Canacol Energy's (TSX:CNE) H121 production averaged 176.3mmscfd, demonstrating its continued resilience as Colombia recovers from COVID-19, and was above the midpoint of management’s full year production guidance of 153–190mmscfd. In August, sales were 186mmscfd. The 2021 drilling programme of up to 12 wells is well underway at an estimated capex of US$98–140m, and has delivered a discovery at Aguas Vivas 1, which encountered the thickest net pay for the company to date. Canacol targets a reserves replacement ratio (RRR) of 200% annually, which we estimate requires an active drilling programme of c 12–16 wells per year over the next five years (assuming a 70% success rate), and discovering gas outside the current core producing acreage. Meanwhile, a new gas pipeline will open up the interior market in Colombia from 2024.

Share Price Performance

New pipeline: Access to interior market

Canacol has secured a new long-term take or pay gas sales contract that will diversify its client base. It will be executed via a new pipeline connecting the company’s gas fields to the interior market in Colombia, an area that accounts for 60% of the country’s natural gas demand and that is expected to enter a supply shortfall from 2022. The pipeline is scheduled for completion by end-2024.

Track record of achieving 200% RRR

Canacol achieved a 200% RRR in all years over the period 2016–19. In 2020, the RRR was 120% (see Exhibit 1), due to only six of the planned 12 wells being drilled after delays caused by COVID-19. It has achieved an average success rate of more than 80% from 2016 and we therefore increase our success rate assumption (used in our valuation for additional risk reserves) to 70% from 50% previously. Canacol is carrying out an up to 12-well drilling programme in 2021 to achieve a 200% RRR, and we estimate that it requires c 12–16 wells per year over 2022–25 to maintain this rate. This will also require moving beyond the current producing licences. A 3D seismic survey in 2021 will look to expand the prospect inventory, while a first well is expected in the Middle Magdalena Valley from 2022.

Valuation: Significantly undervalued

Our risked exploration net asset value (RENAV) is based on a combination of 2P reserves and additional ‘to be developed’ risked reserves that we expect to be added over the next five years. We value core NAV at C$3.15, to which we add C$2.97 for additional risked reserves, to arrive at our valuation of C$6.12/share, which is 85% above the current share price. We believe the current share price does not fully reflect the potential upside from exploration.

Gas sales continue to be resilient

Canacol‘s gas sales remained resilient during 2020 despite lower than forecast production rates as a result of a decrease in spot market sales due to COVID-19. However, this only affected the c 20% of Canacol’s gas production sold under interruptible contracts and, with 80% of sales under long-term take-or-pay contracts denominated in US dollars, the company’s cash flows are protected against oil market weakness. Canacol still achieved a record average annual production rate of 171mmscfd in 2020 (up 19% y-o-y), reflecting the first full year of increased export capacity since the 85km gas pipeline extension between the Jobo gas processing facility and Cartagena came online in Q319. This solid performance has continued into H121, when production averaged 176.3mmscfd. Post H121, demand for spot market values has increased, with a contractual sales volume of c 190mmscfd in July 2021 and c 186mmscfd in August 2021. This increase in demand is due to a number of factors: a reduction in the recent civil unrest in Colombia, progress of the country’s COVID-19 vaccination roll-out and higher natural gas demand as a result of the weakening of the La Niña climate phenomenon. A continuation of sales at the August rate would imply an average production rate of c 181mmscfd, towards the high end of the company’s 2021 guidance of 153–190mmscfd. We adopt 180mmscfd in our forecasts.

2P reserves also increased in 2020 to 637bcf, albeit at a lower rate than in previous years, due to an enforced reduction in operational activity caused by the COVID-19 pandemic. The RRR for the year was 122%, below the company’s annual target of 200%, but we estimate that Canacol will return to this level in 2021, based on a 70% success rate in an assumed 12 wells.

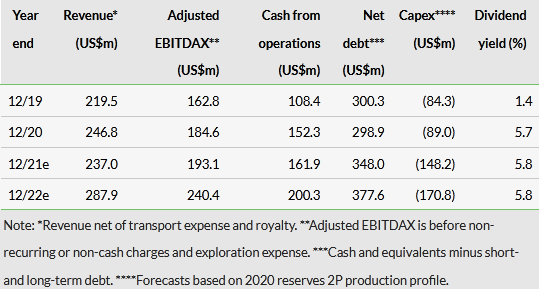

Management expects capex of US$98–140m for the year based on its production guidance range, which will be fully funded from existing cash and 2021 cash flow. Canacol has identified a further US$23.5m of contingent capex for the completion, testing and tie-in of successful exploration wells.

The civil disturbances in Colombia have so far occurred in the cities and in the oil-producing Llanos, Middle Magdalena and Putumayo Basins, and have not adversely affected Canacol’s operations, which are located in the Lower Magdalena basin.

New pipeline to open-up interior market

Canacol announced on 30 August that a new 20-inch pipeline will be built from the Canacol gas treatment plant in Jobo to Medellin, c 285km to the south, at an estimated cost of c US$450m. The project will be financed by 70% debt and 30% equity, and we assume Canacol will own a 25% equity stake (c US$35), which is the maximum stake it can hold from a regulatory perspective. The pipeline, which is scheduled for completion by end-2024, will have an initial transportation capacity of c 100mmscfd, which can be expanded to 200mmscfd if additional compression capacity is installed. Canacol has secured a take or pay gas sales contract with Empresas Publicas de Medellin (EPM) (Colombia’s largest multi-utility). Under the terms of the contract, Canacol will supply gas to EPM in Medellin, via the new pipeline from 1 December 2024, initially at a rate of 21mmscfd, rising to 54mmscfd on 1 December 2025 and remaining at this level until the contract expires on 30 November 2035.

Click on the PDF below to read the full report: