Whilst the dollar's bounce could extend further, bears are likely to seek opportunities to fade into the current rally.

Needs less to say, the USD had a terrible December in line with its seasonal tendency. Yet prices are undergoing a much-needed correction after such a volatile move. The question now becomes as to whether it will provide bears another entry point at a higher-prices, or can it perform a complete reversal? Given the Fed continue to inflate their balance sheet, we suspect dollar gains are merely corrective at this stage.

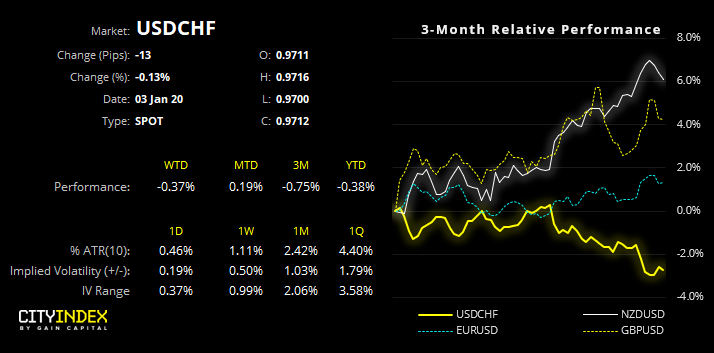

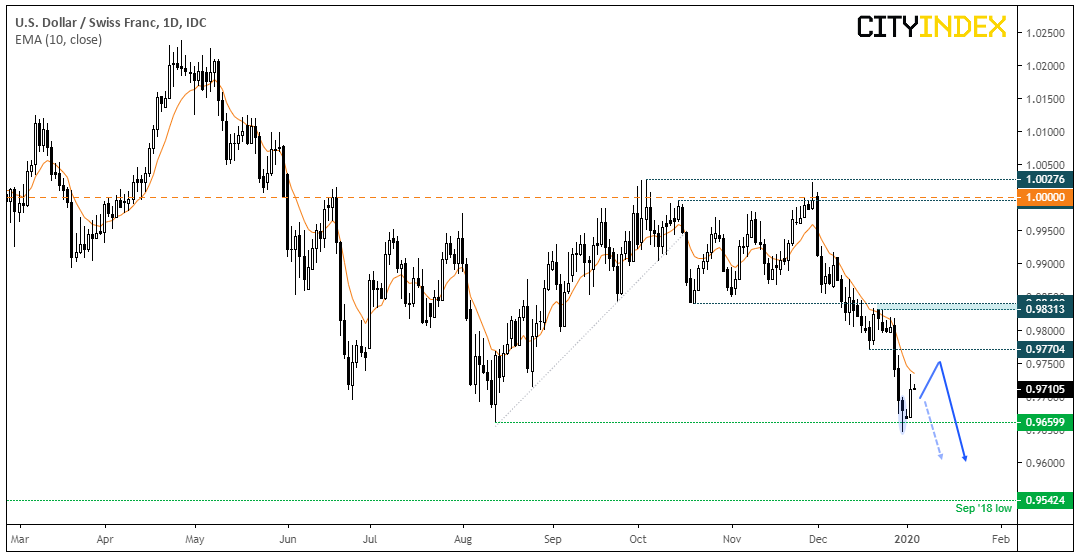

USD/CHF: A bearish engulfing month was confirmed for the Swissy, although our forward returns analysis showed the following month has a positive expectancy. Yet the gains were not compelling, and it still allows for losses earlier in the month even if prices are to reverse their way to a positive close.

Technically a bounce hasn’t come as such a surprise, given the bullish hammer on NYE failed to close beneath key support and warned of a bear-trap. Momentum is clearly bullish and we could see this retrace towards 0.9970 resistance. Yet with a core bearish bias, we’d then seek bearish setups beneath this key level, or switch the bias with a break above it.

NZD/USD: We’ve outlined on several occasions a bullish case for NZD ahead of RBNZ’s February meeting. And we retain this core view unless data turns south beforehand. But unlike AUD/USD, its upside appears stretched over the near-term and a retracement is now underway, making it viable for counter-trend traders to buck the trend whilst trend traders seek a lower entry price.

Its trend is undeniably bullish and prices are respecting a tight bullish channel. A bearish pinbar on NYE warned of exhaustion and momentum has since turned. Whilst the daily trend remains bullish above the 0.6555 low, we’re looking for signs the correction has ended somewhere above the 0.6648 high or the lower bullish trendline.

Related Analysis:After A Strong December Close, AUD Hesitates Around 70cNZD/JPY and AUD/JPY Are Coiling Just Off Their Highs

USD/CHF Is On Track For A Bearish Engulfing Month (Which Forecasts April Showers)

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.