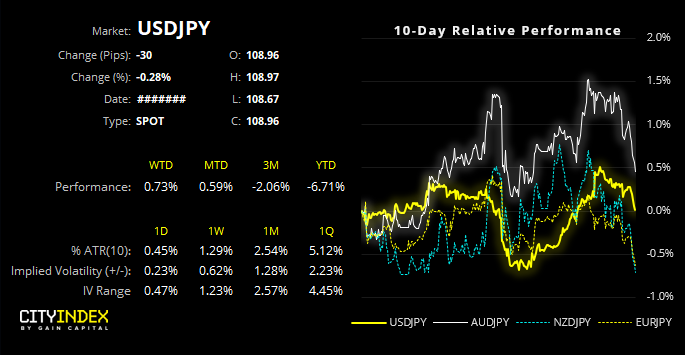

The table could be turning for risk, with several JPY crosses looking like they’re finally topping out and due their anticipated corrections. With indices just off record highs and several markets pausing below key resistance (AUD/USD, EUR/JPY and USD/JPY, just to name a few), it suggests traders are hopeful US and China can sign this famous deal, yet doubts linger in the air. And with reports piling up that US and China aren’t likely to sign the famous “phase one” trade deal until December, then risk could be ripe for a correction. And this potential correction was flagged a couple of weeks ago with so many markets pausing at the said key levels. Now momentum has turned, the probability of downside for risk assets could be increasing, although equity markets are yet to play catch up.

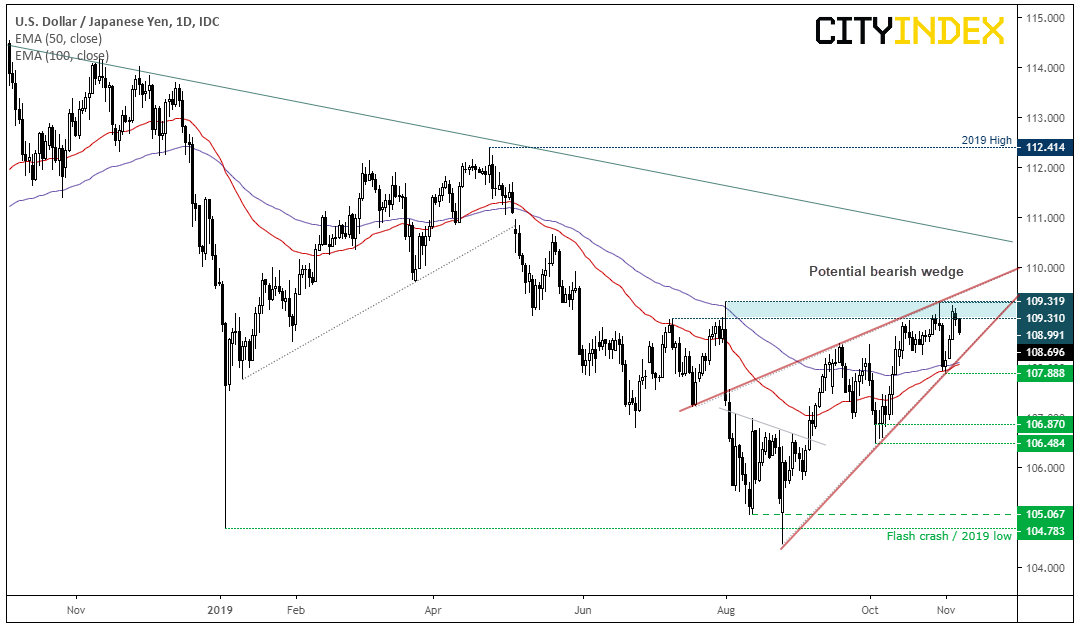

109.32 is clearly a big level for USD/JPY as its tired and failed to break this level three times. The Elongated bearish engulfing candle marked prominent resistance on the 1st August and prices rolled over to print a fresh YTD low. Whilst a recovery saw it recoup losses, a bearish pinbar reaffirmed the key resistance levels, and prices have retreated from it once more with a bearish Harammi pattern today.

We could go as far to say that 109.32 could be the ‘phase one’ line in the sand so, without a deal, its hard to envisage a bullish breakout yet. Yet if we stand back there is the potential for a larger bearish wedge formation.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."