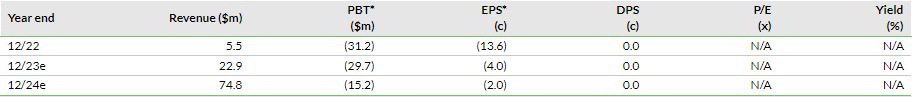

Shield Therapeutics’ H123 results were largely as expected. Despite the minor operational adjustments with the commercialisation ramp-up, our long-term expectations remain unchanged. H123 revenue of $4.3m grew 65.8% y o y and was largely driven by US Accrufer sales. Total prescriptions grew 59% (vs H222) to 26,200 and are anticipated to accelerate in H223 with the completed build out of its sales platform. For the medium term, we anticipate additional launches in the EU and regulatory approvals in China and our longer-term assumptions remain unchanged. Our valuation remains largely unchanged at £390.4m (£388.9m previously), reflecting updates to net cash (including the recent $6.1m equity raise) and our near-term estimate adjustments for volume and operating expenses in line with latest management guidance.

US prescription revenues led the way in H123

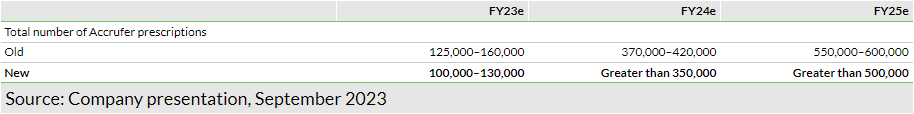

In H123, Shield reported 65.8% y-o-y revenue growth, which was primarily led by growing US Accrufer sales ($3.7m). Management expects H223 growth to be primarily driven by higher Accrufer prescriptions, driven by its focused (100 individuals) sales team, expanding market access (123m covered lives) and continued brand campaigning. Management has adjusted its FY23 US prescription volume guidance to 100–130k in FY23 (125–160k previously) but maintains its long-term expectations of over 500k in FY25. These sales activities will be supplemented with field experts to assist providers in registrations, which management anticipates will reduce the average gross-to-net discount and as a result increase the average selling price to $220–240 by FY25 to achieve its revenue target of over $120m.

Cash position bolstered by raise

At the end of H123, the company had cash of $13.6m, supported by equity financing ($20.2m in net proceeds) in H123 and a $10m convertible shareholder loan from AOP. Post-period end, Shield secured a $20m term loan through SWK Holdings, raised $6.1m (gross) through an equity issue and announced a retail offer to raise an incremental $1.4m, which is valid until 3 October. Net of these cash injections, we believe the company is sufficiently funded to profitability in FY25.

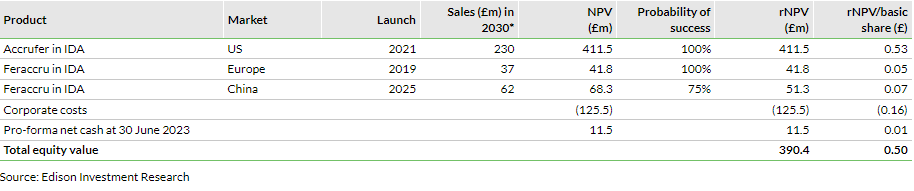

Valuation: £390.4m or 50p per share

Our valuation is largely unchanged at £390.4m from £388.9m previously. The slight adjustment reflects revisions to our short-term estimates reflecting H123 results and tweaked near-term management guidance, and an updated net cash balance. Our per share valuation decreases to 50p (66p previously) given the higher share count.

Growth prospects driven by US Accrufer prescriptions

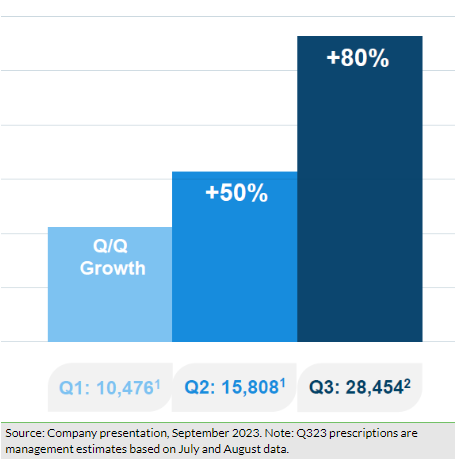

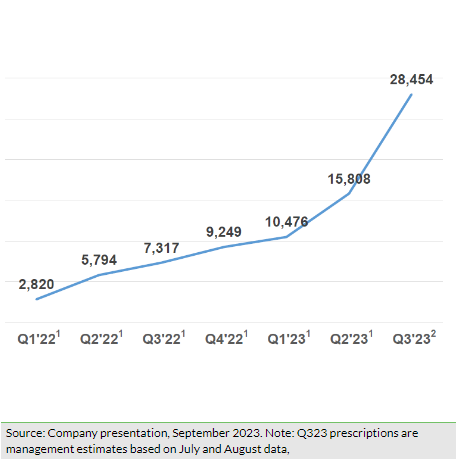

Shield reported c $4.3m in sales in H123, of which over 85% was attributable to US Accrufer sales, indicating the early proliferation of accelerated commercialisation efforts in the US market. During Q223, total US prescriptions grew to 15,808, a 51% (q-o-q) growth over 10,476 prescriptions in Q123. Notably, the company witnessed a strong 157% (q-o-q) growth in first-time writers/prescribers and new prescriptions were up by 63% (q-o-q), along with 73% repeat writers/prescribers from Q123, suggesting favourable clinical responses by the prescribers. In H123, total prescriptions rose to 26,284, which is higher than the total prescription volume of 25,200 in FY22. Based on early indications, the company expects the growth momentum to intensify further, leading management to guide a more profound sequential growth rate of ~80% in Q323 and anticipate US prescriptions in the range of 100,000–130,000 prescriptions in FY23 (details in Exhibit 3).

In line with the co-commercialisation deal with Viatris, Shield implemented several initiatives during the second quarter to access the larger US market potential. Both companies recruited the target sales team of 100 employees by May 2023 (50 each by Viatris and Shield), which are now ready to target over 12,000 of the highest prescribers. We believe that this larger salesforce (vs 16 in January 2023) will allow broader market coverage and an increased number of touch points with relevant stakeholders, resulting in an incremental flowthrough impact on prescriptions in the near to medium term. Based on current visibility on prescription volumes for H223 and near-to-medium-term preparedness to target the market potential, management has provided revised targets for prescription volumes during FY23–25 (Exhibit 3). We note that the new targets are somewhat lower than previous estimates and we have incorporated these into our model (explained below in the Financials section).

Focus on improving the gross-to-net ratio

Management earlier indicated that a good proportion of prescriptions sales are still subsidised through patient assistant programmes, resulting in the lower average net selling price per prescription. In H123, the average net selling price of Accrufer declined to $119 per prescription from $124 and $144 per prescription in H222 and FY22, respectively. This translates into a gross-to-net sales price discount of c 75%, which management aims to bring down to its target of 60% by FY25, which is expected to help in improving the average net sales price to US$220–240 per prescription. We note that this target can be achieved through growing prescription volumes and increased commercial payor and state-run Medicaid coverage and Shield plans to target both:

- Increase prior authorisations (PA) into payers by healthcare providers (HCP): Shield plans to modify patient access programmes so that prior PA submission will be required from HCP into payers before patients can access the preferred cash price (implementation expected in early Q4). This is expected to increase PA submissions, approvals and revenue generating prescriptions. Additionally, the company now has a focused field sales team of 100 (in collaboration with Viatris) in place to target selling activities; therefore, it plans to direct its non-sales team into providing HCP office support for prior authorisations (one per region, 12 total).

- Extending market access: the company continues to focus its market access by targeting new payors. Recent wins of two Medicaid programmes (ie Medi-Cal and Medicaid NYR) expanded its access across California and New York. As a result, Shield was able to expand its market access of total covered lives to 123m as of September 2023, compared to 100m at end Q123. As a reminder, Shield is on the formulary list of several key pharmacy benefit managers (PBMs) n the United States, including Express Scripts (NASDAQ:ESRX), Optum and Cigna (NYSE:CI).

Europe potential yet to be fully tapped

Norgine, Shield’s European sales partner for Feraccru, has been recording stable revenues from the region. In H123, the total sales volume of Feraccru packs increased 19% over H222 and 11% over H122. Germany, the UK and the Nordics remain key sales contributors for Norgine in the region, with the UK and Germany collectively accounting for 88% of total sales packs in Europe. The company continues to seek reimbursement in several European countries, such as Spain and Italy. As a reminder, Norgine has been undergoing internal restructuring (after Goldman Sachs (NYSE:GS) Asset Management acquired a majority stake in the company in December 2022) and is working towards shifting its sales strategy to target the primary/women’s health market, compared to its earlier focus on the gastro-intestinal market. While this may yield an enhanced sales uplift in the medium term, we estimate a similar growth trend (as seen in H123) for this geography unless approvals in new EU countries are obtained.

Update on global partnerships

Though Shield currently generates revenue from US and Europe markets, it has several partnership agreements in other regions as well, which if successfully executed could provide material upside in revenue potential for the company. One of the key partnership deals is with ASK Pharma in China, which is currently enrolling patients for its Phase III study in China, as required for National Medical Products Administration approval. We note that enrolment for the Phase III programme was affected by the prevalence of COVID-19; however, these challenges have been resolved now with eased restrictions and we continue to estimate a launch in 2025 and ascribe a 75% probability of approval.

KYE Pharmaceuticals (Canada) filed a New Drug Submission for Accrufer with Health Canada in Q122 and anticipates approval by the end of FY23. Korea Pharma (Republic of Korea) is enrolling patients in a pharmacokinetic study, which is required to get approval in the region.

Lapse of AOP takeover offer

In an important development, AOP Health International Management (AOP), Shield’s largest shareholder, made a mandatory takeover offer in May 2023. However, the offer lapsed as the company received valid acceptances from only 42.26% of existing shareholders (including 40.75% share capital owned by AOP), which was lower than the threshold limit of 50% for takeover approval. To provide more context to the development, Shield entered into a convertible shareholder loan agreement, worth $10m, with AOP in July 2022 and drew it fully in August 2022. Further in December 2022, the shareholder loan was extended to provide an additional $10m convertible loan facility to Shield, which was drawn in January 2023.

Post the initial conversion of the loan into shares (31.3m) in January 2023, AOP held 26.99% of Shield’s total outstanding share capital. Another conversion request from AOP in May 2023 was also approved by the company’s board and led to the issue of another 127.3m shares, resulting in AOP holding 41.9% of Shield’s share capital post conversion. As per Rule 9 of the City Code on Takeovers and Mergers, AOP made a mandatory takeover offer for the company at 6.2p per Shield share, at a 13.3% discount to the last trading price before the date of the announcement, valuing the company at £46.1m on a fully diluted basis. While Shield advised its shareholders not to subscribe to the offer, AOP also acknowledged that the mandatory offer was at a discount to the traded price and may not be accepted. We note that AOP is a long-term shareholder of Shield and has been supportive its growth strategy. Later, AOP expressed its willingness to let Shield operate as an independent company. Hence, both companies signed a relationship agreement that permitted Shield to continue to work independently despite the takeover offer. On 15 June, the takeover offer lapsed due to an insufficient number of shareholders agreeing to the takeover terms. At end H123, the total outstanding AOP loan was $5.7m, which Shield plans to repay from the recently secured term loan of $20m from SWK Holdings in September 2023 (discussed below).

Financials

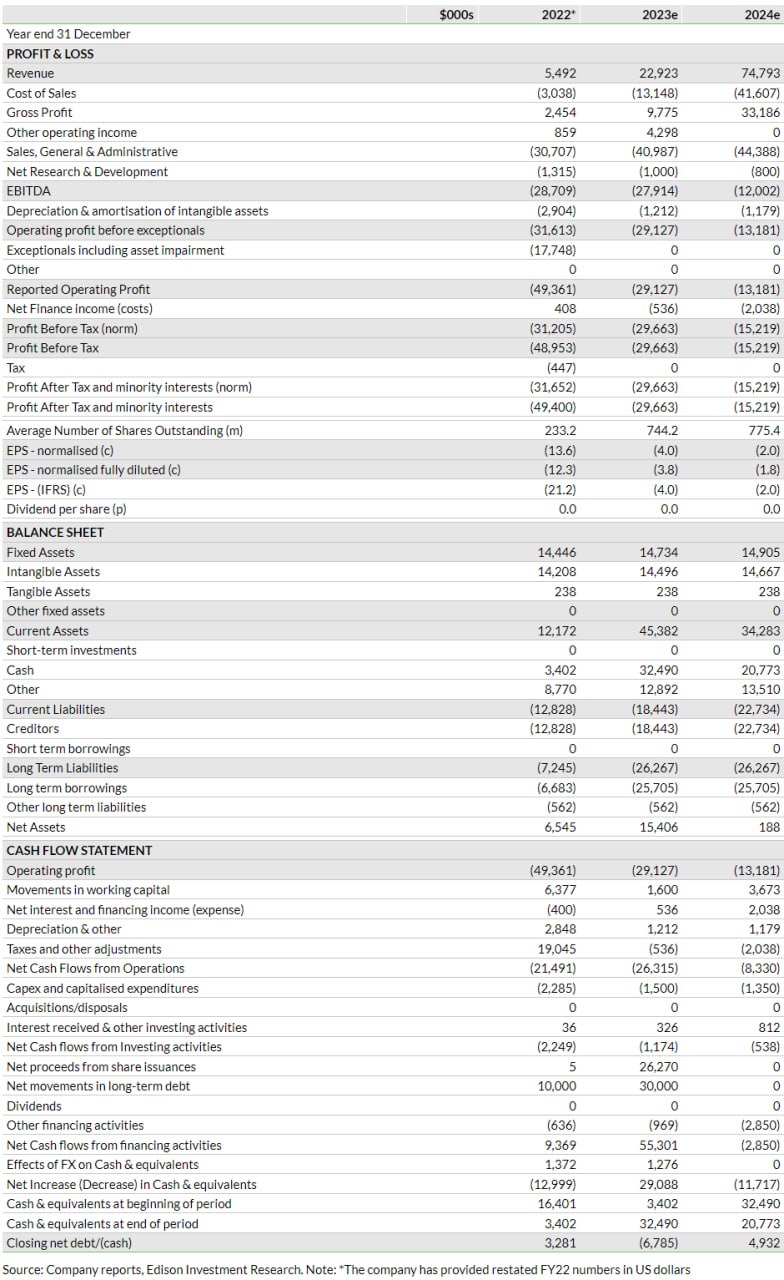

In H123, Shield reported total revenue of $4.3m (65.8% growth over H122 revenue of $2.6m), which mainly comprised $3.7m from Accrufer sales in the US and the remaining $0.6m from royalties from Norgine related to Feraccru sales in Europe. Additionally, the company recognised $4.3m in other operating income in H123, which is primarily the deferred portion of total $5m upfront payment received as part of the Viatris deal at end FY22. Gross profit stood at $2.2m (vs $1.5m in H122), translating into a gross margin of 51.9% for H123, lower than 56.4% in the prior period. The decline in gross margin could be due to a lower average selling price of $119 in H123 compared to $152 in H122. We note that the cost of sales includes the manufacturing cost of prescriptions sold in Europe and the US, along with a 45% share of US net sales as part of the Viatris deal and a 5% royalty to Vitra Pharmaceuticals as per the 2010 asset purchase agreement.

SG&A expenses (excluding $0.5m in amortisation of intangible assets) increased 23.7% y-o-y to $17.2m due to accelerated commercialisation efforts in the US as per the co-commercialisation deal with Viatris (headcount growth to 50 at Shield vs 28 at end FY22). The expensed R&D costs of $0.4m were lower than $1.3m in H122 and were fully attributable to the company’s ongoing paediatric study assessing Feraccru/Accrufer in infants, children and adolescents. The company reported that enrolment is progressing although completion timelines have not been disclosed. We note that $1.5m of R&D related costs were capitalised during first half of 2023, similar to H122. As a result, the operating loss for the period stood at $11.5m versus $15.0m in H122. The operating cash burn rate was reported at $19.9m in H123, up from $14.3m in H122.

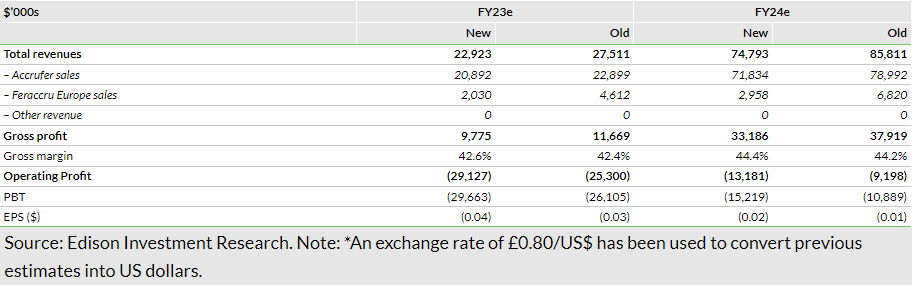

Based on H123 performance and near-term operational visibility from management, we have made adjustments to our forecasts and updated our FX assumptions (to £0.82/$ versus £0.80/$ previously). Additionally, we have converted our estimates into US dollars (vs sterling previously) because Shield has changed its reported currency from sterling to US dollars due to the increased focus on US operations. In line with revised management guidance for US annual prescriptions (lower than previously) during FY23–25 (see Exhibit 3), we have slightly trimmed our forecasts for US prescriptions, resulting in Accrufer sales estimates of $20.9m ($22.9m previously) in FY23 and $71.8m ($79.0m previously) in FY24. Factoring in a lower pace of sales growth in Europe and low visibility on new market launches, we have also reduced European sales forecasts, to $2.0m in FY23 and $3.0m in FY24, versus $4.6m and $6.8m previously in the respective periods. Based on directional guidance from management regarding operating expenses ($42–50m during FY23–25), we have slightly increased our selling expense estimates, hence, our total operating expense estimates are now $42.2m in FY23 and $45.6m in FY24. Our revised operating loss estimates stand at $29.1m in FY23 and $13.2m in FY24, compared to $25.3m and $9.2m, respectively, previously. We note that our longer-term growth assumptions remain unchanged.

We anticipate an increase in interest expenses during FY24–25 as the company raised $20m via a new term loan of $20m from SWK Holdings in September 2023 (details below in the valuation section). As a result, we have revised our net loss estimates for FY23 and FY24 to $29.7m ($26.1m previously) and $15.2m ($10.9m previously), respectively. Though management expects to achieve cash flow break-even by end FY24, we continue to project the company turning EBITDA positive in 2025. Changes to our group-level estimates are presented in Exhibit 4.

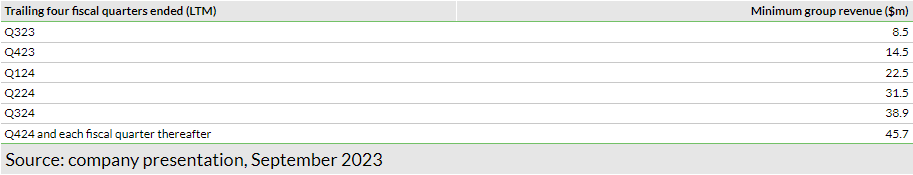

The company closed H123 with a gross cash balance of $13.6m, supported by $20.2m (net proceeds) from equity financing and an additional $10m convertible shareholder loan from AOP, both in January 2023. Shield recently announced it raised $6.1m through the subscription and placement of new shares (62.4m shares) to institutional investors (existing as well as new) and proposed a retail offer to raise another $1.4m. The issue price for both the share placement for institutional investors and retail investors is set at 8p per new share. Additionally, the company secured a $20m term loan from SWK Holdings, which has a five-year term and interest payable at 9.25% plus the greater of three-month CMR term SOFR (secured overnight financing rate) or 5%. Interest needs to be paid for the first eight quarters, following which the loan will be amortised at a fixed $1m per quarter. The loan agreement comes with financial covenants in respect to minimal liquidity (not less than the greater of either trailing one quarter of cash burn or $2.5m) and minimum revenue targets (Exhibit 5). We believe these revenue targets are achievable based on our current revenue estimates.

The company plans to utilise the proceeds in repaying the outstanding AOP loan, accelerating commercialisation and growth initiatives, along with managing working capital requirements. We note that management estimates that the company will become cash flow positive by Q424; however, our projections suggest a more conservative timeline of FY25.

Valuation: £390.4m or 50p per share

As we incorporate the above-mentioned changes in our estimates, roll forward our model and update FX and net cash, our valuation slightly adjusts to £390.4m, from £388.9m previously. However, our per share valuation has reduced to 50p, versus 66p, due to the increased base of shares outstanding of 775.4m, versus 587.5m previously. For valuation purposes, we have considered pro-forma net cash of £11.5m ($14.0m), which includes the recently announced equity raise of $6.1m. The increase in net cash has made a positive contribution to our valuation, while the revised estimates brought down the rNPV of valued assets to £378.9m, from £382.1m previously.

* * *

General disclaimer and copyright

This report has been commissioned by Shield Therapeutics and prepared and issued by Edison, in consideration of a fee payable by Shield Therapeutics. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom