By David Henry

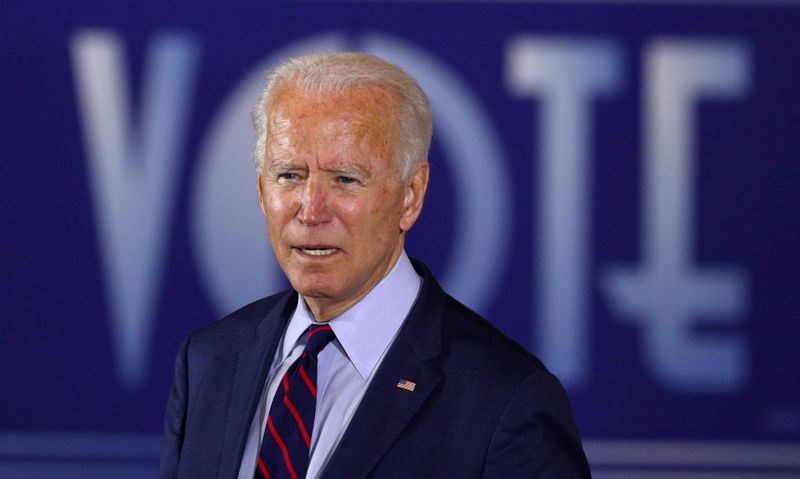

NEW YORK (Reuters) - Democratic presidential candidate Joe Biden's plan to raise corporate taxes would have a modest impact on profits of big U.S. banks and probably not before 2022, analysts said.

Other aspects of Biden's plan, including tax credits for low and moderate income households and government spending on infrastructure, could lead to fewer loan losses and more lending revenue, they said.

Banks were big beneficiaries of tax cuts under President Donald Trump, making a reversal seem ominous. But a second look at what might happen if Biden were to win the election and Democrats were to win control of the U.S. Senate suggests the pain might not be so bad.

Biden's plan would raise the current 21% corporate rate to 28%, putting back only seven of the 14-point reduction enacted during the Trump administration.

That seven-point hike would reduce big banks' earnings per share by a median of 7.4% based on 2021 estimates, according to Morgan Stanley (NYSE:MS) analyst Betsy Graseck.

For Wells Fargo & Co (N:WFC), the estimated hit would be 10.2% because the vast majority of its operations are in the United States. For Citigroup Inc (N:C), which gets a lot of revenue abroad, it would only be 6.5%.

Analysts do not think corporate tax rates will go as high as what Biden has proposed, even if Democrats gain control of Congress in a so-called "Blue Wave." The economy will be too fragile because of the coronavirus pandemic to enact much higher rates, they said.

"There could be reticence, especially with moderate Democrats, to hike taxes out of fear that any fiscal tightening would slow economic activity," said Issac Boltansky, director of policy research at Compass Point Research & Trading.

Biden's proposed 28% rate would also face arguments that the total corporate tax bill from federal, state and local levies would put U.S. companies at a disadvantage to global competitors that have lower rates, said Rohit Kumar, co-leader of PwC's national tax office in Washington.

A Democratic sweep might benefit banks in another way, by launching proposed infrastructure projects. That government money would flow through to businesses and their employees, making it easier for them to repay their loans, analysts said.

Big U.S. banks have put set aside more than $60 billion for potential loan losses since the pandemic started. If those losses do not materialize, the banks will be able to bring the money back into reported earnings.

More government infrastructure spending could also support demand for loans and increase inflation. Higher interest rates would lift bank revenue from loans and securities.

Combined, those factors could offset two-thirds of the 7.4% drag on bank earnings from a 28% corporate tax rate, Morgan Stanley's Graseck estimated.

There are many hypotheticals at play - if Biden wins, if Democrats take control of Congress, if various proposals pass as written - but bank shareholders have been concerned that lenders would lose the huge earnings benefit they gained from the 2017 tax cuts, analysts said.

Biden was leading Trump by 10 points, according to a Reuters/Ipsos poll earlier this month.

Higher rates probably would not take effect until 2022, analysts said.

Democrats would first try to shore up the economy and pursue legislation on healthcare, racial injustice, wealth disparities and the environment before they would turn to reversing gains banks made under Trump, Washington policy experts said.

The history of tax bills back to 1986 shows they take time to move through the legislative process and that hikes almost always take effect in the future, Kumar said.

"It seems more likely it would be January 2022 than January 2021," he said.