Trading outlook:

We are resuming with our positive outlook on gold. Support levels strengthening at higher levels and improving momentum suggests that weakness is ow a chance to buy.

Support:

Resistance:

Today’s morning commentary:

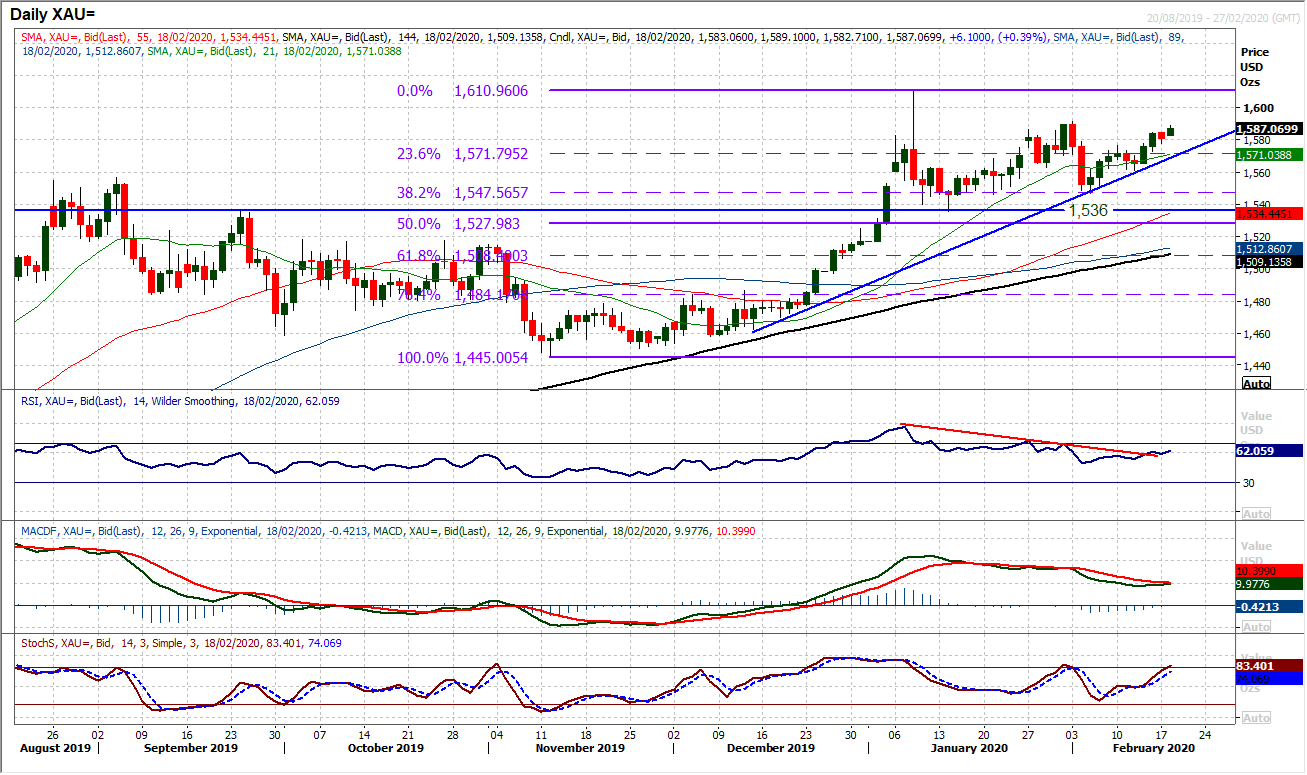

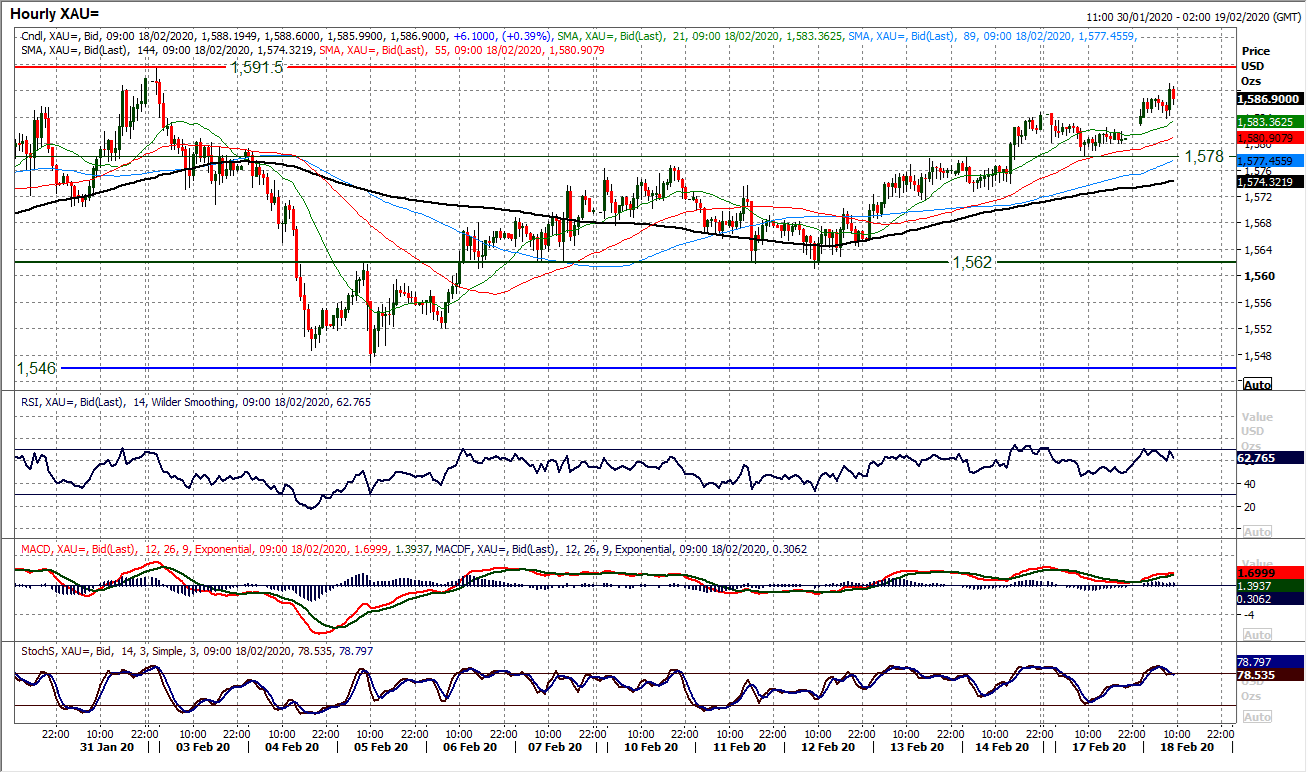

We are turning more positive on gold once more. The consolidation that arose in the wake of the sharp correction back from $1591 is now growing with a positive bias once more. Although the move is not decisive, there is a more positive outlook developing on momentum indicators now. The RSI is edging back above 60 and has broken a recent trend lower, whilst MACD lines are close to crossing higher as Stochastics rise towards 80. Weakness is increasingly being bought into and the bulls are eyeing $1591 again today. We spoke recently about the growing support levels. There is a higher low at $1562, the two month uptrend is at $1570, the market is trading clear of the 23.6% Fibonacci retracement (of $1445/$1611) at $1572, and now the breakout at $1577 was a basis for another higher low yesterday. We continue to look at weakness as a chance to buy, and we favour a move above $1591 to test $1611.

DISCLAIMER: This report does not constitute personal investment advice, nor does it take into account the individual financial circumstances or objectives of the clients who receive it. All information and research produced by Hantec Markets is intended to be general in nature; it does not constitute a recommendation or offer for the purchase or sale of any financial instrument, nor should it be construed as such.

All of the views or suggestions within this report are those solely and exclusively of the author, and accurately reflect his personal views about any and all of the subject instruments and are presented to the best of the author’s knowledge. Any person relying on this report to undertake trading does so entirely at his/her own risk and Hantec Markets does not accept any liability.