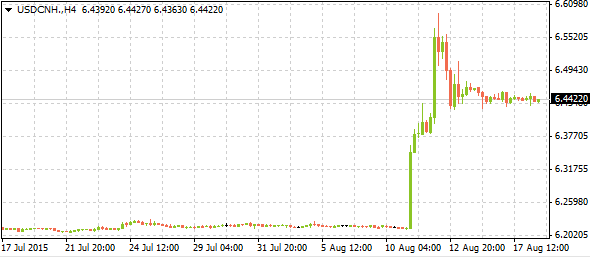

Much was made of last week’s move by Chinese policymakers to revalue the yuan to a level with which they were more comfortable. Despite the inherent risks in such a move including sparking another round of the ongoing currency war, the increasingly desperate policy shifts are reducing confidence in policymakers from market participants. China is already in the midst of an economic meltdown whether or not the Central Planners want to admit the true situation. The People’s Bank of China specifically might have lost control as evidenced by the resurgence in volatility in today’s Asian equity markets after Chinese stocks suffered the worst losses in three weeks. More than half of the stocks trading on the mainland were halted limit down and the Shanghai Composite closed the cash equity session with staggering losses of -6.15%, with the index over 27% off its June peak. The sheer pace of today’s collapse in prices underlines the notion that the Chinese plunge protection team is asleep at the wheel. Bans on short-selling, talking negatively about an instrument, and selling in general are not measures to be taken lightly, and more often than not have unintended consequences.

In the case of China, new rules rolled out in recent weeks have effectively led to a greater moral hazard and peril for investors in Chinese equity markets. The idea of a fair and free market means that the price discovery process is enabled through buyers and sellers coming to a market place to bid on and offer stocks. However, when the sell-side of the equation is prohibited or reduced, it makes the price discovery process increasingly more difficult and also subtracts liquidity. Restrictions placed on a holder’s ability to sell also exacerbate the fundamental problem of liquidity, leading to drops like the ones that were witnessed earlier. These drastic measures are further imperiling the structural integrity of the market and calling into question the oversight of said market. China has a huge reputation problem to deal with at the moment and the loss in confidence in policymakers’ ability to stem the rout in equities is tantamount to Central Bankers losing control of a centrally planned economy. If this can occur in China, imagine what can transpire in other developed markets.