Deutsche Beteiligungs (DE:DBANn) (DBAG) posted a 24.5% NAV total return in 9M21, even after the dilutive impact of the recent €100m share issue. This was mainly a function of improved earnings expectations of portfolio companies, coupled with disposal gains on DNS:Net and Rheinhold & Mahla, as well as a €26.0m uplift upon the announced exit from blikk. Results were further supported by the profit from DBAG’s fund services (up to €13.9m in 9M21 vs €6.6m in 9M20) following the start of DBAG Fund VIII’s investment period. While DBAG closed only one acquisition in Q321 (R+S, its second long-term investment), the management underlines the continued strong pipeline of opportunities (up to 86 in Q321 vs 81 in Q221).

Fund objective

Deutsche Beteiligungs is a German-based and listed private equity investment and fund management company. It invests in mid-sized companies in Germany and neighbouring German-speaking countries via MBO transactions and growth capital financings. It focuses on growth-driven profitable businesses valued at €50–250m. DBAG’s core objective is to sustainably increase net asset value.

Bull points

- Solid track record, with an average management buyout exit multiple of 2.7x.

- Growing exposure to broadband, IT and healthcare.

- Stable and recurring cash flow from fund services.

Bear points

- Significant exposure to German industrials may weigh on performance in a prolonged recovery scenario.

- Ample dry powder in the market translating into high competition for quality assets.

- High valuations in most resilient sectors.

Why consider Deutsche Beteiligungs now?

DBAG is a well-established player in the German private equity (PE) mid-market. It has been increasing its exposure to new ‘growth’ sectors, which currently make up 43% of its portfolio and have proved resilient in the COVID-19 crisis. In particular, these include broadband/telecom businesses (25%), which are a play on the secular trend of network roll-out in Germany. At the same time, DBAG’s industrial portfolio (currently valued slightly below acquisition cost on average) may appeal to investors seeking exposure to cyclical value companies, even if their earnings recovery has been partially curbed by supply bottlenecks and cost inflation recently.

The analyst’s view

DBAG’s shares currently trade at a 10.8% premium to NAV, visibly below the five-year average of 18.6%. If we assume that DBAG’s PE investments segment is valued at a discount to NAV in line with its peers (currently at 11%), it implies a P/E multiple for DBAG’s fund services business of 9.0x based on new management guidance of segmental profit of €16–17m for FY21e. This implies a c 69% discount to the current average FY21e multiple for listed alternative asset managers of c 29x (based on Refinitiv consensus), suggesting that DBAG’s current market valuation may be relatively undemanding. DBAG’s shares now offer a dividend yield of 2.1% based on the FY20 pay-out of €0.80 per share. While the dividend per share is unlikely to return to pre-COVID-19 levels (€1.50 in FY19) in the near term, we note that DBAG’s dividend policy is for a stable or rising dividend per share, with a mid-term FY23 target of €1.00–1.20 communicated last year.

9M21: Higher earnings expectations versus end-2020

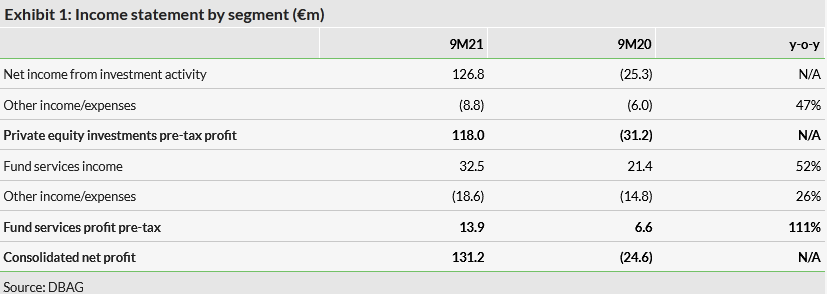

DBAG reported net income of €131.2m in the first nine months of FY21 (9M21) ending June 2021 (versus a €24.6m loss in 9M20, see Exhibit 1), driven mainly by strong revaluations in the PE segment, which posted a €118.0m pre-tax profit (versus a loss of €31.2m in 9M20).

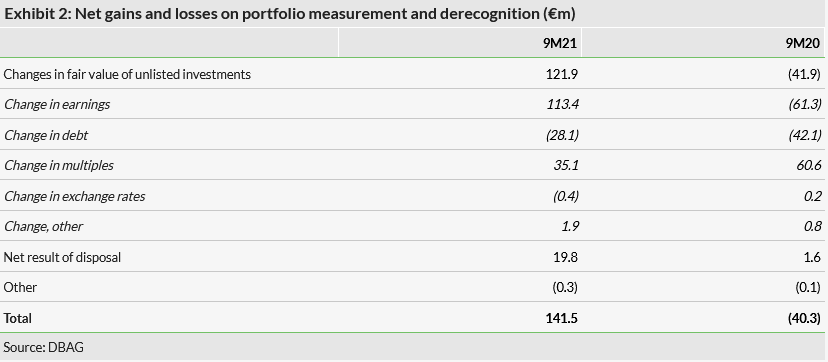

The result of the PE investments segment in 9M21 was primarily assisted by improved earnings expectations in portfolio companies (€113.4m, see Exhibit 2), especially in the broadband/telecom sector (including the impact from several bolt-on acquisitions completed by one of the platform investments), IT services/software companies and one company within the ‘other’ sectors bucket. Having said that, manufacturing businesses and related service providers (including automotive suppliers) also had a positive contribution. This, however, has been partially offset by supply bottlenecks, raw materials cost inflation and higher freight rates.

A further €35.1m positive effect came from the change in valuation multiples, including €26.0m attributable to the uplift upon the disposal of the blikk radiology group agreed in Q321. The remaining upward revaluations came mostly from broadband/telecom and IT services/software businesses, partially offset by write-downs of DBAG’s holdings in automotive suppliers. Change in debt had a €28.1m negative impact, mostly associated with the financing of bolt-on acquisitions. We note that the share of companies with a net debt to EBITDA ratio above 3.0x fell to 45% at end-June 2021 from 72% at end-September 2020 on the back of improved earnings (see Exhibit 5). Finally, the company recognised a €19.8m net result of disposals, which includes: 1) a €4.2m gain on the sale of Rheinhold & Mahla (RM); 2) a €13.5m gain on the disposal of DNS:Net; and 3) the result on the disposal of DBAG’s stake in the remaining externally managed foreign buyout fund.

DBAG values its portfolio at 1.34x cost at end-June 2021 (versus 1.3x at end-March 2021, 1.2x at end-December 2020 and 1.1x at end-September 2020), with its industrial portfolio still valued slightly below acquisition cost (at 0.9x), reflecting the COVID-19 impact and structural changes in the automotive sector. At the same time, its five broadband/telecom holdings are on average valued at a healthy 3.7x cost.

The fund services segment reported a €13.9m pre-tax profit in 9M21 (significantly up from €6.6m in 9M20), with income up to €32.5m from €21.3m in 9M20, mostly on the back of fees from DBAG Fund VIII, whose investment phase started in August 2020 (€13.9m fees in 9M21) as well as capital calls from the top-up funds of both DBAG Fund VII and VIII. We note that the main funds collect fees based on committed capital, while fees from their respective top-up funds are based on capital invested. The above was partially offset by the decline in fees from DBAG Fund VII to €10.8m from €13.1m last year, as these are now calculated based on invested rather than committed capital. Net expenses for the segment increased to €18.6m from €14.8m in 9M21, primarily due to higher provisions for variable remuneration, as well as team expansion.

NAV development

DBAG reports net asset value (NAV) attributable solely to its private equity investments, which amounted to €622.7m at end-June 2021 (€33.12 per share), translating into a 20.3% total return. In our analysis, in order to capture the performance of the whole group, we use DBAG’s equity value as NAV which stood at €643.3m at end-June 2021 (€423.5m at end-September 2020), translating into €34.21 per share, according to our calculations. The NAV per share total return was 24.5% in 9M21 after accounting for the dilutive effect of the €100m share issue (compared to LPX Europe NAV at 19.8%). The main value driver was the change in value of portfolio holdings, adding €114.2m (including accrued income) to the NAV, which excludes gains on disposals and revaluations to the agreed price of the disposals not closed yet (a further €44.5m). While the ongoing costs (net of other operating income) increased significantly to €32.0m, we note that these include fund services segment costs that are offset by generated fee income (the segment’s pre-tax margin increased to 43% from 31% in 9M20). We calculate the annualised net expense ratio at a minor 0.3% of DBAG’s average assets under management (AUM) (compared to 0.1% in FY20).

Click on the PDF below to read the full report: