EUR strengthens as market's most traded currency pair begins the week at 1.0940. The euro (EUR) demonstrates strength as the market's most traded currency pair, commencing the week around 1.0940 against the US dollar (USD).

The diminished enthusiasm for the US dollar can be attributed to the anticipation of a soft "downturn" in global economies and the hawkish stance of central banks outside the United States. There is a growing belief among market participants that the G-10 countries will experience a milder economic slump rather than a severe recession, potentially transitioning into a period of stagnation.

One key factor contributing to the euro's strength is the European Central Bank's (ECB) hawkish stance. In the past week, the ECB provided clear indications of its preparedness to raise interest rates further, which has bolstered confidence in the euro.

Technical Analysis:

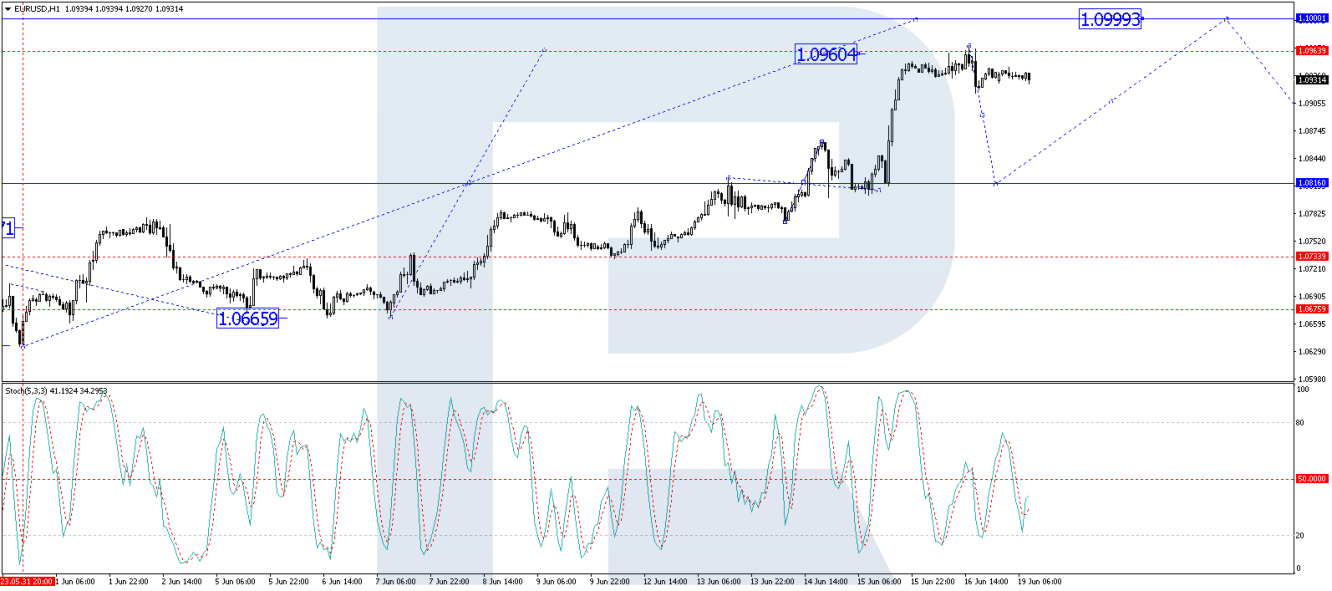

On the H4 timeframe, the EUR/USD pair has recently completed a third wave of growth, reaching 1.0960. The target for this wave is localized. The market is expected to enter a consolidation range below this level, and if it breaks out downwards, a corrective wave towards 1.0816 could ensue. Once the price reaches this level, a new wave of growth towards 1.1000 is anticipated. This technical scenario is supported by the MACD indicator, as its signal line is currently at its highs and preparing for a decline towards zero.

On the H1 timeframe, a consolidation range has formed around the level of 1.0816. Upon breaking out above this range, the market has completed the structure of a growth wave, reaching 1.0960. A new wave of corrective decline towards 1.0816 is expected to commence. The Stochastic oscillator also confirms this technical scenario, with its signal line currently below 50 and potentially heading towards 20 during today's trading session.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR Strengthens Against USD as Market Expects Milder Economic Downturn

Published 20/06/2023, 07:24

EUR Strengthens Against USD as Market Expects Milder Economic Downturn

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.