- According to FactSet, S&P 500 companies' earnings will increase by only +0.8% this year

- But for these four airlines, earnings are expected to increase by more than 50%

- Are these airline stocks worth buying at current levels?

With most sectors within the travel industry finally surpassing pre-pandemic levels of activity in 2023, our focus turns to the some of the greatest beneficiaries of this upswing: a selected quartet of airline stocks expected to post earnings growth of more than 50% this year.

One of the best ways to gain exposure to the industry is through the U.S. Global Jets ETF (NYSE:JETS).

This ETF boasts a portfolio of 51 holdings that encompass industry stalwarts like Delta Air Lines (NYSE:DAL), United Airlines (NASDAQ:UAL), American Airlines (NASDAQ:AAL), Southwest Airlines Company (NYSE:LUV), and Alaska Air (NYSE:ALK).

Launched on April 30, 2015, this ETF comes with a 0.60% fee and, as of August 18, boasts a 2023 yield of +13%. Its top holdings include Delta Air Lines at 10.93%, American Airlines at 10%, Southwest Airlines at 10%, United Airlines at 9.90%, alongside Hawaiian Holdings (NASDAQ:HA) at 3.49%, and SkyWest (NASDAQ:SKYW) at 3.45%.

Skewed towards mid- and large-cap companies, the ETF allocates a modest 4.2% to small-cap entities. The United States takes center stage in country representation, followed by Canada, Japan, Brazil, and France.

So Without further ado, let's delve into four airline stocks integral to the aforementioned ETF, leveraging the insights provided by InvestingPro.

1. American Airlines

American Airlines, headquartered in Fort Worth, Texas, is a prominent airline that operates an extensive network of both domestic and international routes.

American Airlines, headquartered in Fort Worth, Texas, is a prominent airline that operates an extensive network of both domestic and international routes.

Presently, American Airlines operates flights between Dallas and Shanghai (China) four times a week. Notably, the U.S. government has granted approval for doubling the flight frequency between the two nations, set to commence in January.

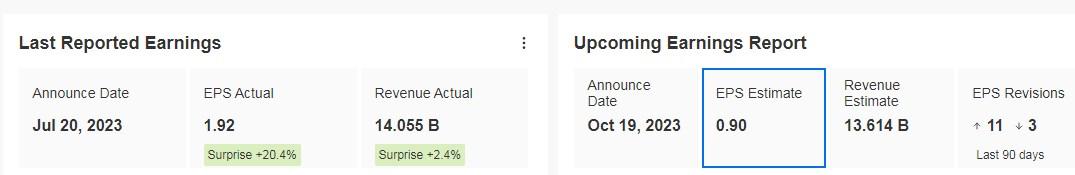

The company's recent earnings, unveiled on July 20, surpassed all market expectations. Notably, both revenue and earnings per share exceeded predictions, with the latter even surpassing forecasts by an impressive +20.4%.

Mark your calendars for the upcoming earnings report, slated for October 19. It's anticipated that earnings per share will surge by +133.68% to reach $0.90 per share.

Source: InvestingPro

Source: InvestingPro

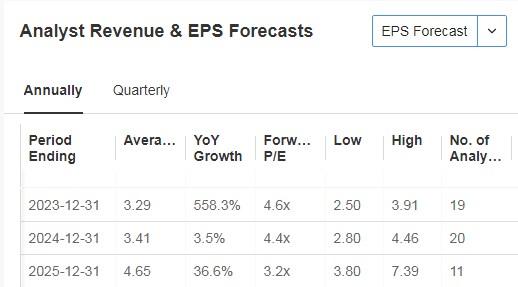

Market estimates indicate that earnings per share will experience significant growth, particularly in 2023, with a projected increase of 558%. This growth is expected to continue with a 3.5% increase in 2024 and a 36.6% increase in 2025.

Source: InvestingPro

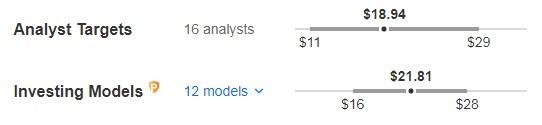

There are a total of 18 ratings for the stock, with 3 being buy, 13 being hold, and 2 being sell. According to the market, it has a potential value of approximately $19. However, InvestingPro models suggest that its value is just over $21.

Source: InvestingPro

2. United Airlines

United Airlines, headquartered in Chicago, Illinois, boasts a global presence. Remarkably, the airline was once owned by The Boeing Company (NYSE:BA), a renowned global aircraft manufacturer. Its origins trace back to its founding in Boise, Idaho, in 1926.

United Airlines, headquartered in Chicago, Illinois, boasts a global presence. Remarkably, the airline was once owned by The Boeing Company (NYSE:BA), a renowned global aircraft manufacturer. Its origins trace back to its founding in Boise, Idaho, in 1926.

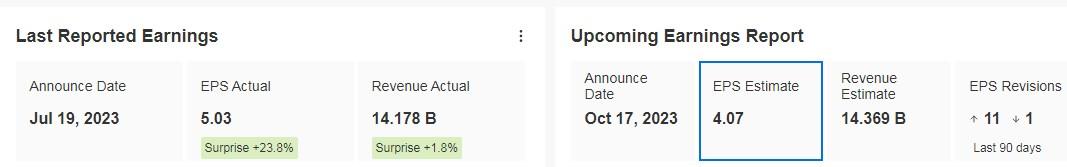

The financial results unveiled on July 19 demonstrated a commendable performance, surpassing market predictions in both revenue and earnings per share. Notably, the latter exceeded expectations by an impressive margin of +23.8%.

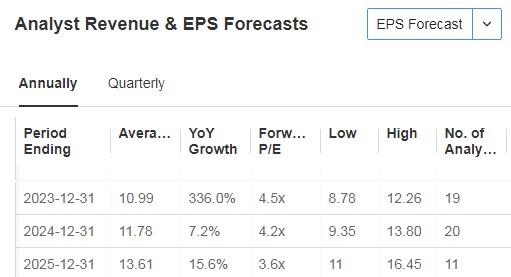

Mark your calendar for October 17th, as that's when the upcoming earnings will be announced. The market is expecting a significant increase of +101.10% in earnings per share. Source: InvestingPro

Source: InvestingPro

According to the market forecast, the earnings per share are expected to increase by 336% in 2023, 7.2% in 2024, and 15.6% in 2025.

Source: InvestingPro

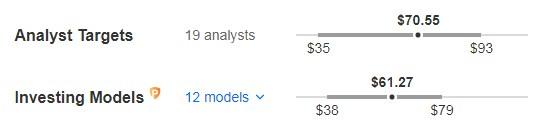

The market gives it a potential of $70.55, while InvestingPro models put it at $61.27.

Source: InvestingPro

3. Delta Air Lines

In the realm of transatlantic flights, Delta stands as the largest U.S. carrier, offering more European and Asian destinations than any other airline. Notably, it ranks as the second-largest U.S. carrier in Latin America, just after American Airlines.

In the realm of transatlantic flights, Delta stands as the largest U.S. carrier, offering more European and Asian destinations than any other airline. Notably, it ranks as the second-largest U.S. carrier in Latin America, just after American Airlines.

Following in the footsteps of American Airlines, Delta has been granted permission by the U.S. government to expand its flights to China. In particular, it plans to introduce 10 weekly flights to Shanghai, departing from its hubs in Seattle and Detroit.

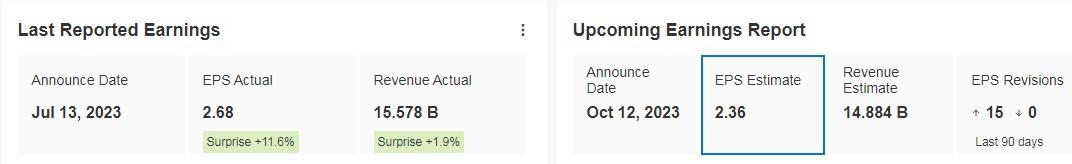

On July 13, Delta shared its financial results, surpassing market expectations. Notably, earnings per share experienced a significant improvement of +11.6%.

Circle October 12 on your calendar for the next round of financial figures. Projections indicate that earnings per share are anticipated to experience a substantial increase of +53.60%.

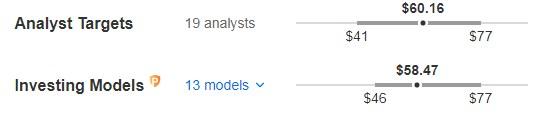

Source: InvestingPro

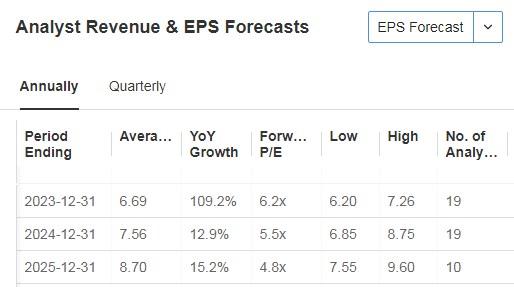

The projected earnings per share growth for 2023 is +109.2%, followed by +12.9% for 2024 and +15.2% for 2025.

Source: InvestingPro

The market gives it a target of $60.16, while InvestingPro models peg it at $58.47.

Source: InvestingPro

4. Alaska Air Group

Alaska Air Group, based in SeaTac, Washington, operates as an airline holding company. Under its umbrella, it encompasses two airlines: Alaska Airlines, its primary carrier, and Horizon Air, a regional carrier.

Alaska Air Group, based in SeaTac, Washington, operates as an airline holding company. Under its umbrella, it encompasses two airlines: Alaska Airlines, its primary carrier, and Horizon Air, a regional carrier.

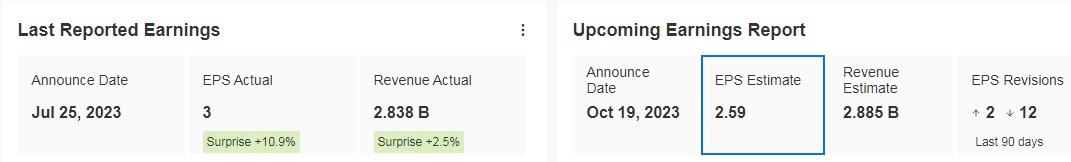

In the most recent earnings on July 25, Alaska Air Group surpassed market projections, posting an impressive +2.5% beat in terms of revenue and a +10.9% outperformance in earnings per share.

Forecasts for the next earnings anticipate a substantial +22% increase in earnings per share.

Source: InvestingPro

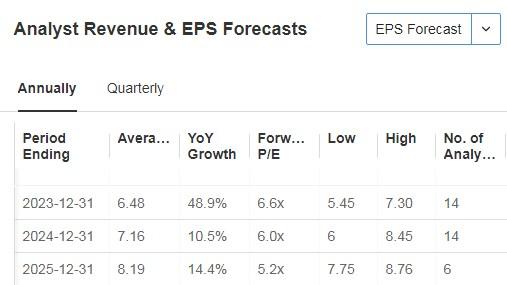

According to the latest projections, the earnings per share growth rate for 2023 is expected to be 49%. For the year 2024, the anticipated growth rate is 10.5%, while for 2025, it is predicted to be 14.4%.

Source: InvestingPro

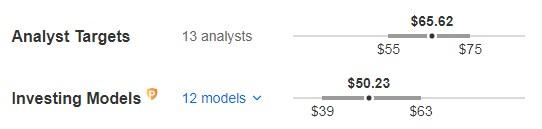

According to market estimates, the target is set at $65.62. However, InvestingPro's models suggest a lower value of $50.23.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.