Benzinga - To gain an edge, this is what you need to know today.

Prudent Investors Should Care Please click here for a chart of the federal deficit.

Note the following:

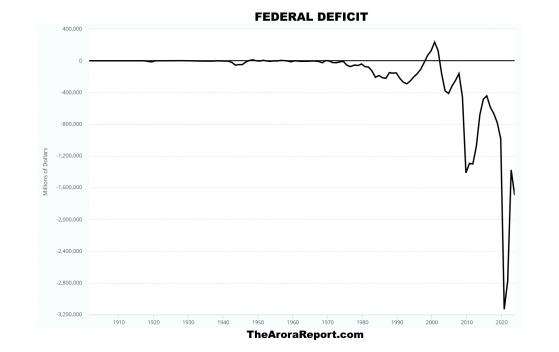

- The chart goes back to 1900.

- The chart shows that large federal deficits are a relatively recent phenomenon.

- The chart shows about a $3T deficit during the pandemic when the government overdid giving away free money. The government did not have the money to give away, so it borrowed more.

- Even though the pandemic is behind us, the chart shows that large federal deficits are still there. A big part of the deficits is the free money that is being given away right now through several programs such as the Inflation Reduction Act and Infrastructure Act.

- Moody’s has downgraded the outlook on U.S. credit to negative from stable. Moody’s cited the large federal deficit as a “key driver” behind the downgrade. Here are pertinent excerpts from Moody’s:

- “The downside risks to the US’ fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths.”

- “In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

- “Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.”

- The news came late Friday after the stock market close. There was only a slight reaction on Friday in after hour trading. When futures started trading on Sunday, the reaction was still slight.

- This morning, the momo crowd is buying the slight dip driven by FOMO (fear of missing out), oblivious to Moody’s downgrade.

- In The Arora Report analysis, prudent investors should pay attention to Moody’s downgrade, even though the momo crowd is buying the shallow dip. The reason is that the U.S. is on an unsustainable fiscal path. In the long term, money is made by looking ahead. A practical way for investors to protect themselves is to diversify by investing some money overseas and in different asset classes as appropriate. For those who can, it is also very helpful to be able to short to take advantage of prices coming down. Here are the three key points:

- Money is to be made in the U.S. and outside the U.S. Yet, most investors have 100% of their investments in the U.S.

- Money is to be made when prices go up and when prices go down. Yet, most investors try to make money only when prices are going up and do nothing more than complain when prices go down. Imagine if someone was to insist on driving only on a one way road that went north.

- A practical, actionable way to protect yourself and enhance your returns over the long term is to subscribe to the Corporate Bundle that brings you more opportunities from across the globe and also helps you make money when prices go down. Please read the Accelerating Wealth Generation section in the Trade Management Guidelines.

- Be careful if you are just looking at the Dow Jones Industrial Average (DJIA). DJIA is being boosted by one stock – Boeing Co (NYSE: BA). There are two reasons behind the boost in Boeing:

- There are reports that China is about to lift the freeze on Chinese airlines buying Boeing jets. This is a good will gesture from China ahead of Biden and Xi meeting.

- Boeing is likely to win several orders from the Dubai Air Show.

- As a full disclosure, BA is in the core Model Portfolio.

- On the positive side, the risk of a U.S. government shutdown has lessened. U.S. House Speaker Mike Johnson has proposed a two-step measure to postpone hard decisions to next year. In essence, the proposal is the same as the proposal that resulted in the ouster of former Speaker Kevin McCarthy. Hardline Republicans are opposed to this proposal. However, indications are that the proposal is getting some Democratic support.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Magnificent Seven Money Flows In the early trade, money flows are positive in Tesla Inc (NASDAQ: TSLA), NVIDIA Corp (NASDAQ: NVDA), and Microsoft Corp (NASDAQ: MSFT).

In the early trade, money flows are negative in Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), and Meta Platforms Inc (NASDAQ: META).

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is