No change in message means no change in curve flattening bias for now

The spillover into other markets was limited in the end, but the higher-than-anticipated UK inflation data yesterday is a reminder of what drives the current hawkish stance of central banks. The focus on current (core) inflation to determine policy success will also mean that the flattening bias for yield curves will not pass quickly. Just as EUR and Sterling curves have moved to record inversions, a similar test of previous lows looks imminent in the US as well. Market circumstances such as the still punitive carry on steepening positions and declining liquidity going into summer only add to the persistence of the bias.

Central banks' focus on current inflation will also mean that the flattening bias in yield curves will persist

Fed Chair Jerome Powell reiterated the Fed’s “strong” commitment to bring inflation back to the 2% target, even though the prepared remarks of his testimony to the House broadly stuck to the script of last week’s FOMC meeting. Policy rates were held to give time to assess the impact of past policy tightening while "nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year." Recall that the Fed's dot plots had been adjusted to see two more rate hikes this year. At the same time, with the messaging not going beyond what was said earlier, market pricing of the near-term Fed path was little changed - one hike is close to being fully discounted. If anything, there was a tendency to further price out cuts from the peak policy rate.

The BoE is unlikely to push back against market pricing

The Bank of England will make its decision today against a backdrop of inflation data continuing to surprise on the upside. The consensus is unanimously looking for a 25bp rate hike today, though likely most replies came ahead of yesterday’s data and some might now at least highlight growing risks of a 50bp move today. And indeed, the BoE itself might see one or two of its members voting for a larger move today. Our economist thinks the bar for a 50bp hike remains high, but a 25bp hike today and another one in August now look like a given.

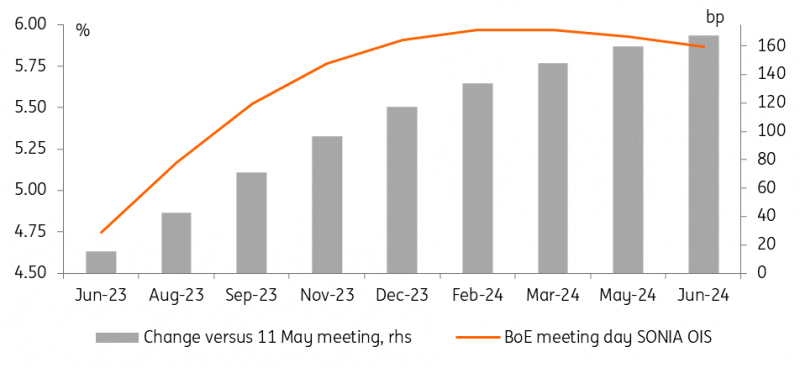

A BoE terminal rate of 6% by early next year is now the market’s base case

Markets have certainly reacted. In money markets, SONIA OIS pricing has shifted higher by up to 15bp since yesterday alone. A forward of 34bp higher for the upcoming meeting period implies that markets are now seeing a more than 30% chance of a 50bp hike today. The BoE reaching a terminal rate of 6% by early next year is now the market’s base case - 150bp above the current interest rate level. For comparison - and to highlight the significance of the recent shift in pricing - after the May meeting the market was looking for a peak rate of 4.75% to 5% after this summer.

The main question around this meeting for markets will be to what extent the monetary policy committee will push back against this extreme market pricing. Our economists think pushback will be unlikely. For one, the BoE appears to be just as wise about the near-term outlook of inflation as the market and is probably unwilling to pick a side for the risk of having to walk back later. And BoE officials have passed on plenty of opportunities to already do so in the recent past.

Inflation and wage data have led to aggressive market pricing of the BoE

Today’s events and market view

Central banks will remain in focus, certainly with the BoE meeting today as well as the Swiss National Bank and Norges Bank decisions in the broader global picture. But we also have Fed Chair Powell’s second day on Capitol Hill giving testimony to the Senate Banking panel today. Add to that a busy slate of other speakers, where from the Fed we will hear from Christopher Waller, Michelle Bowman, Loretta Mester and Thomas Barkin, while over in the eurozone, the European Central Bank's Fabio Panetta and Luis de Guindos are speaking.

Given what is priced, the question is, of course, how much more can be priced in. As the UK CPI release has shown, data remains key. And given central banks' narrow focus, inflation data is particularly important.

Other data feeding into investors’ concerns over the longer-term outlook, with central banks potentially taking the tightening too far, could further feed into the curve flattening bias. Today’s US initial jobless claims are expected to remain elevated after they had come in higher than expected last month. Other releases today are data on US existing home sales and the Chicago and Kansas Fed activity indices. In the eurozone we get the preliminary consumer confidence reading for June.

Sovereign primary market activity today is limited to the US selling a 5Y inflation-linked bond.

First published on Think.ing.com.