Pierre Debru

Head of Quantitative Research & Multi Asset Solutions, WisdomTree Europe

Time in the market beats timing the market

The end of each year brings long-awaited traditions like thanksgiving turkeys, Saint Nicholas, Christmas trees, Hanukkah’s menorah and New Year’s fireworks. For investors, one of those traditions is the equity forecast for the following year. Recently, as I was reading predictions for 2024, I started to wonder how accurate last year’s predictions had been.

Predicting short term moves in the market is a fool’s errand

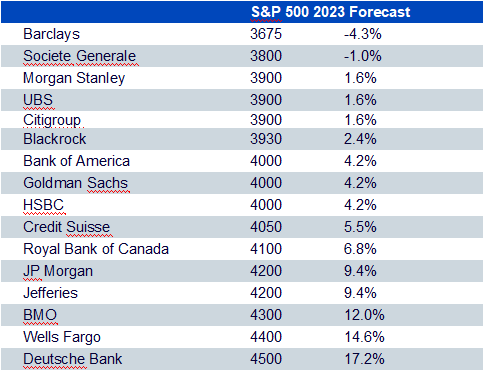

In Figure 1, I compiled predictions from 16 forecasts published at the end of 2022 by different banks and asset managers across the spectrum. As a reminder, the S&P 500 gained 24.2% over the full year in 2023. The results are telling:

- The dispersion is massive, with a 21% spread between the most pessimistic and the most optimistic, with everything in the middle

- Not one expert got it even close to right. Some predictions ended up 28% off

Figure 1: What experts predicted for the S&P 500 in 2023

So, what should we conclude from this little anecdote? I think we should acknowledge that when it comes to short term moves in markets, “nobody knows anything”, and that the successful investors are long-term investors that aim to harness the equity risk premium, over the long term, through time-proven, consistent strategies. In the words of Kenneth Fisher, “Time in the market beats timing the market”.

Investing for the long term: core strategies anchored around academically proven risk premium

Academics have demonstrated again and again that systematically investing in factor portfolios would have outperformed the market over the long term. Investing in high-dividend stocks, high-quality stocks, or cheap stocks in a systematic manner gives investors one of the keys to outperforming the market. It is worth noting that academic research has shown that the expected outperformance yielded by such approaches has not meaningfully decreased over time, with markets becoming more efficient.

WisdomTree Quality Dividend Growth strategies are a good example of how using this decade-long research can help outperform the market and grow investors’ wealth over the long term. Every strategy in this range (global equities, US equities, Eurozone equities, UK equities) has outperformed the market since launch. One of the reasons for this success is that the investment process is rooted in academic literature and focuses on the systematic selection of a diversified basket of highly profitable companies with solid dividend-paying credentials, leaning heavily into the Quality and High Dividend factors.

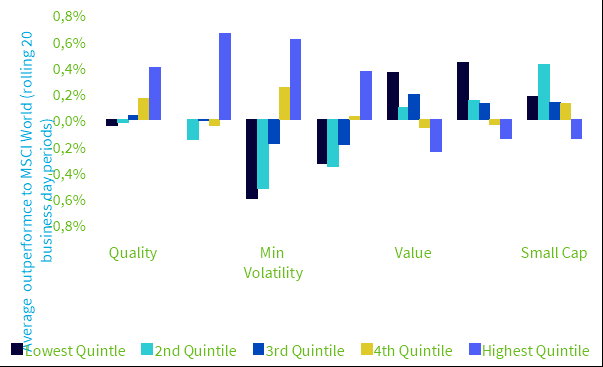

Figure 2 illustrates the historical average relative performance of different global equity factors depending on volatility regimes. We observe that some factors, like Min Volatility, are fundamentally defensive. They outperform a lot when volatility is high (and usually markets are down) but they struggle and underperform significantly in bull markets when volatility is low. On the contrary some factors, like Small Caps, are very cyclical. They do well in periods of low volatility but exhibit deeper drawdowns in high volatility markets which take a long time to recover from.

Figure 2: Average relative performance of different global equity factors depending on volatility regimes

WisdomTree’s approach to Quality offers a very balanced mix with strong outperformance in high volatility markets, helping to reduce drawdowns and time to recovery but also some outperformance in other volatility regimes. This combination is what we tend to call ‘all-weather’. Such a strategy can be used comfortably as a strategic holding to put time in the market as it capture most of the upside, while also protecting on the downside.

Key Takeaways

Looking forward to 2024, S&P 500 predictions remain incredibly diverse from 4,200 (-12%) by JP Morgan to 5,100 (+7%) for Deutsche Bank (ETR:DBKGn). Uncertainty in the markets also remains at very high levels. US monetary policy remains extremely volatile and around half the world’s population will vote in 2024, including the US in November. Overall, and as always, it looks like core, resilient equity investments that do not rely on knowing the future should be investor’s best friends. Long term in Quality and High Dividend could continue to be the best answer for long-term minded investors.

At WisdomTree, we advocate the adoption of circular economy principles across all walks of life. Or at least where reasonably possible. The WisdomTree Recycling Decarbonisation UCITS ETF (WRCY), built in partnership with experts TortoiseEcofin, is founded on two key pillars. The first is waste to energy; this is the process of generating energy from waste such as garbage, animal manure, agriculture products and/or animal fats. This theme includes companies engaged in the production of renewable fuels, such as sustainable jet fuel, as well as ethanol and other biomass like wood pellets. The second pillar is recycling; these companies are engaged in recycling business activities including traditional processes such as plastic recycling, recycling plastics into original materials such as polypropylene for re-use and lithium-ion battery recycling, as well as companies engaged in carbon capture and sequestration.

______________________________________________

IMPORTANT INFORMATION

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.