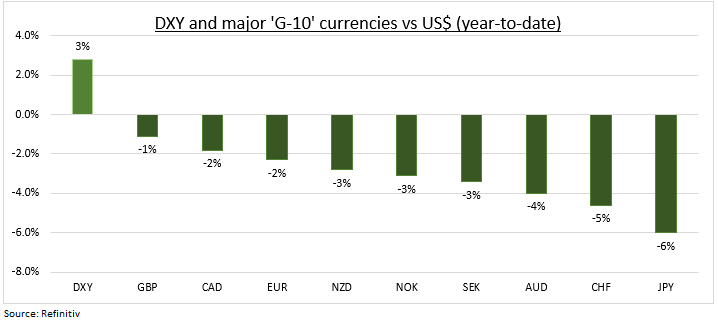

RALLY: The dollar (DXY) is near its highest since Nov. and the best performing G-10 currency this year. As markets react to more US growth strength and stickier inflation. Pushing up bond yields and widening differentials. Delaying start, and softening magnitude, of forecast US interest rate cuts this year. This US exceptionalism is now better priced, much of dollar outperformance behind us, and impacts from commodities to emerging markets have been limited. But conditions are diverging and to drive more currency dispersion. Sterling (GBP) has much in common with the dollar and has kept pace. Whilst Yen (JPY) round-tripped and has been the big laggard. New Zealand (NZD) is ready for more hikes, but Switzerland (CHF) and ECB (EUR) are early cutters.

GBP: Sterling (GBP) has been the ‘dollar of Europe’, and is similarly c.7% overvalued. The UK’s super sized consumer has cushioned its technical recession. Whilst inflation is still double target, giving the BoE plenty of ammunition to push against market hopes of early rate cuts. GBP outperformance is in stark contrast to the underperformance and bearishness on other UK assets. And has sapped the overseas sales focused FTSE 100 large caps. March 6th ‘spring budget’ the next catalyst and may be GBP positive if see well-calibrated tax cuts. Whilst October election risks are likely discounted with Labour 20 points ahead in polls and moved to centre.

JPY: Yen underperformance has resumed as US growth exceptionalism has twinned with the BoJ’s go-slow on policy normalisation. The USD/JPY has broken below the psychological 150 again, triggering verbal intervention from the authorities. But anything more forceful is unlikely. Given the fundamental drivers and with no rate hike likely until mid-year from current -0.1% level. The Yen is the world’s cheapest major currency and is approximately 25% undervalued on a real effective exchange rate basis. Weakness has given a new lease of strength to the Nikkei255, that is now closing in on its 1989 all-time-high. And fuelled near 10% export growth.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar well-priced as macro differences rise

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.