Proactive Investors - Bitcoin (BTC) has reverted to its safe-haven status amid escalating tensions in the Middle East.

Although the world’s largest cryptocurrency can exhibit qualities closer to equities and other risk assets, it has followed gold in rallying over the past couple of days as the market becomes increasingly spooked by Israel’s missile attacks on Iranian military targets.

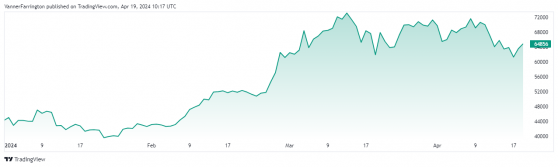

Bitcoin gained 3.5% against the US dollar on Thursday and another 2% this morning, bringing the BTC/USD pair above $64,700 at the time of writing.

The upshot on bitcoin’s price comes just hours before the big Halving event, when the rate of bitcoin distribution will be slashed in half.

This mechanism ensures that the total supply of Bitcoin will approach, but never exceed 21 million coins and works as a deflationary economic model.

Bitcoin is not expected to have a major reaction immediately following the Halving, though it should support bitcoin’s price in the long run.

“The first to be impacted by the halving event will be the bitcoin miners who will now need to be twice as efficient just to standstill,” said Malcolm Palle, executive chairman and founder of Coinsilium.

“But likely most of the larger miners will have already prepared for this event and will have recalibrated their economic models to ensure their operations can withstand the instant supply shock.”

Ethereum also made gains against the US dollar over the past couple of days, though at $3,099, the BTC/USD pair still remains around 12% lower week on week.

In the broader altcoin space, BNB, Solana (SOL) and Ripple (XRP) are down in the upper teens week on week, while Dogecoin (DOGE)’s losses have surpassed 23%.

Global cryptocurrency market capitalisation currently stands at $2.36 trillion, with bitcoin dominance at 54.3%.