Proactive Investors - 14.34: Solana stakers rush for exit

Over US$520mln worth of Solana (SOL) was withdrawn by Solana’s proof-of-stake (PoS) validators today, with a further US9.3mln already set for withdrawal at the next epoch due in two days.

Staking is the process of validating the Solana blockchain network, and large-scale withdrawals cause two major problems.

- With less SOL being staked by Solana’s validators, the network becomes less efficient and more susceptible to exploits

- When validators capitulate, the market gets diluted with SOL tokens, causing downward pressure on the coin

Crypto exchange Kraken is one SOL whale rushing for the exit.

Nearly 11% of Kraken’s stake is due to be withdrawn at the next epoch for a net change of -7.87%.

Kraken capitulates– Source: Solana Compass

However, while some stakers are rushing for the exit, this actually presents an opportunity for those sticking around.

Fewer stakers at play means a greater share of the staking rewards.

Top Solana stakers are currently enjoying average returns of around 8.3%, up nearly 43% month on month.

SOL stakers get bonus as other capitulate – Source: stakesolana.app

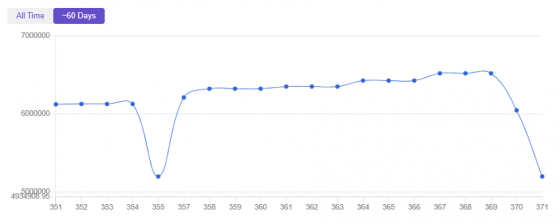

SOl’s price has recovered in the past couple of hours, with market capitalisation heading back above US$6bn, thus bringing the network up from 15 to 12 on the global charts.

1.16pm: Tether briefly depegs

Tether (USDT), the largest stablecoin in existence and the lubricant that keeps the crypto markets ticking over, briefly fell 2% below its US$1 peg in the past hour.

While stablecoin depeggings are common, anything greater than a fraction of a percent can be worrying.

Purportedly backed by real-world assets (though this has been a point of contention), USDT and other stablecoins are synthetic assets that act as digital representatives of the US dollar.

They solve the problem of price volatility in the crypto markets: With stablecoins, crypto traders can engage with the decentralised finance (DeFi) markets without worrying about noticeable price fluctuations.

Since USDT is/should be backed 1:1 with US dollars or equivalents, a significant drop in USDT’s value could devastate the crypto markets.

To put this into context: The two trillion dollar market rout earlier this year was largely due to the depegging of another stablecoin called TerraUSD (UST).

UST had a market cap of US$18bn preceding its collapse. Tether (USDT) currently has a market cap of US$70bn.

USDT is far and away the most traded cryptocurrency, with recent daily volumes exceeding US$130bn.

#tether processed ~700M redemptions in last 24h.No issues.

We keep going.

— Paolo Ardoino ???? (@paoloardoino) November 10, 2022

Tether’s chief technology officer Paolo Ardoino sought the assure the market online, and Tether has stated that it had no exposure to FTX prior to collapse.

12.41pm: Sequoia Capital moves to reassure partners after writing off entire FTX investment

Sequoia Capital wrote down all of a US$214mln investment in FTX, conceding that it is “in the business of taking risks”.

With a liquidity crunch creating a solvency risk for FTX likely leading to bankruptcy, the US venture capital firm marked its investment in the international and US businesses down to US$0 in a bid to cut losses.

In a note to its limited partners, Sequoia highlighted that other investment firms will likely be hit by FTX’s woes, including the likes of BlackRock Inc (NYSE:NYSE:BLK) and Tiger Global Management.

It was also quick to outline that its exposure to FTX was limited, with less than 3% of its Global Growth Fund III, and under 1% of its SCGE fund invested in FTX.com and FTX.us.

These losses, it explained, are offset by roughly US$7.5bn in gains from the growth fund.

Previously, the venture capital firm had been singing its praises of FTX founder, Sam Bankman-Fried, even dubbing him a “legend,” but its confidence seems to have finally faltered.

12.22pm: Margin calls inevitable as FTX faces bankruptcy

The cryptocurrency markets face a “cascade” of margin calls from the crisis befalling Sam Bankman-Fried’s crypto empire, according to JPMorgan (NYSE:JPM) analysts.

SBF’s crypto exchange FTX, once the second largest in the world until just this week, has effectively ceased operating following a bruising bank run.

Contagion has spread throughout the entire crypto sector, causing bitcoin’s price to crash to US$16,000.

Some analysts warn of a further crash to US$13,000, a brutal -80% down from last November’s high of US$69,000.

Billions in long-Bitcoin positions could be wiped out, leaving retail and institutional investors with big losses.

According to coinglass.com data, US$231mln worth of bitcoin liquidations has occurred in the past 24 hours.

Once among the most esteemed figures in the crypto sector, now-disgraced SBF has warned investors of bankruptcy should a US$8bn blackhole fail to get filled.

“I f---ed up,” SBF told investors, according to a Bloomberg report, adding that he would be “incredibly, unbelievably grateful” if stakeholders could help.

Perhaps more tragic is the fate facing FTX customers, whose billions in assets are on tenterhooks.

The last time a major cryptocurrency exchange went bust was in 2014, when the once-leading bitcoin exchange folded.

Mt. Gox customers have yet to receive compensation.

11.34am: Solana smashed amid crypto contagion

Solana (SOL) is down 56% this week as sentiment in the crypto markets sours.

Having been in the top-10 digital currencies for over a year, the massive hit to its market cap has knocked Solana down to 15th place.

Embattled FTX and Alameda Research founder Sam Bankman-Fried has strong ties with the blockchain, showing just how toxic his name has become in a mere matter of days.

SBF recently came out batting for Solana in a year of hacks, exploits and dodgy performance issues, calling it the most “underrated token right now” in a Fortune interview.

SBF casts shade on SOL – Source: CoinMarketCap

He’s certainly not without skin in the game.

There’s the little issue of Alameda Research’s balance sheet being packed with SOL tokens, which he has purportedly been using as leverage.

In fact, so large is Alameda’s SOL stash that it represents around 20% of SOL’s circulating supply.

Now that SBF’s empire looks to be in dire straits, there are fears that he is poised to liquidate his entire SOL position.

No wonder the coin is crashing as investors seek to minimise their exposure.

As a venture fund, Alameda Research also participated in a US$314mln funding round for Solana Labs in 2021 and subsequently went to work on building the Solana-based decentralised exchange Serum.

Which brings us to another point: Serum (SRM) is the second-worst performing decentralised finance (DeFi) protocol across the entire cryptocurrency space, having lost over half its value in the past week.

Bitcoin takes the biggest nosedive in months amid an ongoing crisis in the crypto markets

Having agreed to rescue the FTX cryptocurrency exchange following a crushing bank run, Binance has pulled out of the deal, seemingly after acknowledging the dire state of its former competitor's financials.

Withdrawals remain frozen on the FTX platform and while bitcoin itself is largely unaffected, it has shaken confidence in the already tenuous marketplace.

Now changing hands below US$16,700, bitcoin is down 18% week on week; its lowest point since November 2020.

Bitcoin bulls will attempt to defend the US$16,600 support line.

Can bitcoin stabilise following yet another crypto crisis? – Source: currency.com

Ethereum has crashed nearly 25% in the past week to four-month lows on US$1,100.

Solana (SOL), which is linked to FTX founder Sam Bankman-Fried, is bearing the brunt of the latest bout of crypto contagion having plummeted over 50% in the past week.

As a result, the blockchain has lost its long-held position as a top-10 cryptocurrency.

Ripple (XRP) has had 20% of value carved from its market capitalisation.

Contagion was less severe among the other large-cap altcoins.

Polygon (MATIC) has managed to keep losses in the single digits, while Cardano (ADA), Polkadot (DOT), and Tron (TRX) are also faring comparatively well.

As for FTX Token (FTT), it has lost 90% of its market value since the crisis kicked into gear last Friday.

This spells disaster for Sam Bankman-Fried’s Alameda Research venture fund, which is mainly propped up by now-worthless FTT tokens.

FTT tanks from US$3.2bn to US$320mln – Source: CoinMarketCap

Dogecoin (DOGE) has all but lost the massive gains it recently saw following Elon Musk’s Twitter takeover.

The meme coin is 40% down week on week, bringing its market capitalisation to US$10.6bn.

All in all, global crypto market cap is sitting at US$830bn and while low values have been logged this year, there is a good change of more pain to come.

Read more on Proactive Investors UK