US: The general theme likely to be higher inflation

It is a very big week for US data as the last major reports ahead of the Federal Reserve’s September FOMC meeting come in. Consumer and producer price inflation, retail sales and industrial production are all due, with the general theme likely to be higher inflation than seen of late versus weaker activity relative to recent trends. Nonetheless, Federal Reserve officials are seemingly of the mindset that they will likely pause interest rate hikes again and re-evaluate in November with just 2bp of policy tightening priced for later this month.

For inflation, we look for fairly big jumps in August’s month-on-month headline readings with upside risk relative to consensus predictions. Higher gasoline prices will be the main upside driver, but we also see the threat of a rebound in airfares and medical care costs, plus higher insurance prices. These factors are likely to also contribute to core CPI coming in at 0.3% MoM rather than the 0.2% figures we have seen in the previous two months. Slowing housing rents will be evident, but it may not be enough to offset as much as the market expects. Nonetheless, the year-on-year rate of core inflation will slow to perhaps 4.4%. We are hopeful we could get down to 4% YoY in the September report and not too far away from 3.5% in October. We would characterise these relatively firm MoM inflation prints as a temporary blip in what is likely to be an intensifying disinflationary trend.

Indeed, it was interesting to see the Fed’s Beige Book characterise recent consumer spending strength as being led by tourism expenditure, which had been "surging". But the general sense was that this would be "the last stage of pent-up demand for leisure travel from the pandemic era". Moreover, other spending was softer, "especially on non-essential items". This may well show up in the retail sales report. We already know that auto volume sales fell quite heftily too, but remember this is a value figure and that higher prices, particularly for gasoline, will help keep overall retail sales just about in positive territory. But with savings being rapidly exhausted and credit card delinquencies on the rise, there are concerns that weaker numbers are coming – particularly with student loan repayments restarting, which will add to financial stresses on the household sector.

Rounding out the reports, we expect industrial production to be much softer than the 1% jump seen last month. Manufacturing surveys continue to point to contraction, and weakness in the component could offset a bit of firmness in utilities and mining/drilling activities.

Key UK wage data to help lock-in September BoE rate hike

There’s mounting evidence from surveys that price pressures in the UK are easing, the jobs market is cooling, and growth is slowing. But the Bank of England has made it abundantly clear that it’s waiting for the actual data to show those trends too, and next week we’ll get crucial wage and jobs data.

Private sector wage growth currently stands at 8.2% and is likely to stay there when we get fresh data next week. But there’s an outside risk that we see this nudge slightly lower on the basis that separate data from firms' payrolls indicated that median pay actually fell in level terms during August. This data is released a month ahead of the more traditional average weekly earnings numbers. We’d expect that to be coupled with a further modest rise in the unemployment rate, as well as a renewed fall in vacancies. The ratio of unfilled job openings to unemployed workers is coming down quickly and closing in on pre-Covid levels.

All of that seems sufficient for the BoE to hike again in September, especially if services inflation nudges higher in data due the day before the rate announcement. But we remain comfortable with our call for a November pause and that September’s hike is likely to be the last.

Separately, we’ll get growth data for July, and we expect a modest contraction in economic output. June saw surprisingly strong growth, including a huge increase in manufacturing production. That surge, which was highly unusual (outside of the Covid period), seems like an anomaly and we expect some retracement in July.

Poland: CPI expected to decline below 9%

Current account (July): €1598mn

Poland’s current account has been improving markedly over the recent months amid improving trade balance. The 12-month cumulative current account balance turned positive (+0.1% of GDP) in June, whereas in late 2022 it was approaching 3.5% of GDP. While export growth has been slowing in nominal terms over recent months, imports have started declining as the surge in imported energy commodities abated. We expect another current account surplus (€1598mn) in July as exports (+1.7% YoY) outpaced imports (-5.8% YoY). The outlook for the rest of the year is less positive, as poor conditions in German manufacturing are likely to weigh on Poland’s export prospects. On the other hand, external positions may benefit if the current weakening of the PLN is continued.

CPI (August): 10.1% YoY

The StatOffice should confirm its flash estimate of August CPI inflation at 10.1% YoY. While headline inflation remained at double-digit levels, price growth has continued moderating. The decline in inflation seen last month can mostly be attributed to developments in food and beverages prices (down by 1% MoM), lower annual growth of house energy and further moderation of core inflation. Our current estimates point to CPI inflation decline below 9% YoY.

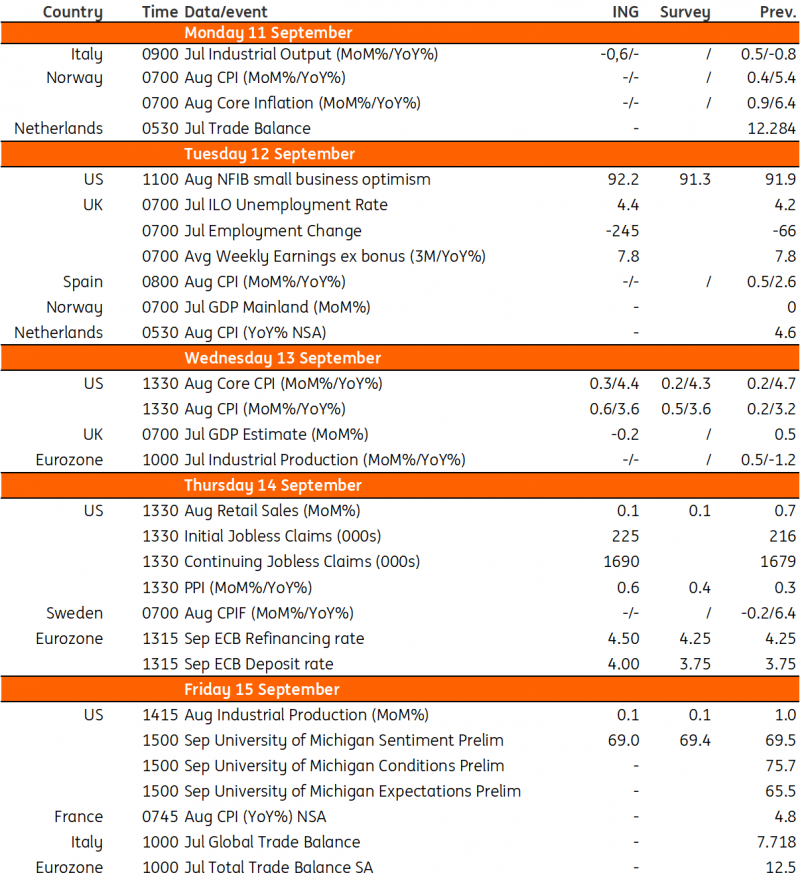

Key events in developed markets next week

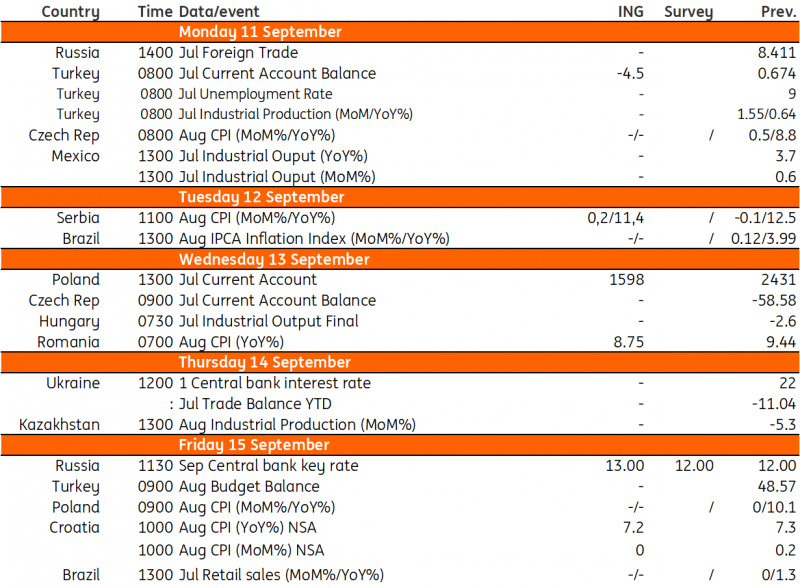

Key events in EMEA next week

First published on Think.ing.com.