InMed Pharmaceuticals Inc (NASDAQ:INM) continues its transition from a pure-play pharma R&D firm to one also benefiting from commercial sales into the health and wellness market. Product launches of high-value, rare cannabinoids into this market should provide the majority of its revenue in the near future. INM also made notable advances in its pharmaceutical drug development programs, including its ongoing 755-201-EB Phase II trial and preparing for an FDA pre-investigational new drug meeting on glaucoma drug candidate INM-088. We expect to see a different InMed going forward, one that offers near-term revenue generation combined with the longer-term value of its pharma drug development programs.

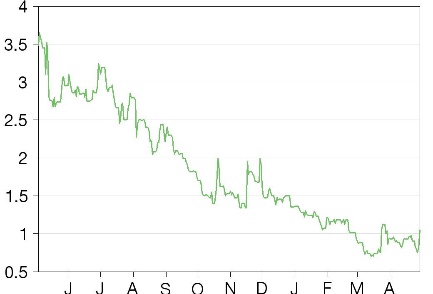

Share price performance

Business description

InMed Pharmaceuticals, a North American-based biopharmaceutical company, is a leader in the research, development, manufacturing and commercialization of rare cannabinoids. Together with its subsidiary BayMedica, the company has multiple and flexible cannabinoid manufacturing capabilities to serve a spectrum of consumer markets, including pharmaceutical and health and wellness.

Health and wellness product launches

With its recent BayMedica acquisition, InMed expanded its focus to the health and wellness market, with several recent and upcoming product launches generating its first revenues. In addition to access to the manufacturing of naturally occurring cannabinoids, BayMedica brought a large library of rare cannabinoid analogs, providing an additional commercial opportunity. As well as cannabichromene (CBC) and cannabicitran (CBT), the latter of which was recently launched and had its first B2B sales in Q1 of CY22, INM launched cannabidivarin (CBDV) and plans to launch tetrahydrocannabivarin (THCV) in Q2 CY22, both of which have potential health indications and are considered by management to be high-demand cannabinoids.

INM-755 and INM-088: Notable advances

InMed has made notable advances in both preclinical and clinical phases of its pharmaceutical development platform. Enrollment for the 755-201-EB trial (to treat epidermolysis bullosa (EB)) began in December and management expects to complete it during CY22. Also in December, INM announced a peer-reviewed scientific article regarding using cannabinol (CBN; the API in INM-755) to treat glaucoma. It also continued advancing INM-088 towards human trials, as it prepares for its pre-investigational new drug meeting with the US FDA.

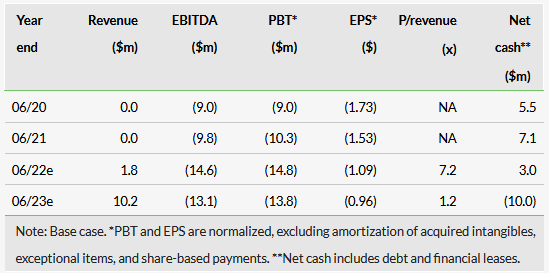

Valuations: $6 (base), $16 (bull), $1.5 (bear) per share

We have updated our valuation to consider a range of scenarios as well as accounting for the BayMedica acquisition. Our risk-adjusted per basic share valuations are US$6.0 (base), US$16.0 (bull), and US$1.5 (bear), versus the previous US$20.53. The key factors influencing our valuation are the market share InMed can capture with its biosynthesis platform and its EB treatment, projected sales for its cannabinoid health & wellness products, and rolling our model forward.

Click on the PDF below to read the full report: