By Paul Sandle

LONDON (Reuters) - U.S. drugmaker AbbVie Inc (N:ABBV) bought Dublin-based Shire Plc (L:SHP) on Friday in a 32 billion pound deal that will allow it to slash its tax bill by relocating to Britain.

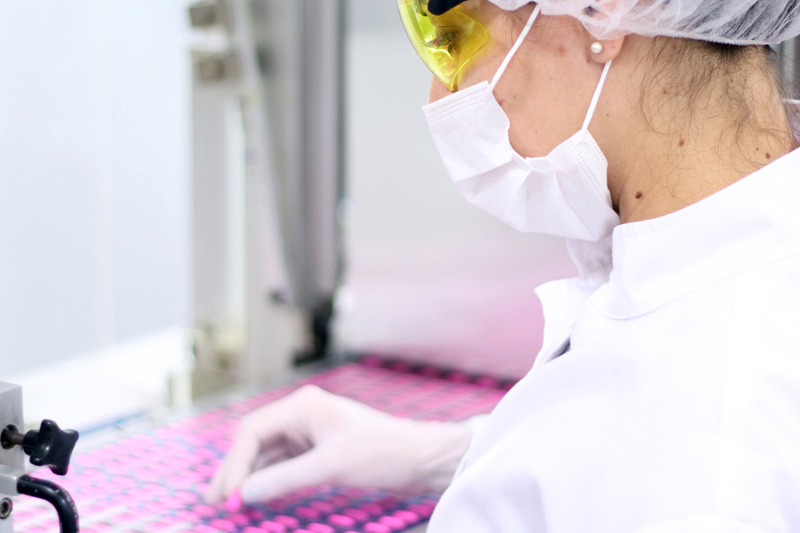

The London-listed company, which makes expensive medicines to treat rare diseases, fought off four earlier bids from AbbVie until the U.S. firm raised its price to 52.48 pounds per share - made up of 24.44 pounds in cash and 0.8960 new AbbVie shares.

Chicago-based AbbVie is buying Shire to cut both its U.S. tax bill and its reliance on arthritis drug Humira, the world's top selling medicine which loses U.S. patent protection in 2016. AbbVie, which generates nearly 60 percent of its revenue from Humira, had until Friday to announce a firm offer for Shire, extend the deadline or walk away under UK takeover rules.

It now plans to create a company listed in New York, incorporated in Jersey, the Channel Islands, and tax-domiciled in Britain, which will pay an effective tax of about 13 percent by 2016, sharply lower than its current rate of about 22 percent, making the deal one of the biggest driven by the tactic known as tax inversion.

America's Pfizer Inc tried to pull off the same trick earlier this year when it made a bid for Britain's AstraZeneca plc (L:AZN) though its $118 billion deal was rejected.

Calls for political action to stop tax inversion deals are growing in the United States. U.S. Treasury Secretary Jacob Lew urged Congress this week to take steps to discourage companies moving their tax domiciles aboard, saying "economic patriotism" was needed.

AbbVie's agreed price represents a premium of about 53 percent to Shire's share price on May 2, the last business day before AbbVie's first offer, which was rebuffed by Shire.

Shares in Shire, which will own about 25 percent of the combined group, closed 3.9 percent higher at 49.96 pounds, while AbbVie was up 2.1 percent to $54.65 at 1615 GMT.

Gonzalez said Shire Chief Executive Flemming Ornskov, whose tenure at the drugmaker was marked by earnings upgrade after earnings upgrade, would stay on, initially to help with integration and then to head a dedicated rare disease division.

Separately, Shire raised its earnings guidance for the year on Friday, to low-to-mid 30 percent growth, from mid-to-high 20 percent growth. The company, which also produces hyperactivity drug Vyvanse, reported record revenue of $1.5 billion for its second quarter and a 42 percent jump in its preferred earnings measure of non-GAAP adjusted earnings per ADS to $2.67.

Shire was advised by Goldman Sachs, Morgan Stanley, Deutsche Bank, Evercore and Citi, while AbbVie was advised by J.P.Morgan.

(Editing by Sophie Walker)