Foxtons (LON:FOXT) core London market has been improving all year and the interim results highlight both the recovery and the contribution from recent acquisitions. Furthermore, the company announced a return to paying dividends in respect of the half year and given the strength of both trading and the balance sheet, revealed a £3m share buyback programme that should augment earnings. We retain our underlying assumptions but raise our valuation by 1p to 130p to reflect the share buyback.

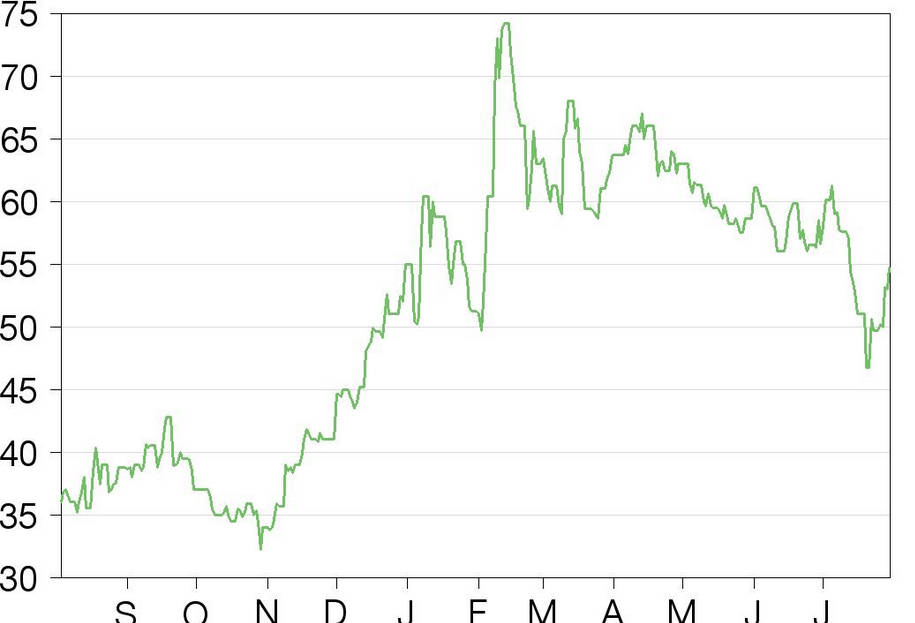

Share Price Performance

Strong markets and M&A imply good growth

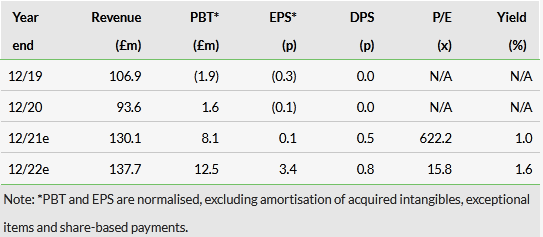

Foxtons reported H1 revenue of £66.9m, up 29% versus H119, comfortably ahead of our expectations. Operating profit was £5.2m having been in loss in both 2019 and 2020 and PBT was £3.3m, again having been in loss for the previous two years. Adjusted EPS was 1.1p/share which has allowed Foxtons to declare a dividend of 0.18p/share. The company ended the period with net cash of £24.4m which along with the positive cash inflow has encouraged the board to announce a £3m share buyback.

Underlying forecasts unchanged

The outlook is encouraging despite the tapering of the stamp duty holiday as the market appears to be maintaining momentum. Our underlying full year forecasts are essentially unchanged, bar the inclusion of £1.5m of branch business rates, taken voluntarily in H1 and paid in July. Foxtons continues to roll out its growth strategy which was highlighted in its June capital markets day. This includes investing in the underlying business, pursuing M&A of lettings books, regional expansion and focusing on the Build to Rent (BTR) market which is expanding rapidly.

Valuation: Bull case value edges up to 130p/share

Our base case shows 2022e EPS of 2.4p, which gives a valuation below the current share price when we apply the average 2014/15 P/E of 17.5x. If we roll over our forecasts to 2023e, our basic, adjusted and diluted EPS of 2.9p implies a valuation of 50.8p, much closer to the current price. However, we would argue that future growth may not be fully reflected in the share price or our estimates as we do not forecast acquisitions. Our bull case highlights the potential upside in forecasts, where Foxtons is particularly geared to further acquisitions of lettings books as well as growth from BTR, regional expansion and underlying markets. Our bull case scenario suggests a potential 2022e EPS of 7.4p, which implies a valuation of 130p/share when the 17.5x P/E is applied, a 1p uplift due to the £3m share buyback announced.

Click on the PDF below to read the full report: