Can Dixons Carphone (LON:DC) avoid further collapse with next Wednesday’s interim results?

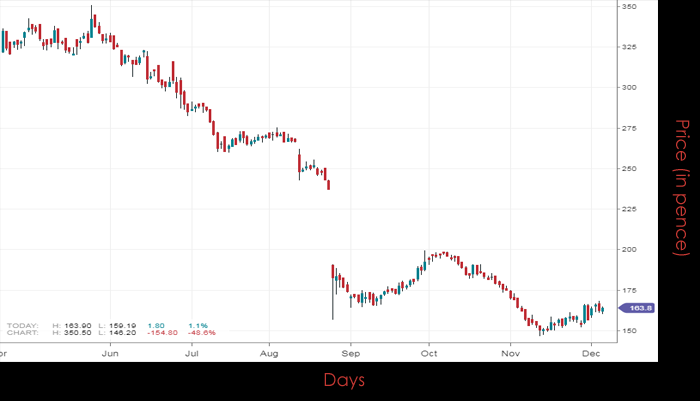

In an increasingly bleak UK retail landscape Dixons Carphone has been one of the major casualties. From an opening price of £3.60 the stock fell all the way to an all-time low of £1.46 in mid-November; the company now sits at a current trading price of £1.64 (Spreadex, 06/12/2017).

Thing is, for a while it seemed like Dixons was managing to navigate the choppy retail waters. Despite a ‘challenging’ mobile market the company posted a 10% rise in full year pre-tax profit to a record £501 million, alongside a healthy 4% increase in like-for-like revenue and a 3% jump in total sales to £10.5 billion. CEO Sebastian James was even so bold to say that Dixons Carphone was ‘no longer a retailer’ given the strength of its services division.

Cut to the end of August, however and the company was releasing a very different statement. Its first quarter figures were actually pretty impressive; UK like-for-likes rose 4%, with an 8% jump in the Nordics and a 6% rise in Greece, leading total comparable sales up by 6%. Yet this growth couldn’t prevent Dixons plunging 23% in a single session as it warned that its full year profits would come in between £360 million and £440 million, well down on the £501 million posted in 2016/17.

James blamed ‘a more challenging UK postpay mobile phone market’ where currency fluctuations have made handsets more expensive and ‘incremental’ technical innovation has left less people clamouring for an upgrade. The CEO also highlighted the fact that ‘changes in EU roaming legislation’ may cause a net negative charge of anywhere between £10 million and £40 million (in contrast such one-off adjustments boosted profits by £71 million last year).

In terms of Wednesday’s interim update, Dixons might be able to help itself out if it can post the same kind of like-for-like growth for the half year as it did in Q1. Of course, what investors will really want to see is a (positive) revision to those profits forecasts, and more clarity on the roaming-related charges, though that’s less likely.

Dixons Carphone PLC has a consensus rating of ‘Buy’ alongside an average target price of £2.62.

"Disclaimer: Spreadex provides an execution only service and the comments above do not constitute (or should not be construed as constituting) investment advice or recommendations, or a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any person placing trades based on their interpretations of the above comments does so entirely at their own risk. Spreadex Ltd is a financial and sports spread betting and sports fixed odds betting firm, which specialises in the personal service and credit area. Founded in 1999, Spreadex is recognised as one of the longest established spread betting firms in the industry with a strong reputation for its high level of customer service and account management.

In relation to spread betting, Spreadex Ltd is authorised and regulated by the Financial Conduct Authority. Spread betting carries a high level of risk to your capital and can result in losses larger than your initial stake/deposit. It may not be suitable for everyone, so please ensure you fully understand the risks involved. In relation to fixed odds, Spreadex Ltd is licensed and regulated by the Gambling Commission under licence number."