Is there a new slump coming for oil prices?

WTI crude oil futures stabilized at over $73 a barrel Tuesday on a possible technical rebound. Investors are still assessing the global oil supply and demand situation while prices have posted a loss of more than 6 percent in the last three trading sessions.

There are doubts about supply reduction by OPEC+ that may not have a significant impact on prices, and negative economic data from major economies are increasing fears of a decrease in energy demand.

Last week, some OPEC+ (Organization of Petroleum Exporting Countries) members including Saudi Arabia, the United Arab Emirates and Kuwait voluntarily announced further production cuts of 2.2 million barrels per day, while others have not yet made any commitments.

In addition, the Saudi energy minister told Bloomberg on Monday that the cuts can "absolutely" continue beyond the first quarter if necessary. Meanwhile, traders remained concerned about the geopolitical situation in the Middle East after the escalation of fighting in the Gaza Strip over the weekend.

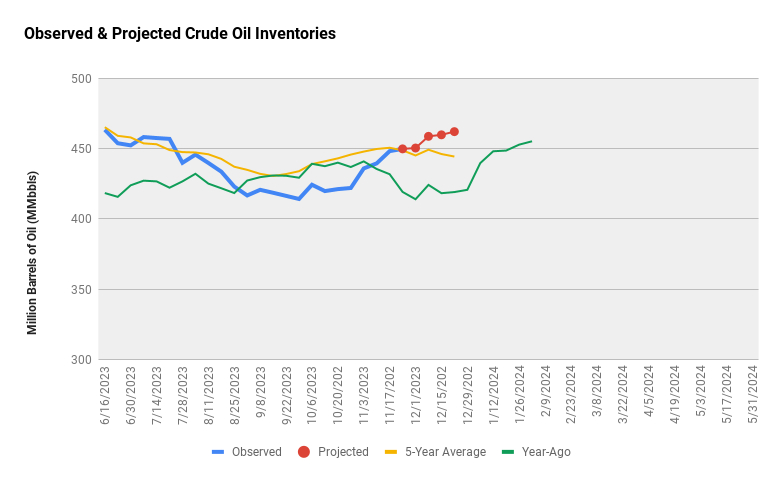

The market is looking ahead to 2024 with concern about a possible oversupply in the first quarter of next year due to seasonally lower demand. However, OPEC+ has recently taken steps to prevent this expected surplus.

Saudi Arabia and Russia have decided to extend voluntary supply cuts until the end of the first quarter of 2024, and other members have announced further supply reductions.

I am concerned about what is happening. For an investor, hearing about "voluntary cuts" is a nightmare.

An organization like OPEC cannot afford such a situation, and the same goes for a CEO who has to be crystal clear when providing business estimates. It is clear that the market has reacted negatively to this news, and we will continue to monitor the situation closely.

The latest OPEC+ meeting highlighted some important issues within the group. First, some members (notably Angola) are dissatisfied with their production quotas for 2024 and have stated that they will reject their quota level for next year.

However, from the supply side, given the pressure we have seen on Angolan production, this is unlikely to have much impact on the market. The biggest concern for OPEC+ should be the fact that they have been unable to agree on group-wide cuts, with some members choosing voluntary cuts instead.

This chaos within the group is making it increasingly difficult for some members to endure further cuts.

From a technical point of view, the graphical situation is not positive. Prices remain below the moving average of 100, and the bearish trend is supported by above-average volumes.

In my previous research, I correctly predicted the collapse of oil prices and achieved my goal.

However, for the first quarter of 2023, I update my oil price estimates to $65. My negative view is influenced by the growth in U.S. oil supply, which has exceeded expectations in 2023 with a projected growth of one million barrels per day to a record 12.9 million barrels per day.

This abundant increase in supply is hurting oil prices, and the chaotic situation within OPEC is not helping.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is there a new slump coming for oil prices?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.