zone at the height of the bloc's debt crisis.

The Mediterranean nation became the first and, to date, the only euro zone member to impose controls, acting to stem a flight of capital from its banks in March 2013.

But with an incremental relaxation over the past 18 months, banks reported no unusual activity on Monday.

"It was just an ordinary day. Absolutely nothing out of the ordinary was noted," said a source at lender Hellenic Bank (CY:HBNK). Bank of Cyprus (CY:BOC) also said activity was normal.

The last controls to go were regulatory approval to move more than 1 million euros ($1.1 million) out of the country, and a traveller's limit of 10,000 euros per trip.

"The controls that were in place until this week were sufficiently loose to have been essentially non-binding," said Sofronis Clerides, Associate Professor of Economics at the University of Cyprus.

Announcing the abolition of controls last week, Cypriot President Nicos Anastasiades said banks were largely immune to the troubles of neighbouring Greece, still struggling to unlock remaining funds from its bailout programme.

One condition imposed by international lenders on Cyprus for 10 billion euros in aid was severing its long-time banking links with Greece in 2013.

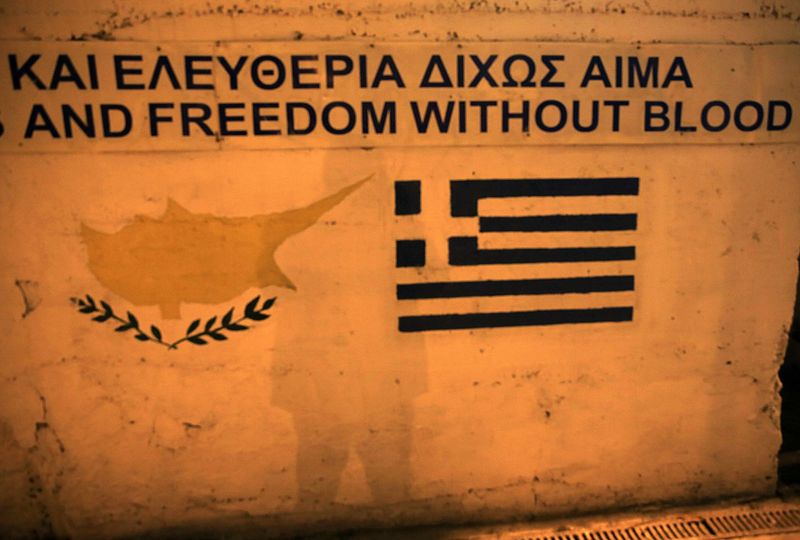

"The Cypriot government has - quite rightly - made a point of distancing itself from Greece," said Clerides, who said financial ties had been reduced significantly.

"The complete abolition of capital controls is another step in that direction. The Cypriot government is taking a calculated gamble that the removal of capital controls reduces the possibility of contagion from Greece should things deteriorate there," he said.

Bank of Cyprus was forced to seize a portion of clients' uninsured deposits and convert it into equity to recapitalise in 2013, while the second-largest bank at the time, Laiki, was wound down. Yet months later, Bank of Cyprus and Hellenic successfully raised capital from international investors.

"The economic damage from the restructuring of the financial sector did not prove as severe as initially feared," Michalis Florentiades, chief economist and head of investment research at online forex broker xm.com, told Reuters.

($1 = 0.9101 euros)