Facebook (NASDAQ:FB), one of the largest tech companies in the US, has revealed its financial results for the third quarter.

Results

- EPS: $3.22 (forecast: $3.19)

- Revenue: $29.01B (forecast: $29.49)

Though FB posted stronger-than-expected earnings, its revenue came out worse than the analysts’ forecasts. The main reason is Apple’s privacy changes.

Tough time for the social media and advertising sector

Social media stocks can be pressed by Apple’s overhaul of its privacy settings, which allows iPhone users to choose not to receive targeted advertising. It is a severe problem for all social media platforms (Facebook, Google (NASDAQ:GOOGL)) as it would decrease their ad sales.

The stock of Snap (NYSE:SNAP) dropped almost 30% on Friday after the owner of the Snapchat app cautioned that Apple’s data collection policy has created barriers for advertisers to test and gauge their campaigns.

Besides, small and medium-sized businesses are reducing their ad spending as they face challenges of supply-chain issues and rising costs. The falling demand for advertising is negative for Facebook and other social media companies.

What’s next?

Facebook has dropped significantly since early September. It may continue falling in the short term amid all these headwinds mentioned above. However, the stock will inevitably reverse up in the long term. Thus, the current drop should be viewed as a correction which the stock will overcome. It has recovered after every big crisis based on its past performance. Why? Other businesses have no option to ignore the Facebook platform due to its huge global reach.

Tech outlook

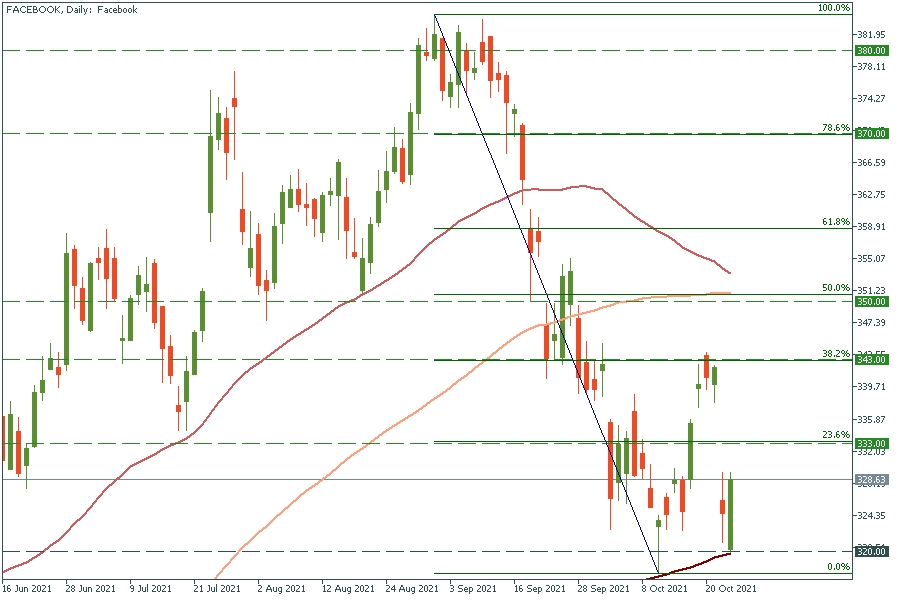

Facebook has failed to cross the support level of $320.00 at the 200-day moving average and reversed up. If it manages to jump above the 23.6% Fibonacci retracement level of $333.00, the way up to the 38.2% Fibo level at $343.00 will be open. Support levels are the 200-day MA at $320.00 and the next round number of $310.00.