Investing.com Poll: Who’s Winning The U.S.-China Trade War? We Asked, You Answered!

Inside Investing | Jun 14, 2019 19:17

For our latest social media weekly poll, which ran both on Investing.com’s Facebook (NASDAQ:FB) and Twitter accounts, we asked our users:

Who’s winning the U.S.-China trade war? Washington or Beijing?

The results for the most part offered further evidence of the uncertainty arising in global financial markets as a result of the ongoing U.S.-China trade dispute, which has been jolting investors for over a year.

Markets fear that the protracted trade dispute between the world’s two largest economies is quickly turning into a technology cold war after the Trump administration stuck Chinese tech giant Huawei on a trade blacklist, effectively banning U.S. firms from doing business with the world's largest telecom network gear maker.

Breaking Down The Results:

Overall, when taking votes from both Facebook and Twitter into account, the results were split 50%-50% right down the middle.

Facebook (NASDAQ:FB)

Out of the 2,700 votes recorded on Facebook, roughly 1,400 users, or 53%, said China was winning the trade war up until this point.

In comparison, 1,300 users, or about 47%, voted in favour of the U.S.

Be sure to give us a like on our Facebook (NASDAQ:FB) page here.

The results we saw on Investing.com’s Twitter account were exactly the opposite.

Of the 418 votes recorded, 221 users, or around 53%, thought Washington has the upper hand so far, while 196 users, or 47%, voted China.

Give us a follow on Twitter here.

What The Numbers Say:

For many market observers there’s only one metric that shows which side is winning the U.S-China trade war: stock market performance.

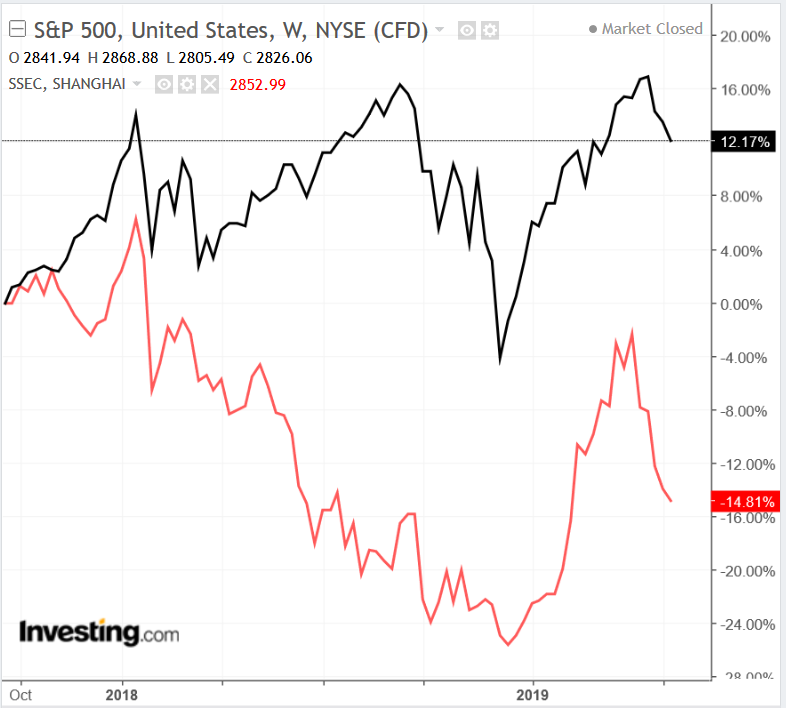

Indeed, China’s Shanghai Composite has took a bigger beating since the trade war started, plunging nearly 25% in 2018, which was four times the drop in the S&P 500 last year.

Stock markets in both countries have gotten off to a great start in 2019, with Shanghai up around 16%, while the S&P 500 has gained almost 13%.

According to that, it seems as if the U.S. has been the winner so far in the U.S.-China trade war.

Be the first to comment on

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.