On Friday, the price of gold reached an unprecedented peak, soaring above 2,230 USD. The global capital market experienced low activity due to the observance of Good Friday in many Catholic countries, leading to abrupt movements by investors.

The surge in gold prices is primarily attributed to anticipations that global financial regulators will lower lending costs within the year. Furthermore, escalating geopolitical tensions have bolstered gold's appeal as a safe-haven asset.

March saw gold's price increase by over 9%, marking a significant uptick for what is typically considered a conservative investment. Several key developments support this rally:

- US Federal Reserve's rate cut intentions: in its March meeting, the Fed outlined plans to reduce interest rates three times over the year.

- Bank of Japan's policy shift: this month, the Bank of Japan abandoned its negative interest rate policy.

- Swiss National Bank's rate adjustment: in an unexpected move, the Swiss National Bank lowered its interest rate, sparking speculation that other financial authorities might take similar actions.

Gold's status as a safe asset has been reinforced amidst a market climate favouring risk aversion, driven by ongoing geopolitical instability, especially in the Middle East.

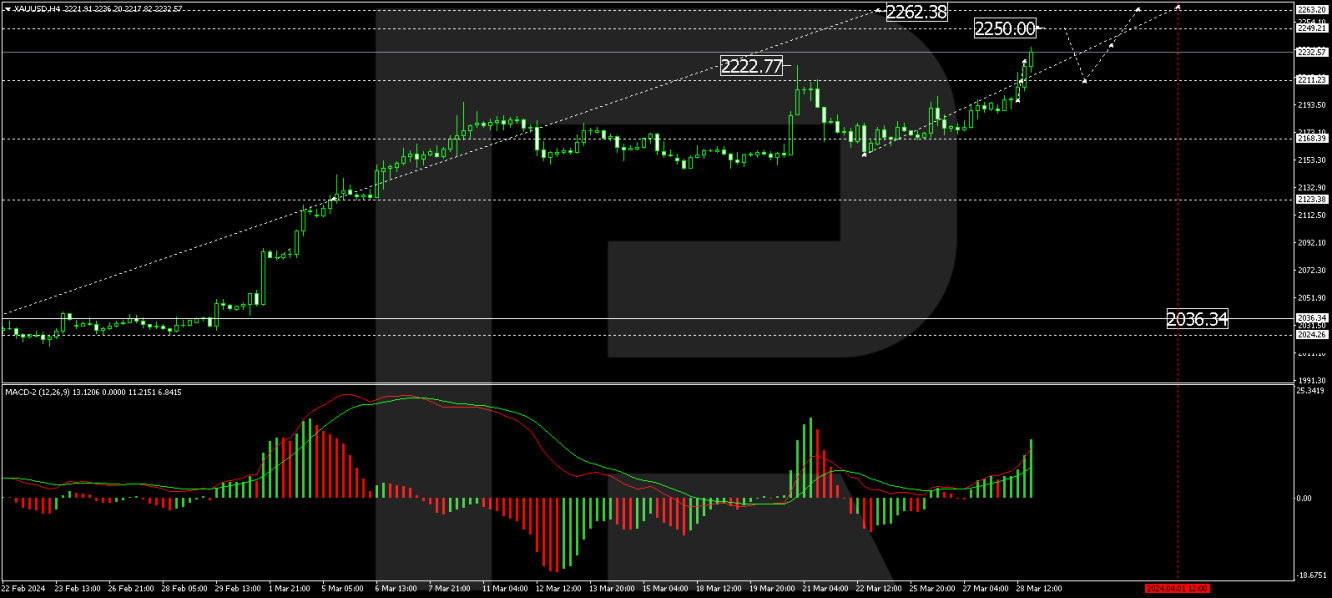

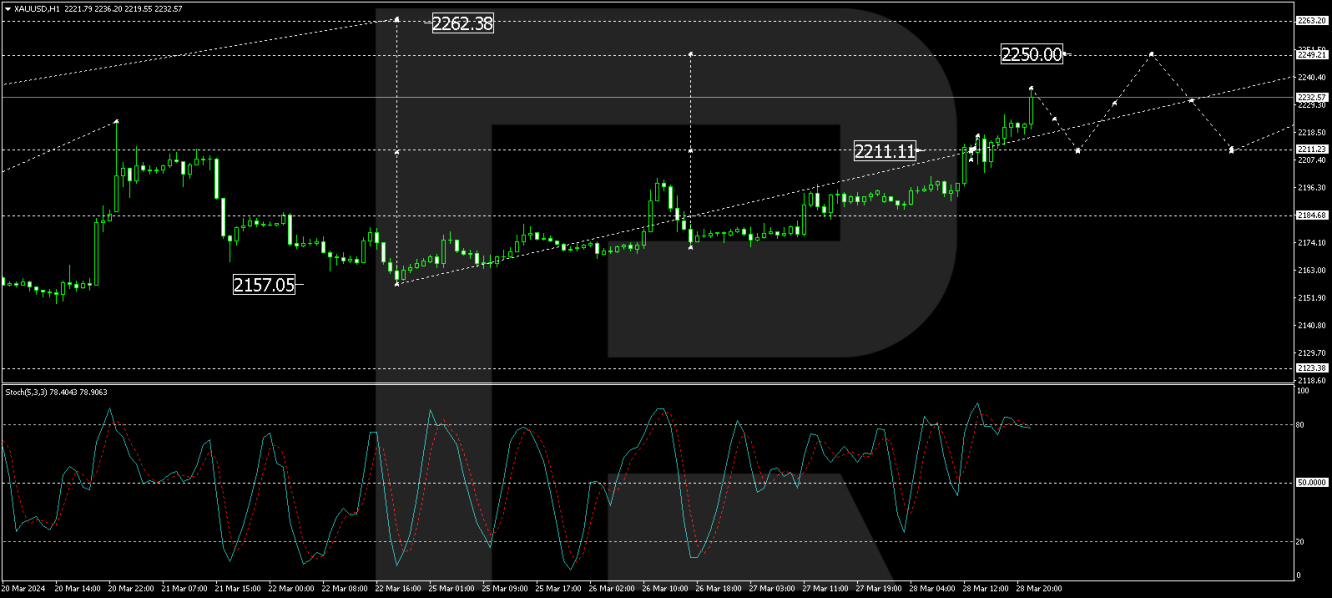

Technical analysis of XAU/USD

H4 chart analysis: The H4 chart reveals that XAU/USD prices have broken out of their consolidation range, embarking on the fifth wave of growth. An upward movement towards 2,250 USD is currently forming. Following this, a corrective movement to 2,211.11 USD may occur, potentially leading to a new growth phase targeting 2,262.38 USD. This scenario is supported by the MACD indicator, with the signal line positioned above zero and trending upwards.

H1 chart analysis: On the H1 chart, XAU/USD established a consolidation range of around 2,211.11 USD. An upward breakout from this range could set the stage for a rise towards 2,250 USD. After achieving this level, a correction towards 2,222.50 USD may unfold before considering a further ascent to 2,262.38 USD and a pullback to 2,180.60 USD. The Stochastic oscillator, currently above 80, indicates a forthcoming decline to 20, aligning with this analysis.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.