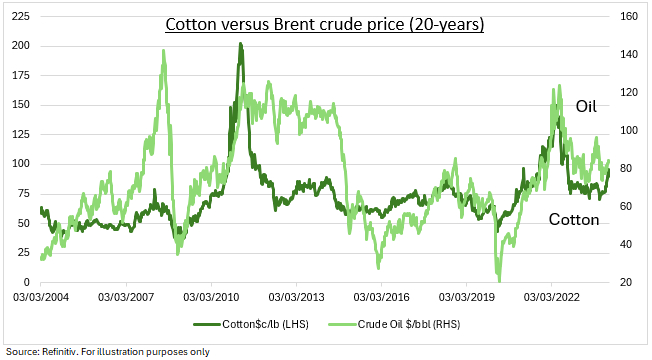

OIL-PROXY: Struggling commodities are finally seeing some relief. With firmer global growth, a stabilising US dollar, and supply-side weather disruptions. Cotton has been a leader in this catch up. This ‘fabric of our lives’ is crucial across clothing, fast fashion, and retail. And stands at the centre of the ESG debate. With its high water and labor intensity. But also biodegradability benefits vs the oil-based fibers that dominate clothing. Cotton prices are being driven by drought and fire in Texas, the largest producer in the largest exporter. And the tight correlation with rising oil that drives competing polyester (see chart). This makes cotton an interesting oil price proxy.

SUPPLY: India and China are the world’s dominant raw cotton producers, at 47% of total. But most is used locally. The US is the largest raw cotton exporter, at 29% of total, and drives the traded market. A quarter of this comes from Texas. The US is also the biggest importer of finished cotton goods. Brazil is the no.2 exporter, at 26%, where cotton is often grown as a rotation crop for soybeans. Raw cotton is then milled in countries like Bangladesh, Vietnam, and China. Global supply has grown c.2.5% per year. Led by new growing areas, in the Indian sub continent and China. And higher GMO seed-led yields. Despite rising water and labour issues.

DEMAND: Synthetic oil-based fibers, like polyester, dominate the global clothing market. Their 70% and rising share makes their relative price a key driver for cotton demand. With cotton having an average c0.50c/lb price premium. Cotton dominates the natural fibers market, with 80% being used for clothing, led by denim. The rest is mainly for household sheets and towels. Making consumer spending, and fast fashion in particular, the major demand drivers. With cotton prices, and sustainability issues, therefore big issues for retailers like Inditex (BME:ITX.MC), H&M (HM-B.ST), and pending IPO of Shein, to clothing stocks GAP (GPS), and Levi Strauss (NYSE:LEVI).

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The cotton ‘fabric of our lives’ rally

Published 08/03/2024, 07:51

Updated 09/02/2024, 07:53

The cotton ‘fabric of our lives’ rally

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.