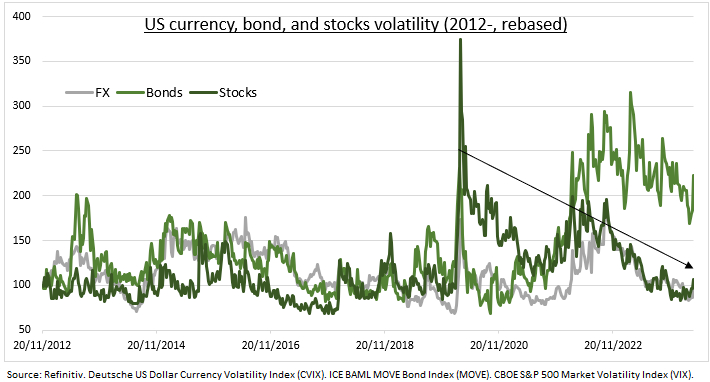

DOLLAR: The US dollar DXY index has surged 6% this year. As US economic ‘exceptionalism’ drives bond yield differentials and sucks capital into the US. Foreign holdings of US treasuries, for example, are up 9% the past year to $8 trillion. And been further supported by geopolitics driving safer haven demand. This has extended the Dollar’s 10% real equilibrium exchange rate overvaluation. And triggered a unwelcome pickup in FX and cross-asset volatility (see chart), as monetary policy divergence grows. With low-yielding SNB cutting, the BoJ ‘one and done’, and ECB ready for June. This also puts China’s PBoC in the crosshairs after relative CNY strength.

VOLATILITY: Currency volatility has rebounded from its lows. This is undermining a key driver of the carry trade and particularly hurting emerging market currencies. And is also catching up with fixed income volatility, and with S&P 500 volatility back near its long term average around 20. The ‘CVIX’ is a measure of 3-month implied volatility for the ten most liquid global currency pairs, weighted by their traded volume. It is concentrated on EUR, JPY, GBP, CHF, CAD, and AUD cross rates with the USD. Its levels have been rising but may have further to go. Levels remain 15% below the average since its 2012 inception and are 40% down from the 2020 high.

CHINA: The RMB has been a relative anchor, losing only 2% vs the stronger dollar this year. With many wondering why authorities don’t allow a stronger depreciation. To help the struggling economy, revert local deflation, and maintain competitiveness vs weaker Asian peers. The authorities are more focused on stability than competitiveness gains. And its ‘ease and squeeze’ fixing keeps traders on their toes. They will likely continue with only modest CNY weakness, backed by strict capital controls and the world’s largest FX reserves. And look to avoid a protectionist response from trading partners, or a repeat of 2015-16’s big $1 trillion reserve loss.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The currency volatility comeback

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.