By Matthew Miller

BEIJING (Reuters) - China is set to publish a planning document aimed at improving the country's inefficient state-led firms by harnessing the power of the market, subject to the government's enduring reluctance to cede too much control over the economy.

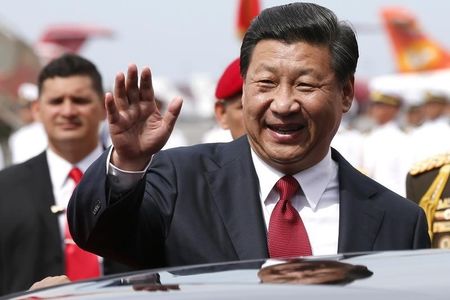

One year after President Xi Jinping called for measures to diversify ownership and improve management at state-owned enterprises (SOE), the document will provide new nationwide principles to draw non-state capital and grant managers more freedom from political interference, according to officials briefed on the plan.

The guidelines, expected within weeks, will fall short, however, of the most far-reaching measures, such as privatisation and market deregulation, which might challenge the state's pre-eminence in economic matters.

"The government wants state enterprises to work more effectively, but the government likes state capitalism," said Joe Zhang, former chairman of small business lender Wansui Micro Credit and one-time deputy head of China investment banking at UBS, who has not seen the document.

"This is a piecemeal effort," he said of the reform programme.

Even so, Chu Xuping, director of the research centre at State-owned Assets Supervision and Administration Commission (SASAC), the ministry-level body that directly oversees China's 113 central government-controlled conglomerates, said these would be significant measures.

"This round of reform isn't designed to further protect state-owned enterprises, but allow the market to play a decisive role and make all companies compete on a level playing field," he said.

Improving the efficiency at the SOEs, which dominate China's economy, is critical as the country struggles to maintain the breakneck pace of growth it has delivered for two decades.

Stephen Sun, head of China equity strategy at HSBC Global Research, says return on equity, an efficiency measure, is less than 5 percent for local state firms and about 10 percent for central SOEs, compared with about 15 percent for private businesses listed in Hong Kong.

"There's a huge performance and operational efficiency gap," Sun said.

OFF LIMITS

The guidelines, which follow a year of pilot programmes at central and local government-backed entities, will encourage the separation of business from politics through the appointment of independent company management and boards of directors, which would be answerable to independent state asset managers.

They are also expected to promote stake sales to portfolio and private investors, particularly in the country's most competitive sectors, though strategic industries would remain largely off limits, especially to foreign investors.

For sectors involved in national security, there "certainly won't be opening", said Zhang Chunxiao, professor of economics at Peking University and adviser to SASAC, while there will be restricted opening for public service industries such as utilities.

Beijing is considering publishing a 'negative list' of the strategic sectors and businesses restricted to domestic investment, said Zhang.

A landmark trial for mixed ownership took place in September, when state-controlled oil giant Sinopec Corp (HK:0386) sold 30 percent of its retail business to 25 big financial companies for $17.5 billion.

Drafting of the guidelines is being spearheaded by President Xi's comprehensive reform office, which in October sent teams to various provinces, municipalities and state-owned firms to conduct assessments.

Local reports say reaching consensus has been complicated by differing political interests at the national and local level and bureaucratic rivalries among government bodies including SASAC, the finance ministry, and top planning agency the National Development and Reform Commission.

While the government wants to promote independent management at SOEs, it has also weighed the competing priority of stamping out corrupt practices at state firms, where executives have regularly enriched themselves.

The official Xinhua News Agency says 252 domestically listed firms with state-owned involvement spent a total of 6.53 billion yuan on "hospitality" in 2012, while Reuters has calculated that at least 55 SOE leaders have been put under investigation since last year's Communist party meeting.

"No reform plan can solve all of the problems," said professor Zhang. "More will be needed."

(Additional reporting by Beijing Newsroom; Editing by Will Waterman)

2_800x533_L_1412520354.jpg)