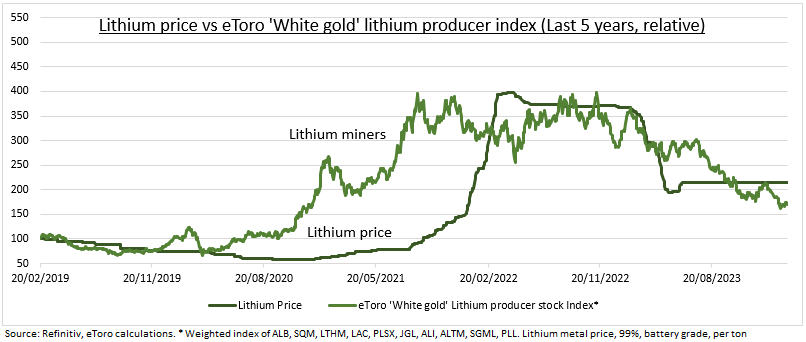

BUST: Lithium prices have plunged 77% in the past year, despite the ‘white gold’ moniker. It’s the worst of a rout in battery metals with cobalt -20% and nickel -40%. It is seeing a glut of new supply and an EV demand slowdown. A price turnaround may be slow in coming, and miners pressured, despite already very poor sentiment. With lithium prices still above pre-2022 levels and above the industry cost-curve. But it’s also a competitiveness silver-lining for battery and EV makers, from Tesla (TSLA (NASDAQ:TSLA)) to battery makers. As they try to rekindle growth with lower prices. Lithium-ion battery pack costs are 30% the total of an EV and fell 14% last year to $139/kWh.

LITHIUM: The supply glut will deepen this year, and equal over 15% of the market. With new supply coming alongside lower-than-expected EV battery demand growth. The pain is most felt by Australian spodumene hard rock producers that have led supply increases. This is a low cost process but gives a lower-margin product vs LatAm ‘lithium triangle’ brine operators. All have started to cut costs and trim supply plans but this has a long way to go. Prices remain above the top of the industry cost curve, pre-2022 levels, and much under long term contracts. Whilst new direct lithium extraction (DLE) tech, including new entrant Exxon (NYSE:XOM), may drive new supply.

STOCKS: We constructed a basket of ten major lithium stocks, from Albemarle (ALB) and SQM (SQM) to Piedmont Lithium (PLL (NASDAQ:PLL)) and Lithium Americas (LAC). It has fallen 58% from its Sept. 2022 highs (see chart). And has seen a 63% fall in its forward net profit estimates. Investor sentiment on the group is terrible with short interest ratios running as high as 21%, at Pilbara (PLS.AX). This has started to drive cutbacks and consolidation, including the recent creation of Arcadium (ALTM). But prices remain above the top of the cost curve, and these 10 still on track to make combined profits of $6 billion, with a prospective P/E that has risen to an overall 12.3x.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A lithium price turnaround may take time

Published 22/02/2024, 08:09

Updated 09/02/2024, 07:53

A lithium price turnaround may take time

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.