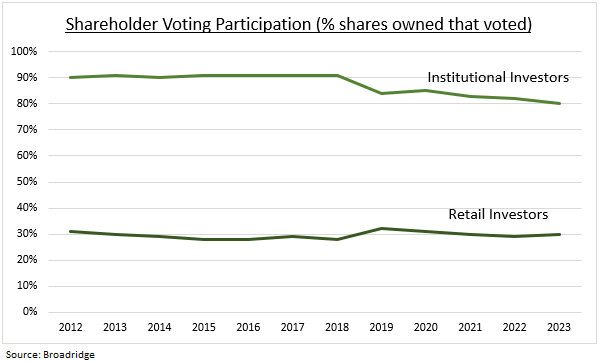

PROXY: With Q4 earnings season almost over, focus will shift to shareholder annual general meetings and ‘proxy voting’ season. This ramps up to a May peak and is one of the most important ways investors can influence how a company is run, from pay to policy and dividends. Retail investors now directly own an estimated 31% of US shares. But historically have been chronically under-represented as only 30% actually vote. This is starting to change as more brokers encourage participation. And fund companies now offer ‘pass-through’ voting that allows underlying investors to vote their holdings. All the industry big-3, Blackrock (NYSE:BLK), investor owned Vanguard, and State Street (NYSE:STT), that collectively vote 25% of US ballots now offer this.

TRENDS: The Annual General Meeting (AGM) is a formal meeting between a company’s shareholders and the board of directors who supervise the company on their behalf. The most famous is Berkshire Hathaway’s (BRK.b) ‘Woodstock for Capitalists’ in Omaha, set for May 4th this year. An AGM must be held annually and within six months of the end of the financial year. 2023 saw a five-year low degree of shareholder support for management proposals, reflecting depressed markets and an ESG backlash. 2024 is set to see 1) new cybersecurity disclosures, 2) lower bar to activists with growth of universal proxy regulations. 3) popularity of virtual AGM’s.

RETAIL: Retail investors punch below their rising weight. With only a slowly increasing 30% of eligible shares historically voted (see chart), even as it becomes easier. Versus a high 80%, though falling, of institutional investors who have a fiduciary duty to vote on behalf of holders. The ‘voting’ industry is a duopoly of advisory firms. Institutional Investor Services (ISS) which Deutsche Boerse (ETR:DB1Gn) (DB1.DE) paid $1.8 billion for 80% in 2021, and privately owned Glass, Lewis. Whilst proxy processing is dominated by Broadridge (BR), with a 80% share of the US market.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stepping up to the AGM

Published 06/03/2024, 08:29

Updated 09/02/2024, 07:53

Stepping up to the AGM

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.