OUTLOOK: Five of the ‘Magnificent 7’ US big-tech stocks report earnings next week. With only Apple (NASDAQ:AAPL) and NVIDIA (NASDAQ:NVDA) later on May 2nd and 22nd respectively. They remain the most important drivers for another S&P 500 earnings upside surprise. Alongside less inflation-driven profit margin pressure, low analyst expectations, and the energy profits slump offset. And this earnings surprise is needed now more than ever. As the Fed rate cut catalyst is pushed back. Profits growth is slowly rebalancing away from big-tech. But they continue to do the heavy lifting for now. Accounting for 29% of S&P 500 market cap and est. to grow profits by 37% this quarter.

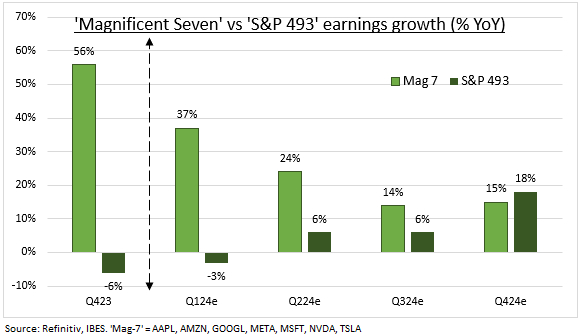

MAG-7: We saw a huge dispersion in big-tech price performance in Q1, led up by NVIDIA’s 80% gain. Whilst Tesla (NASDAQ:TSLA) plunged by 30%, giving other ‘tech’ names Broadcom (NASDAQ:AVGO), Visa (NYSE:V) and Eli Lilly (NYSE:LLY) now bigger market capitalisations. Yet the original group of seven still represents a near-record 29% of total S&P 500 market cap. And have driven over 60% of index returns in the past year. Last quarter they saw a 56% profits surge vs a 6% decline for the ‘S&P 493’ (see chart). This single-handedly saw the blue-chip index hit double-digit profits growth. Whilst six of seven have net cash balance sheets, led by Alphabet’ (GOOGL) $100 billion hoard.

Q1: Tech growth will be lower this quarter but still lead. Mag-7 profits are seen surging 37% vs a less-bad -3% fall for the ‘493’. Analysts have raised Mag-7 Q1 estimates 5% this year. Or double that if one excludes Tesla. NVIDIA is the AI ‘picks and shovel’ leader with profits seen quintupling. Amazon (NASDAQ:AMZN) profits up an est. 170% on AWS strength and resilient consumer. Meta (META) profits est. doubling on the digital ad rebound and lower costs. Alphabet (NASDAQ:GOOGL) up 25% on the broadening ad recovery. Microsoft (NASDAQ:MSFT) up 15% on AI adoption. Apple struggling +2% on the smartphone and China slowdown. Whilst Tesla est. -40% on production and pricing falls.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Magnificent-7 still doing earnings heavy-lifting

Published 19/04/2024, 08:00

Magnificent-7 still doing earnings heavy-lifting

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.