Benzinga - by Zacks, Benzinga Contributor.

Colgate-Palmolive Company (NYSE: CL) has reported first-quarter 2024 results, wherein the top and bottom lines beat the Zacks Consensus Estimate and improved year over year. Results have benefited from strong top-line growth, improved organic volume performance, and gross and operating profit margin expansions. Notably, the company delivered double-digit growth in operating profit, net income and earnings per share for the third consecutive quarter.

On a Base Business basis (non-GAAP basis), earnings were 86 cents per share, up 18% from the prior-year period. The bottom line surpassed the Zacks Consensus Estimate of 82 cents.

Net sales of $5,065 million increased 6.2% from the year-ago quarter and beat the Zacks Consensus Estimate of $4,951 million. On an organic basis, the company's sales advanced 9.8%. The sales momentum was mainly driven by organic sales growth in each of the six divisions and across all four categories. The rise was also aided by mid-teen growth in oral care compared with double-digit growth last year.

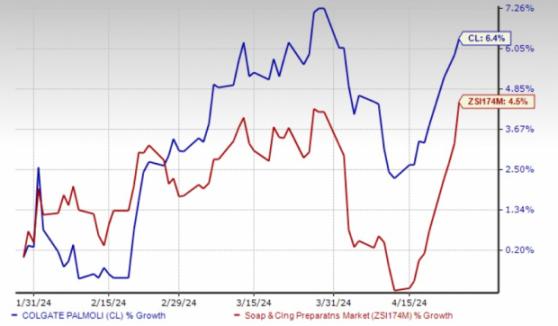

Following the strong first-quarter 2024 results, shares of Colgate rallied 1.7% in the pre-market trading session on Apr 26, 2024. Shares of this Zacks Rank #2 (Buy) company have rallied 6.4% in the past three months compared with the industry's growth of 4.5%.

Image Source: Zacks Investment Research

Q1 Details Total volumes were up 1.3% year over year on an organic and reported basis, attributed to sequential growth in North America and Europe. Meanwhile, pricing improved 8.5%, backed by positive pricing across all six divisions. Currency negatively impacted sales growth by 3.6% in the quarter. Strong currency in Mexico, Colombia, Brazil and Europe was more than offset by weakness in Argentina, Türkiye and Nigeria.

We estimated organic sales growth of 4.3% for the first quarter, with a 7.8% rise in pricing and a 3.5% decline in volume.

Gross profit of $3,039 million increased 12.1% year over year. The gross profit margin expanded 310 basis points (bps) to 60% on both GAAP and adjusted basis. We expected a gross margin expansion of 150 bps to 58.4% for the first quarter.

Colgate-Palmolive Company Price, Consensus and EPS Surprise

Colgate-Palmolive Company price-consensus-eps-surprise-chart | Colgate-Palmolive Company Quote

Selling, general and administrative (SG&A) expenses grew 9% year over year to $1,916 million. As a percentage of net sales, SG&A expenses expanded 90 bps year over year to 37.8%. We predicted SG&A expenses, as a percentage of revenues, to expand 40 bps to 37.3%.

The company's adjusted operating profit of $1,083 million advanced 15% year over year. The adjusted operating profit margin was up 170 bps year over year to 21.4% despite continued investments in advertising.

Colgate's global market share in the manual toothbrushes category has reached 31.7% year to date. The company has maintained its leadership position in the global toothpaste market, with a market share of 41.3% year to date.

Segmental Discussion North America's net sales (20% of total sales) rose 4% year over year on both reported and organic basis. The segment gained from a 1.2% increase in pricing and a 2.9% rise in volume. The segment witnessed volume growth, backed by gains in toothpaste, liquid hand soap, manual toothbrushes and body wash. The segment's hello brand reported strong sales and market share growth across oral care and personal care.

Latin America's net sales (25% of the total sales) advanced 16.5% year over year on 19.7% pricing gains and a 6.2% increase in volume, offset by a 9.4% unfavorable currency impact. On an organic basis, sales rose 25.9%, led by volume growth across all countries in the region, except for Argentina.

Europe's net sales (14% of the total sales) increased 9.5% year over year on a reported basis and 7.2% on an organic basis. Sales growth was driven by a 3.1% rise in volume, a 4.1% pricing gain and a 2.3% favorable currency impact. During the quarter, Europe returned to volume growth for the first time since second-quarter 2021 mainly on the back of strong performances in the U.K. and France.

The Asia Pacific segment's net sales (14% of the total sales) declined 1.5% year over year, reflecting a 2.9% decline in volumes and a 3% adverse impact of currency, partly offset by a 4.4% rise in pricing. Organic sales improved 1.5% due to gains across oral care, personal care and home care.

Africa/Eurasia's net sales (5% of the total sales) declined 4.5% year over year due to a 20.7% unfavorable currency impact, offset by a 3.9% increase in volume and 12.2% growth in pricing. Organic sales for the segment grew 16.2%, driven by strong pricing and volume growth. Volume growth mainly stemmed from continued double-digit growth in toothpaste and strength in body wash.

Hill's Pet Nutrition's net sales (22% of the total sales) improved 3.9% from the year-ago quarter on a reported basis and 4.2% on an organic basis. Results have gained from an 8.2% increase in pricing, offset by a 3.9% decline in volume and a 0.3% negative currency impact. The segment's volume was impacted by lower volume from private labels. Despite soft volumes, the segment benefited from continued volume and market share growth for its Hill's Science Diet and Hill's Prescription Diet across the specialty channels, driven by its science-led innovation and momentous increases in brand support.

Other Financial Details Colgate ended first-quarter 2024 with cash and cash equivalents of $1,079 million, and a total debt of $8,689 million. Net cash provided by operating activities was $681 million for the first three months of 2024. The free cash flow before dividends was $555 million.

Outlook Management has raised its sales forecast for 2024 and has reaffirmed its adjusted earnings per share view. Colgate anticipates net sales growth of 2-5% compared with 1-4% growth mentioned earlier. The revised sales view includes a mid-single-digit negative impact of currency compared with a low-single-digit negative impact expected earlier. The company expects organic sales growth of 5-7% for 2024 versus 3-5% growth mentioned earlier.

CL foresees gross profit margin expansion on both GAAP and adjusted basis, driven by continued pricing gains, benefits from revenue growth management initiatives and strength in the funding-the-growth program. On both GAAP and adjusted basis, the company anticipates higher advertising investment for 2024, resulting in an increase in advertising costs both on a dollar basis and as a percentage of sales. The company expects the tax rate for 2024 to be 24-25% on both a GAAP and adjusted basis.

Colgate expects adjusted earnings per share to grow in the mid to high-single digits. On a GAAP basis, earnings per share are expected to increase in the double digits.

Other Stocks to Consider Helen of Troy (NASDAQ: HELE), a leading consumer products player that operates through a diversified portfolio of renowned brands, currently carries a Zacks Rank #2. HELE has a trailing four-quarter earnings surprise of 8.9%, on average.

The Zacks Consensus Estimate for Helen of Troy's current fiscal-year sales and earnings suggests growth of 0.4% and 8.5%, respectively, from the year-ago quarter's reported figures.

Celsius (NASDAQ: CELH), which specializes in commercializing healthier, nutritional functional foods, beverages and dietary supplements, currently carries a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius' current financial year's sales and EPS suggests growth of 41.62% and 41.56%, respectively, from the year-ago reported numbers.

Kraft Heinz Company (NASDAQ: KHC), one of the largest consumer packaged food and beverage companies in North America, currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 7.6%, on average.

The Zacks Consensus Estimate for Kraft Heinz's current financial-year sales and earnings suggests growth of 0.5% and 1.3%, respectively, from the year-ago period's reported figures.

To read this article on Zacks.com click here.