- Xi Jinping and Blinken met recently

- Both indicated 'progress' made on issues straining relations between the two countries

- Does this mean Chinese stocks are worth considering now? Let's take a closer look

- Revenue trend: Increasing

- EPSd trend: Growing

- Liquidity + BT (LON:BT) assets: 76B

- Accounts payable: 27B

- Current assets: 101B

- Current liabilities: 57B

- Total liabilities: 91.7B

- Total equity: 163.5B

- FCF Yield: 12%

- Revenue trend: Increasing

- EPSd trend: Decreasing

- Liquidity + BT assets: 25B

- Accounts payable: 13B

- Current assets: 31B

- Current liabilities: 11B

- Total liabilities: 22B

- Total Equity: 34B

- FCF Yield: 5%

The recent meeting between President Xi Jinping and Secretary of State Antony Blinken has the potential to alleviate fears of potential conflict between the US and China and positively impact the stock market in the long run.

While it is still early to draw conclusions, the significance of the meeting signals a positive development.

This raises the possibility that the Chinese stock market, which has been lagging behind, could receive a much needed boost and catch up with Europe and the United States.

So, let's take a quick look at two of the most influential stocks in Asia using InvestingPro:

The charts below indicate that both stocks remain considerably below their 2020 and 2021 highs. So, is this a buying opportunity?

Let us take a closer look at both stocks using InvestingPro, and find out.

1. Alibaba

Despite undergoing a major restructuring, including the recent appointment of a new CEO, Alibaba stock has been unable to regain stability and reclaim the critical $100 level.

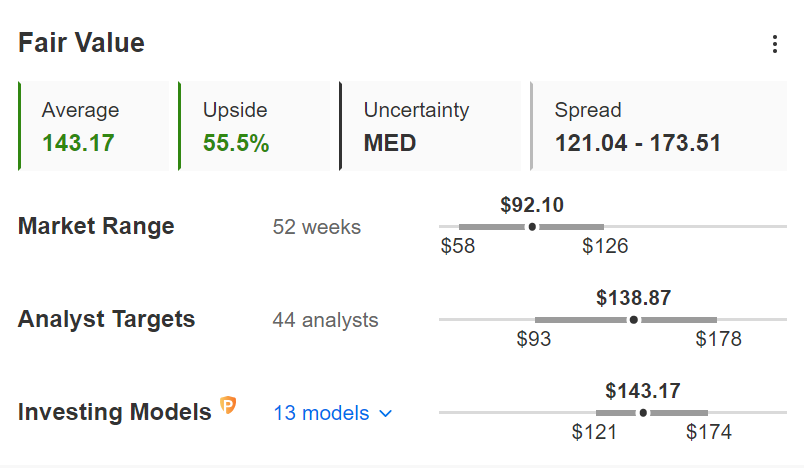

InvestingPro fair value indicates that Alibaba has an intrinsic value of around $143 per share, but the stock has been unable to reach or surpass that level.

Source: InvestingPro

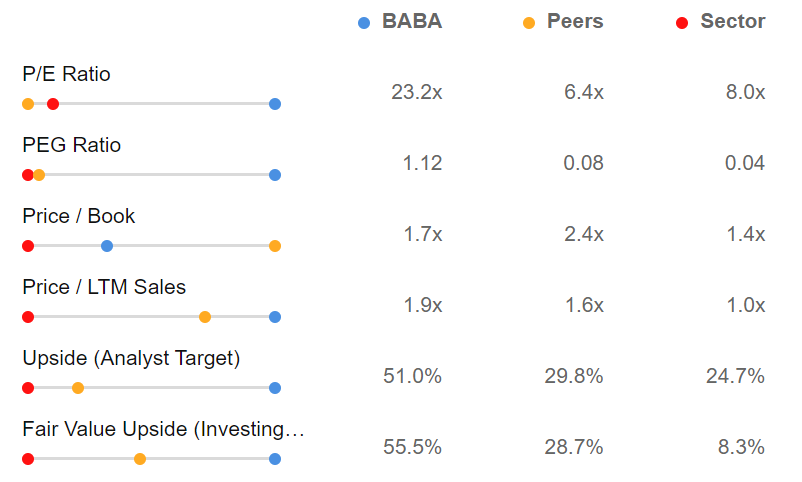

However, comparing Alibaba to other Chinese companies and direct rivals changes everything. Despite appearing undervalued on the surface, Alibaba actually appears overvalued.

Source: InvestingPro

Other metrics, according to InvestingPro, are as follows (at the end of 2022):

Alibaba demonstrates a robust balance sheet and an above-average cash flow yield. If the company continues to improve earnings and turnover, there is a strong possibility the stock could break above $100.

Additionally, the markets' favorable reception of the new corporate structure could provide the stock enough fuel to do so.

2. Baidu

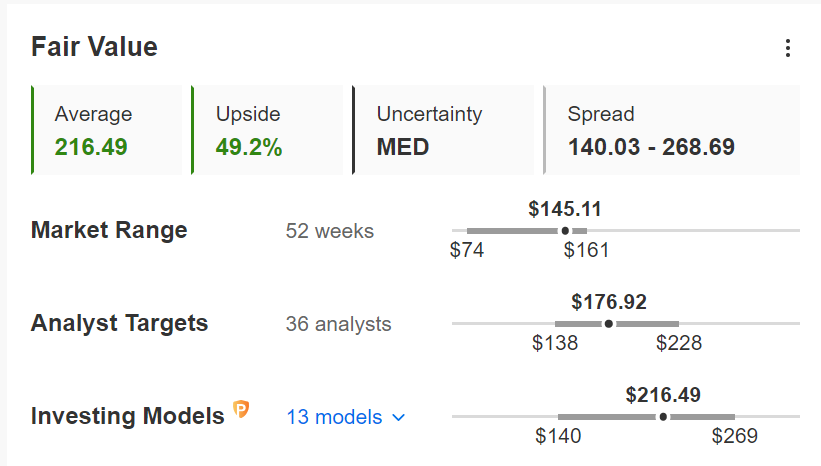

Regarding Baidu, there is a clear gap between analysts and mathematical models regarding valuation. However, both indicate that the current prices are undervalued.

Source: InvestingPro

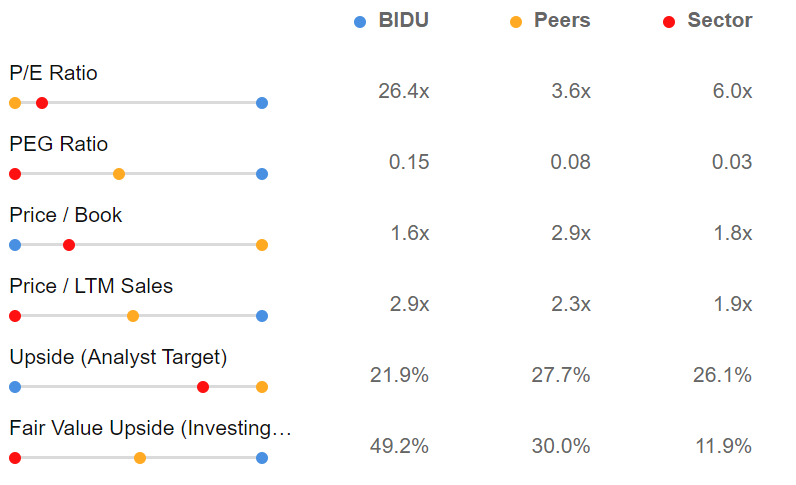

Just like Alibaba, Despite appearing undervalued at first glance, Baidu actually exhibits more expensive multiples than its counterparts.

Source: InvestingPro

As far as other metrics (data until 2022 end) on InvestingPro are concerned, here is a summary:

Conclusion

Both Alibaba and Baidu exhibit robust strength, although Baidu has a notably lower cash flow yield. Both companies have displayed a strong balance sheet, with some recent weakening on the income statement side, but signs of recovery are evident.

Considering current valuations, particularly in the context of a broader recovery in Chinese equities, there appears to be potential for double-digit growth for patient investors in both companies.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

You can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort.

Start your InvestingPro free 7-day trial now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis.