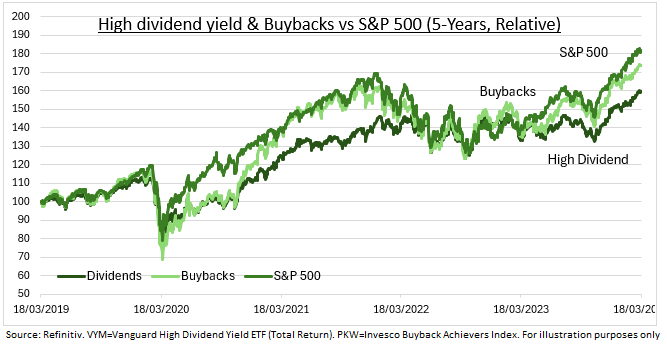

STYLES: Dividends and especially stock buybacks are coming back into style with investors. With their chronic 2023 style underperformance narrowing sharply this year (see chart). This maybe set to continue to build as earnings recovery spreads, supporting increased buybacks and higher dividend payouts. And as competition from high interest rates starts to ease as Fed and ECB cut. Company buybacks remain the biggest buyers of US stocks, at $800 billion last year. With the largest buy-backers in the tech sectors and the US. Whilst stickier dividends drive cash returns in the rest of the world, with banks, utilities, real estate among the biggest payers.

BUYBACKS: S&P 500 companies spent 18% more on share repurchases last quarter, taking the Q4 total to $220 billion. The new 1% buyback tax seemed to have little impact on company decisions. Though chances are it gets significantly raised in the future. Buybacks are top-heavy with 20 stocks accounting for half of activity. Led by Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL), and newcomers RTX (RTX), General Motors (NYSE:GM), and Broadcom (NASDAQ:AVGO). The total Q4 buyback + dividend yield was 3.30%. Companies prefer buybacks for 55% of their shareholders cash returns, led by tech. Utilities and real estate led those preferring dividends.

DIVIDENDS: Global dividends rose 7% in Q4, led by Emerging markets and Europe, with half the growth coming from the banking sector. Though much of this growth was offset by sharp cuts across the mining sector, as profits plunged. And rising Japanese payouts eroded by the sharply weaker Yen. Dividends dominate cash returns to shareholders in non-US markets. Forecasts are for a 5% growth this year, with underlying dividends supported by rising payouts and improving profits. Whilst lower special divs flatten overall growth. Microsoft (NASDAQ:MSFT), Apple (AAPL), and Exxon (NYSE:XOM) were world’s three largest payers last year.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Buybacks and dividends coming back into style

Published 20/03/2024, 08:15

Updated 09/02/2024, 07:53

Buybacks and dividends coming back into style

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.