Warren Buffett, the famed investor and CEO of Berkshire Hathaway (NYSE:BRKa), is known for saying, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." This quote encapsulates his investment philosophy of prioritizing the quality of a company's business and its long-term growth potential over merely looking for undervalued stocks.

Conceptually, picking strong stocks is easy, because it revolves around two major criteria:

- Trend

- Timing

The trend in this case includes:

The direction the stock or ETF has been trending in for at least a year, or more; the longer, the better.

The angle of momentum; a steady 35-35 degree is very sustainable and healthy.

The quality of the flow of price, the smoother (and less ‘gappier’), the better.

Timing, which is very tricky for Fundamental Analysts, is substantially easier, although not foolproof, and can use several ways to arrive at high-quality entries.

Price swings between overbought and underbought, and moving averages often provide excellent locations for decent price entries.

Timing is easier when a healthy stock has a clear, strong momentum.

Moving averages do not have to be complicated; 20 & 50 simple moving averages should do the trick.

Now, what about these great and no-so-great UK stocks or ETF’s??

For this article, I going to highlight charts that show steady-as-she-goes promise, and contrast those with even some well-known brands that, upon closer inspection, are not that great.

Folks, it doesn't matter how well know the brand is- that doesn’t guarantee success. Don’t take it from me, I employ Warren Buffett’s approach of reaslitically expecting performance and a return on my money within the first year.This is realistic if the chosen brands have no reason not to perform well.

ADORE

SCTS (Softcat (LON:SCTS))

Softcat supplies IT infrastructure software centred around four areas: cyber security, IT intelligence, hybrid infrastructure and digital workspace tools.

Technically, it’s starting to become very nullish, and may be beginning a new bull run.

Sage Group plc (LON:SGE) is a premier UK-based enterprise software company, specializing in accounting, payroll, and enterprise resource planning (ERP) solutions for small and medium-sized enterprises (SMEs). Since its inception in 1981, Sage has transitioned towards cloud-based services, catering to a global clientele. As a constituent of the FTSE 100 index, Sage is noted for its significant market presence and is a key player in the technology and software sectors, appealing to investors with its innovative product offerings and strategic market positioning.

The chart shows great-quality price action, all that’s needed is a patient entry closer to the moving average, where the blox box lies as an example.

3i Group plc (LON:III) is an international investment manager based in London, UK, focusing on private equity, infrastructure, and debt management. Founded in 1945, 3i has grown to become one of the UK's leading investment companies, with operations spanning across Europe, Asia, and North America. It's known for investing in high-potential companies and assets, with a strategy aimed at generating capital growth and income for its shareholders. Listed on the London Stock Exchange and a part of the FTSE 100 index, 3i's portfolio includes a diverse range of sectors such as consumer, industrial, healthcare, and technology. The company's performance is closely watched by investors for its strategic acquisitions, asset management capabilities, and returns on investment.

Chart-wise. It’s a great performer, but needs a minor correction for a good entry from the moving averages, in terms of price.

Scottish Mortgage Investment Trust (SMT) is a publicly traded investment trust managed by Baillie Gifford & Co Limited. It aims to achieve long-term capital growth by investing in a diversified portfolio of global equities, focusing on companies that can offer significant growth potential over time. Established in 1909 and listed on the London Stock Exchange, SMT has a history of investing in a mix of public and private companies, ranging from technology giants to innovative startups across various sectors. Known for its willingness to take a long-term view on investments, Scottish Mortgage Investment Trust has become a popular choice for investors seeking exposure to a broad range of growth opportunities worldwide, including in areas like technology, biotechnology, and renewable energy.

This one could be a great one for the portfolio - it’s just about to break out to the upside, and has plenty of room before it gets back to it’s all time highs.

Diploma PLC (LON:DPLM) is a London-based international group of businesses supplying specialized technical products and services. It operates across three key sectors: Life Sciences, Seals, and Controls. Founded in 1931, Diploma PLC focuses on high-margin, niche markets with a strategy centered on acquiring and developing businesses that offer essential products and services to industries requiring technical expertise and support. The Life Sciences sector provides consumables and instruments for the healthcare and environmental industries, Seals offers a wide range of seals and gaskets for industrial and hydraulic applications, and Controls supplies specialized wiring, connectors, and control devices for technology and industrial use. Listed on the London Stock Exchange and a constituent of the FTSE 250 index, Diploma PLC is recognized for its strong operational performance, international growth strategy, and resilient business model, catering to a diverse customer base across the globe.

The chart shows price about to start a new bull leg up- timing is good on this one. Timing.

HOLD

HLMA (Halma (LON:HLMA)), a dividend aristocrat, is an acquisition-led FTSE-100 business that buys companies, invests in them and helps them grow.

Technically, it’s in a slump right now, but overall it’s more bullish than bearish.

Games Workshop (LON:GAW), identified by its ticker GAW, is a prominent UK-based creator of wargames and miniature figures. As a standout retailer in the FTSE 250, the company has seen its stock price increase more than threefold over the past five years, marking it as one of the index's top performers since 2017.

DODGE

Aferian PLC (LON:AFRNA), previously recognized as Amino Technologies, has undergone several transformations in recent years, including a significant rebranding. This company, which specializes in video streaming, has updated its board multiple times and has recently completed a substantial acquisition. It purchased The Filter, a service offering AI-driven video recommendations, in a transaction valued at $5.2 million.

But, this one is dead in the water. A major red flag with no appeal to me. Stay away.

Moonpig, trading under the ticker MOONM, is a digital platform specializing in greeting cards and gifts. It's often categorized as a technology stock because of its reliance on tech platforms, applications, and data analytics to engage with its customers.

But, as a stock, it’s no winner, and should be avoided for now, by all means.

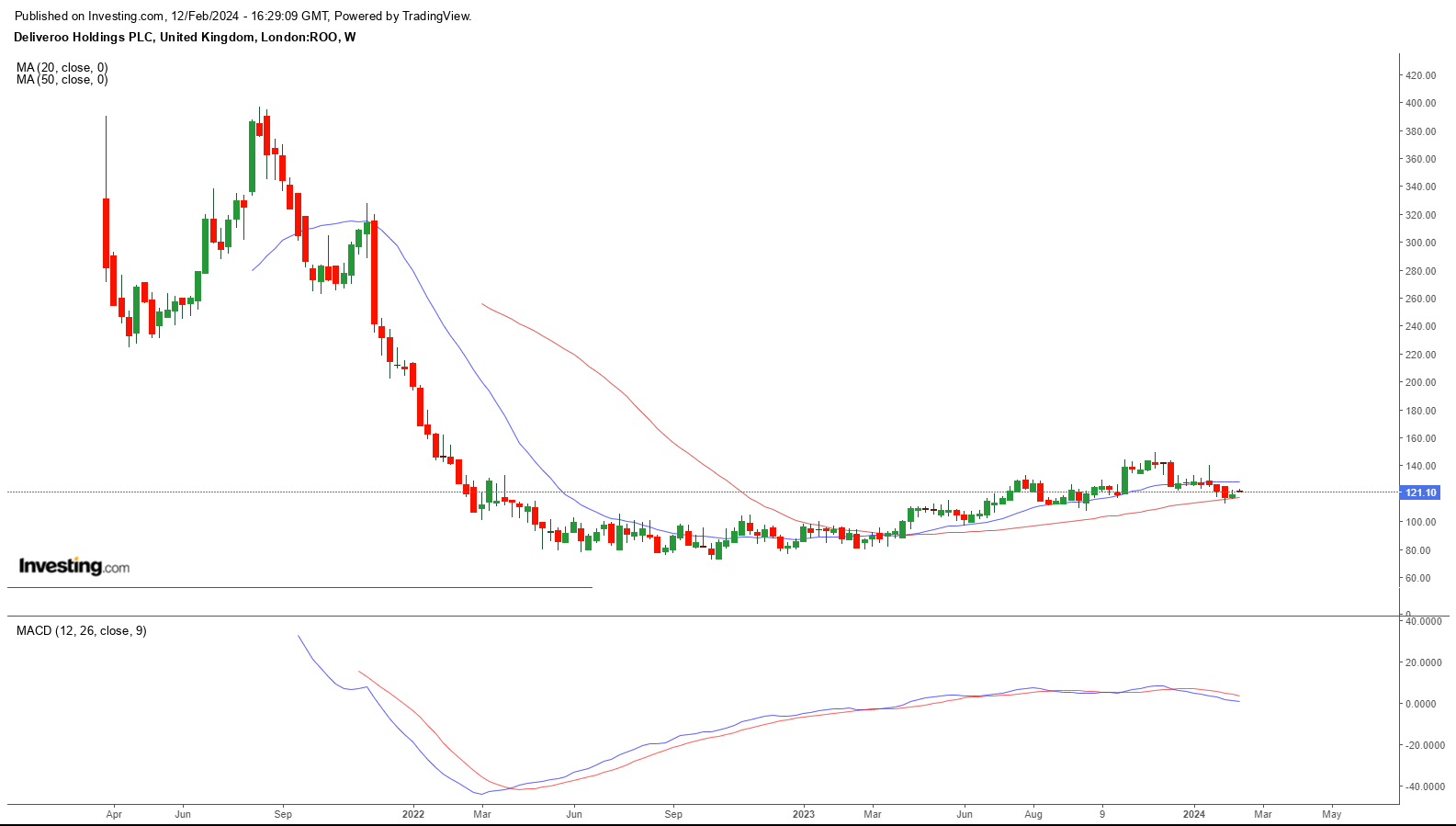

Deliveroo (LON:ROO) Based in London, Deliveroo operates as a food delivery service and is publicly traded on the London Stock Exchange. Established in 2013, it provides services in more than 200 countries throughout Europe, Asia, and the Middle East. The primary function of Deliveroo is to facilitate the delivery of meals from restaurants to the homes of customers. Additionally, its branch, Deliveroo Editions, focuses on cooking and delivering meals directly to consumers.

Looking at the chart, although there is a slight, very slight, move higher, the overall weakness of this stock should not qualify it is a great investment when put up against the others.

BT Group plc (LON:BT.A) is a leading British multinational telecommunications company headquartered in London, United Kingdom. It operates globally, providing broadband, fixed-line, mobile services, and television products and services. Founded as a state-owned company before privatising in the 1980s, BT has evolved into one of the UK's largest telecommunications providers. It's listed on the London Stock Exchange and is a constituent of the FTSE 100 index. BT's market performance is influenced by regulatory changes, technological advancements, and competitive dynamics within the telecommunications industry. The company plays a crucial role in the UK's communications infrastructure, with ongoing investments in broadband and mobile network technologies, including 5G.

From an investment perspective, this is nothing but a red flag. Not even remotely attractive at this time.

Vodafone Group plc (LON:VOD) is a global telecommunications giant based in Newbury, Berkshire, England, known for offering mobile services, fixed line services, and a range of broadband products across numerous countries. Established in 1984, Vodafone has become one of the world's leading telecom companies, with a significant presence in Europe, Asia, Africa, and Oceania. Listed on the London Stock Exchange and a constituent of the FTSE 100 index, its operations include owning and operating mobile networks in various international markets. Vodafone's strategic initiatives often focus on digital growth, enhancing network infrastructure like 5G, and expanding into new markets, making it a noteworthy stock for investors interested in the global telecommunications sector.

Oof, this might be one of the worst performers in the FTSE. No signs at this time of any change in it’s precipitous fall.

So, there we go. I’ll be doing future articles focusing on promsing UK stocks, but today’s piece is a great starting point that should result in a happy and resilient portfolio.

2024 may well be the beginning of the next golden era for stocks.

_______________________________

Like this article? Read more from my Investing.com profile here: https://uk.investing.com/members/contributors/256252463

Disclaimer: Any content in this article is purely financial markets discourse and not financial advice. Please consult a regulated professional before making any financial decisions.

All content and images are sole property of the author.