China's economic gloom worsens

One of the key drivers for the price decline has been disappointing recovery in Chinese demand.

China is the world's largest producer and consumer of stainless steel – key for nickel demand, accounting for 70% of total consumption of the metal.

The latest data from China is showing the country is still struggling to rebound following prolonged Covid-19 lockdowns.

China’s manufacturing activity expanded at a slower pace in June – the Caixin manufacturing purchasing managers index, which covers mainly smaller and export-oriented businesses, hit 50.5 last month, easing from 50.9 in May. The official PMI, which tends to focus on larger, state-owned enterprises, showed manufacturing activity remaining in contraction territory for a third straight month.

Apart from a short-lived bounce in the manufacturing sector after the zero-Covid measures were shelved in early December 2022, China's manufacturing has been lagging.

The official PMI index for the manufacturing sector has been below the breakeven 50 level since April.

Instead, it has been the non-manufacturing sector, buoyed by consumer spending, that has been keeping China's economy growing in the first half of this year.

Our China economists expect the government to step in and provide some support in due course. However, they believe it will be smaller, more targeted measures that may not move the GDP figure substantially.

Indonesia’s surging output to keep market in surplus in the third quarter

Supply from Indonesia continues to surge to meet growing demand from the electric vehicle (EV) battery sector.

Indonesia is the world’s largest nickel producer. The country holds the world’s largest reserves of the metal with much of Indonesia’s output being of Class 2, lower purity material, used in stainless steel production.

Indonesia’s nickel mine output grew by 48% to 1.58 million tonnes in 2022, boosted by the ongoing commissioning of nickel pig iron (NPI) and stainless-steel projects, and by another 41% in the first three months of 2023, according to data from the International Nickel Study Group (INSG).

Nickel smelting has expanded in Indonesia since the government imposed a permanent ban on nickel ore exports in January 2020 in a drive to attract foreign investors, encourage domestic processing and further downstream use of its raw materials. The ban has enticed foreign investors, mainly from China, to build local smelters and helped to boost the value of Indonesia’s exports.

Most recently, the Indonesian government announced a $9 billion investment plan covering nickel mining to battery cell development by a group of companies, including Swiss commodities trader Glencore (LON:GLEN), Belgian battery materials producer Umicore and Indonesian state miner Aneka Tambang. So far, Chinese companies have dominated investment in Indonesia’s natural resources sector.

Meanwhile, the number of nickel smelters in Indonesia has jumped from just 15 in 2018 to 62 as of April, according to the Indonesian Nickel Miners Association (APNI). More are on the way, with about 30 smelters are under construction and 50 are in planning stages, according to APNI.

As well, high pressure acid leaching (HPAL) plants to produce mixed hydroxide precipitate (MHP) – a mixture of nickel and cobalt, sourced from nickel laterite ores, for battery production – are continuing to ramp up output. Three HPAL smelters are currently operational in Indonesia and six others are under construction. A shortage of Class 1 nickel, which is primarily sourced from Russia, Canada and New Caledonia, has shifted the attention of battery manufacturers to HPAL process and processing Indonesia’s low-grade nickel ore into materials that are suitable for batteries.

MHP is increasingly emerging as the preferred battery-grade nickel intermediary product among China’s nickel sulphate producers due to its cheaper price.

Indonesia’s exports of MHP have totalled 855,474 metric tonnes since the country’s first HPAL plant started operating in May 2021, with 96.5% of the material bring shipped to China, according to trade data from S&P Global Market Intelligence Global Trade Analytics Suite

Meanwhile, the conversion of Class 2 into Class 1 nickel is likely to increase supply into LME warehouses and could put downside pressure on prices. Earlier this year, Chinese stainless steel and nickel producer Tsingshan, announced it will add Class 1 nickel to its production mix by converting idle copper plants in China to produce Class 1 nickel using the company’s nickel matte as an input.

The announcement came after reports that a new Tsingshan plant in Indonesia, capable of producing 50,000 tonnes per year of Class 1 nickel from nickel matte, will start operating this year.

Meanwhile, the LME has introduced new initiatives, including reduced waiting times for approving new brands that can be delivered against its contract to three months from six to nine months.

Last month, the LME said it had received its first application to approve nickel produced by Quzhou Huayou Cobalt New Material Co, a subsidiary of China's Zhejiang Huayou Cobalt Co, as a list brand.

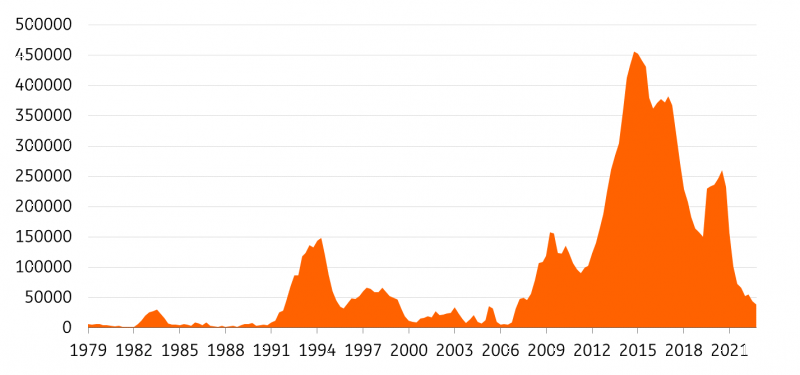

This could potentially increase nickel inventories on the exchange and help with liquidity. One of the reasons for the low liquidity, which has often led to volatility in the LME nickel price, is historically low inventories. They now stand at its lowest since 2007 at 37,944 tonnes.

The LME also said in March it would work with China's Qianhai Mercantile Exchange to introduce a new Class 2 nickel spot market in China.

LME nickel inventories are at the lowest since 2007

Surplus in Class 2 but Class 1 still tight

Although the total nickel market is forecasted to be in a surplus in 2023, the Class 1 nickel, the type deliverable on the LME, has been relatively tight, with LME stocks sitting at historical lows, which should limit downside pressure on nickel price this year.

World primary nickel production was 2.610Mt in 2021 and 3.060Mt in 2022 and it is expected to reach 3.374Mt in 2023, the INSG forecasts.

Meanwhile, world primary nickel usage was 2.779Mt in 2021 and 2.955Mt in 2022. The INSG forecasts an increase to 3.134Mt in 2023.

After a deficit of 169kt in 2021, the market moved into a surplus of 105kt in 2022 and is forecast to be in a surplus of 239kt in 2023.

In the past, market surpluses have been due to Class 1 nickel, however in 2023, the surplus will be on account of Class 2 nickel.

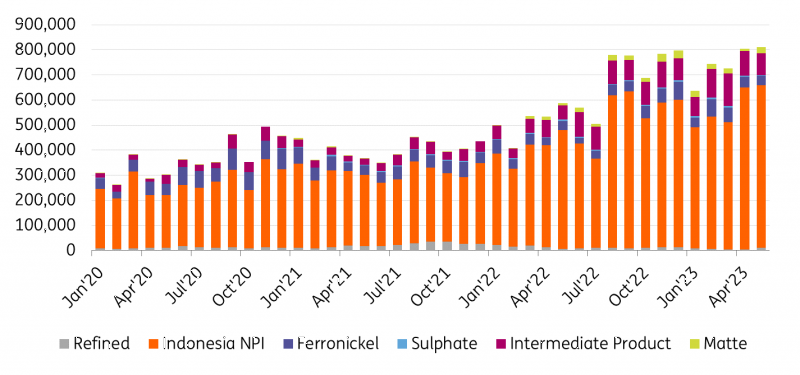

China nickel imports at multi-year low

Meanwhile, China’s imports of refined nickel have fallen to lowest levels in almost 20 years as the country shifts to Indonesia’s supply of Class 2 intermediate nickel products.

China's imports of Class 1 refined nickel totalled just 3,204 tonnes in April, the lowest monthly total since January 2004. Imports over the first four months of 2023 came in at 23,453 tonnes, down 65% on the same period of last year.

China’s nickel imports by product

China Class 2 imports set a record in April

At the same time, China Class 2 imports have been accelerating reflecting shrinking domestic production. The jump in April was due to imports from Indonesia as the growth in the country’s capacity continues.

China’s demand for the Class 1 market has been also decreasing as the country’s stainless steel mills have favoured NPI for some time now, while its EV battery sector doesn’t require the high purity Class 1 material either.

China imported 628,000 tonnes of Indonesian NPI in April, a new monthly record, bringing cumulative imports to 2.0 million tonnes in the first four months of this year, up 46% on last year.

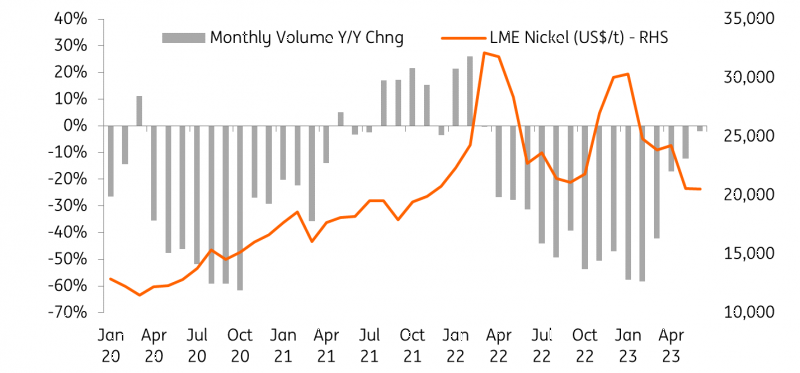

LME nickel volumes remain subdued after March 2022 crisis

LME struggles to regain momentum

The LME is still struggling to regain momentum following the exchange’s decision to suspend nickel trading for a week and cancel billions of dollars’ worth of trades amid the historic short squeeze last year.

LME volumes have declined since then as many traders have reduced activity or cut their exposure due to a loss of confidence in the LME and its nickel contract.

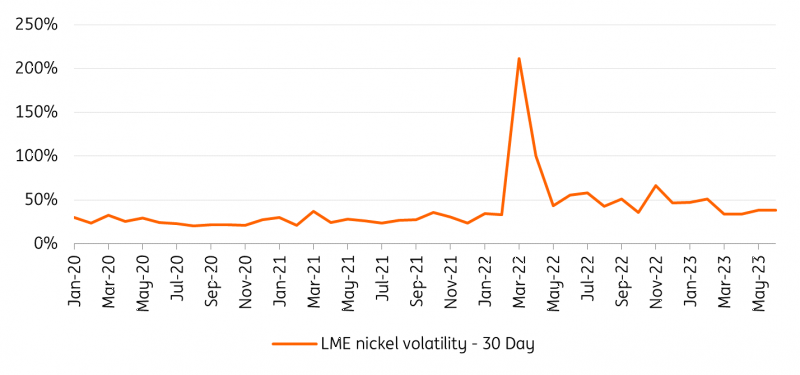

These low levels of liquidity have left nickel exposed to sharp price swings – even amid small shifts in supply and demand balances. But as the exchange introduced daily price limits and margin requirements fell, volumes have started to pick up.

The resumption of Asian trading hours has also encouraged more volumes and improved liquidity, which in turn has reduced volatility in the contract.

Although the volumes have stabilised over the past few months, they are still at lower levels than before the nickel crisis last year. Volumes for the benchmark nickel contract on the exchange's electronic system, LME Select, rose to 64,530 contracts traded in June, the highest since March 2022 when the number was 99,139. This compares to 163,475 contracts traded in June 2021.

We expect more near-term volatility to continue until the LME rebuilds trust in the benchmark nickel contract, volumes pick up again and the market’s confidence in it recovers.

Low liquidity can exaggerate price moves

Prices to remain under pressure as surplus builds

We forecast nickel prices to remain under pressure in the short term as a surplus in the global market builds and slowing global economy mutes stainless steel demand. We see prices averaging $21,000/t in the third quarter and $20,000/t in the fourth quarter. However, downside will be limited, due to tightness in the LME deliverable market.

Prices should, however, remain at elevated levels compared to the average prices pre the historic LME nickel short squeeze due to nickel’s role in global energy transition and the metal’s appeal to investors as a key green metal will support higher prices in the longer term. In EV batteries, nickel boosts their energy density and increases their driveable range.

Looking further ahead, we see prices averaging $20,000/t in 2024 and $23,000/t in 2025.

First published on Think.ing.com.